Amazon.com (NASDAQ:AMZN), the largest e-commerce company in the world, is also a leading player in the cloud computing market. The slowdown in the Amazon Web Services (AWS) segment in recent quarters has created negative investor sentiment toward the tech giant, but this presents a good opportunity for long-term-oriented investors to cash in. The company will take a hit from challenging macroeconomic conditions in the short run, but Amazon still has years of growth ahead. For this reason, I am bullish on Amazon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AWS Segment Outlook

Although Amazon has built its reputation around the e-commerce business, AWS, its cloud business, is the most profitable business segment. For context, the North America segment and the International segment reported operating losses of $200 million and $2.2 billion, respectively, in Q4, while the AWS segment reported an operating profit of $5.2 billion. The AWS segment is still the smallest segment of the company from a revenue perspective despite contributing to the bulk of operating profits, which highlights the highly profitable nature of this business.

In Q4 2022, AWS revenue increased 20% year-over-year to $21.4 billion. Although a 20% gain seems substantial, investors are accustomed to the Cloud segment growing at a much faster clip, which explains the negative market reaction following the earnings release. The company said that the AWS segment grew at an even slower pace in January, which added to investor fears.

The slowdown in AWS revenue in the most recent quarter masked some of the big wins the company scored from a new customer addition perspective.

In Q4, Yahoo Ad Tech chose AWS as the preferred cloud partner to develop immersive solutions for its clients, Nasdaq (NASDAQ:NDAQ) completed the migration of its MRX trading system to the cloud, Brookfield Asset Management (NYSE:BAM) partnered with AWS for its renewable energy business, and Duke Energy Corporation (NYSE:DUK) picked AWS for its smart grid solutions.

The company is expanding AWS Availability Zones and AWS Regions to cater to the projected rise in demand for cloud computing services worldwide. In Q4, new AWS Regions were launched in Spain and Switzerland while adding a second Region in India to facilitate the strong demand for cloud infrastructure in India stemming from multi-billion-dollar IT infrastructure investments in the country.

Amazon plans to expand its global footprint by launching 15 Availability Zones and five Regions in the coming quarters. The expanding scale of the AWS network should help the company onboard new, global clients.

Amazon is expanding its AWS product portfolio as well, which is another promising sign. In Q4 2022, the company added new features to its product portfolio, such as Amazon Clinic, and announced a few other products, including Security Lake, DataZone, AWS Supply Chain, and AWS SimSpace Weaver. Amid the slowdown in AWS revenue growth, the company is doubling down on its investments in the Cloud segment, which is an encouraging sign given the favorable long-term outlook for this sector.

Macroeconomic Tailwinds

According to data from Statista, Amazon is the leader of the global cloud infrastructure market, with a market share of 34% as of Q3 2022. Microsoft Corporation (NASDAQ:MSFT), the second-largest player in the industry, is far behind with a market share of 21%, which highlights the competitive advantages enjoyed by Amazon today. With Amazon continuing to invest in people and products, AWS is likely to remain the leader of this market in the foreseeable future.

In the short term, companies are slashing their IT infrastructure investment budgets because of the increasing odds of a recession this year. As a result, investments in migrating to the cloud will decline this year – at least in the first half of the year. The financial performance of Amazon will be impacted by this negative development, but in the long run, the trend is set to reverse.

The flexibility and scalability associated with cloud computing, cost efficiency, the increasing number of employees who are working remotely, seamless collaboration tools available in the cloud, and the growing number of Internet-connected devices that request access to confidential company data are all reasons for every company to migrate to the cloud. These tailwinds have created a strong platform for AWS to grow in the next decade as the world’s leading cloud infrastructure solutions provider.

Is Amazon a Buy, According to Analysts?

Morgan Stanley (NYSE:MS) analyst Brian Nowak reiterated his Buy rating for Amazon last week amid the deceleration in revenue growth for the AWS segment claiming that this segment’s revenue growth will hit a bottom by the end of the second quarter, paving the way for AWS revenue to grow at a stellar pace in the second half of the year. The analyst expects AWS revenue to grow 19% this year, in which case it will cross $100 billion in annual revenue. Brian Nowak has a price target of $150 for Amazon.

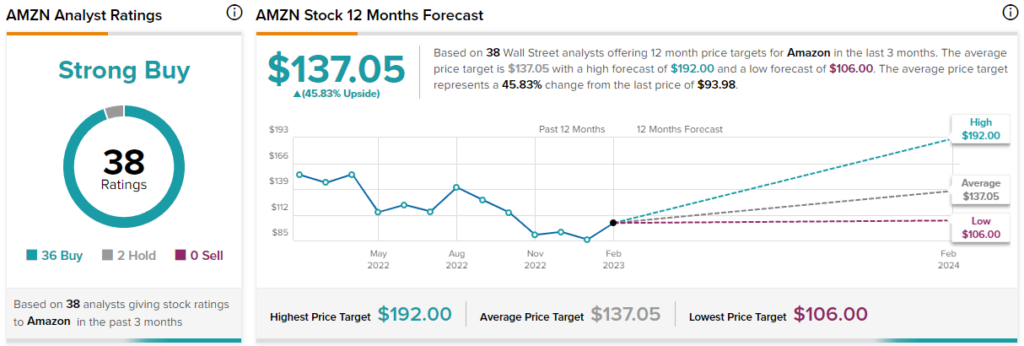

Overall, based on the ratings of 38 analysts, the average Amazon stock price target is $137.05, which implies upside potential of 45.8% from the current market price.

The Takeaway

The decelerating growth of the AWS segment has spooked investors, leading to market uncertainty regarding Amazon’s growth potential. Despite these fears, the segment looks well-positioned to grow exponentially in the next decade, rewarding long-term investors handsomely.