2023 is ending on a very positive note. While the investors’ attention is drawn to the tech giants who led the gains in the markets for the better part of the year, there are some overlooked smaller stocks, whose gains leave even Nvidia in the dust. As these companies book gains of over 1,000% for the year, we can’t help but wonder whether they can continue their outperformance in the New Year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Magnificent Seven’s Wild Ride

We are now entering the final trading days of this year, and, barring some major surprises, stock performance for the whole of 2023 will not substantially differ from the numbers we are seeing now. We can already look back at the best-performing stocks of the year and try to forecast (without too much extrapolation) whether they can continue to be winners going forward.

Since analysts on Wall Street or elsewhere have already issued their reviews of the S&P 500 (SPX) stocks, I’d like to look beyond the well-covered universe of large-cap stocks. Besides, even a seven-year-old nowadays would know who the winners of the SPX are.

Most of the largest S&P 500 gainers belong to the group of the mega-cap technology leaders, also known as the Magnificent Seven: Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Nvidia (NVDA), Alphabet (GOOGL), Tesla (TSLA), and Meta Platforms (META).

These stocks are responsible for over 60% of the S&P 500’s gains in the passing year, while at some point in the summer this figure stood at 80% or even 90%. This points to the exceptional narrowness of the stock market rally in 2023. While tech behemoths’ huge weight in the index is a considerable factor behind their impact on its movements, the historically low proportion of stocks outperforming the S&P 500 during the year further underscored the concentration of the gains.

Through the end of November, only 25% of the S&P 500’s stocks outperformed the index, compared to a 20-year median of 50%. This narrowness raised many doubts, since historically, sustained rallies feature broad market leadership amid bullish investor sentiment, while narrow gains are in many cases a sign of a brewing bubble.

However, the rally began to broaden at a fast clip towards the end of the year, after the consistently weakening inflation and a cooling, but still robust job market provided investors with a defendable case of a “Goldilocks” economic scenario, which also includes the expected interest-rate cuts beginning next spring. The surging tide of investor sentiment lifted all boats, supporting the outlook for an extended period of broad market gains.

If this indeed plays out as expected, the assets that dragged behind the technology leaders through most of 2023 will play catch-up, producing even larger gains. In this case, it is worthwhile to have a look at the stocks that managed to overcome investors’ mistrust of anything outside of the mega-cap technology circle, which was apparent for most of 2023. Those may well be the leaders of the 2024 bull market.

Stock Market Has More Than Seven Opportunities

As we gain more clarity about the economic outlook and the direction of interest rates, and as the profits cycle continues to recover, the iterative process of rally expansion will continue, with many other stocks joining the winners’ cohort.

If indeed the economy skips an outright recession and begins to re-accelerate after the Federal Reserve delivers its long-awaited rate cut, the largest percentage of outperformers is expected to be found among small-cap firms, which are dependent on the domestic economy’s health, as well as growth stocks, whose fortunes are contingent upon investors’ sentiment toward risk. These categories will also be the main beneficiaries of lower funding costs. Of course, these classes interlap, as a large proportion of growth stocks are small caps.

The earnings recovery will be most acutely felt at cyclicals, which are by definition most susceptible to economic cycles. Historically, smaller capitalization stocks are more cyclical than their larger counterparts, thus they tend to outperform during periods of profit acceleration. Traditionally, cyclicals belong to the Energy, Materials, and Industrials sectors; however, cyclical stocks can be found within all sectors, including even the stable Utilities.

While statistically, during previous periods of earning rebounds the best performers were the lowest-quality stocks, I believe this time will be different, as “once burned, twice shy” investors will not throw money at anything growth-promising. Instead, they will keep their eyes open for fundamentals and earnings growth prospects. High earnings-growth champions can be found not only in the IT sector, but also in the Consumer Discretionary, Communication Services, Real Estate, and even Energy sectors. Therefore, opportunities for portfolio diversification are abundant.

The Three Biggest Winners of 2023

Let us have a look at the best-performing stocks of 2023 and try to find out whether they will be able to continue beating the broad market. Of course, “past performance does not guarantee future results,” but most of the biggest gainers this year have not moved up on pure hype, but rather have some real results to point to. So, if they have something great to offer, which has attracted investors this year, who says they can’t continue building on their strong gains in the coming year, or even longer?

Soleno Therapeutics, Inc. (SLNO)

The first prize for outstanding stock performance this year belongs to a little-known biotechnology company, Soleno Therapeutics, which specializes in innovative treatments for rare diseases. It is a small-cap company with just 25 employees, and despite being established back in 1999, it is still unprofitable.

Small-cap stocks are very volatile, and biotech small-caps are probably the most volatile stocks in the U.S. markets. Still, SLNO’s 600% jump in the course of three days was something for the books. Even more notable is the fact that the stock didn’t crash after an initial jump: although it slid back on some of its gains, its overall 2023 upsurge (current as of December 27) stands at an eye-popping 1,727%.

In September this year, the company reported positive results in therapeutic trials of its flagship drug, which is intended to treat a genetic disorder called Prader-Willi Syndrome. The markets took notice of the speculations about a possible FDA approval, which would finally take the company to the next level and allow it to see revenues and even net profits. That would produce enormous gains for SLNO’s investors.

However, along with great potential comes great risk, as the approval alone could take years, with additional time and money needing to be invested into taking the new drug to the market. But at the moment, Soleno is well-funded, having raised a $130 million equity investment round in September 2023. The company is well-run, and the faith of its investors, some of whom repeatedly put their money into the company, is viewed positively by the markets.

Despite the surge, analysts see an additional upside of 19.4% for the stock in the next 12 months, and rate it a “Strong Buy”:

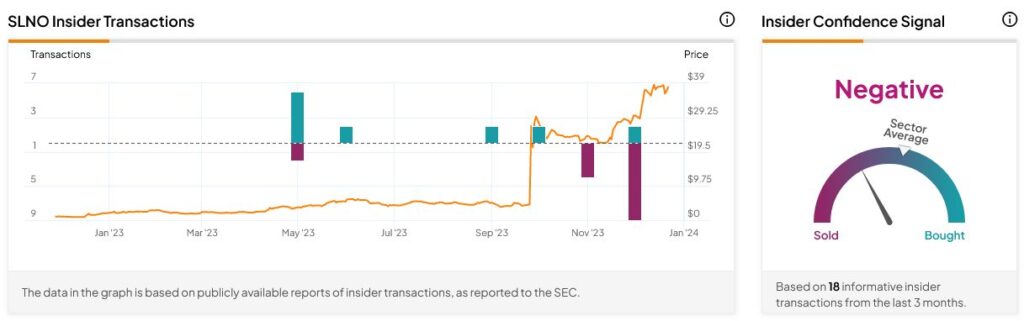

However, insider activity in the stock raises some concerns, with SLNO’s top managers, including the CEO, becoming net sellers in the past two months:

We don’t know, of course, whether the management just grabbed their chance to take out some profits on the shares they own after their extraordinary rise or they have some information we don’t, which led them to doubt the sustainability of this rally. But investors are advised to pay attention to insider transactions, as they often indirectly reveal the actual state-of-affairs at the firm in question.

Applied Optoelectronics (AAOI)

The second-best performer of 2023 is the stock of a provider of fiber-optic access network products, Applied Optoelectronics, which surged by 1,103% this year through December 27th. The company has been in operation since 1997 but has yet to turn in a net profit.

What is interesting is that this is the second time in the company’s trading history that Applied Optoelectronics has become one of the top three market performers. The previous time was in 2016-2017 when AAOI surged almost 800% over the course of 12 months. Back then, its market capitalization reached over $1 billion; it is now 800 million, including the recent upsurge. The stock crashed as spectacularly as it rose, continuing to slowly diminish in value afterward – until this year.

This year, the company’s stock took off in August after AAOI reported a much smaller quarterly net loss than was expected, with EPS surpassing analysts’ estimates by a wide margin, which led the company’s management to issue a guidance upgrade. A positive snowball effect ensued, with analysts noticing the swiftly rising stock and issuing positive price targets, which in turn added to investor optimism toward the stock, lifting it even higher.

Besides the improved, if still weak, finances, a supply agreement with Microsoft has added a lot to investor optimism about AAOI’s prospects. It must be noted, though, that MSFT had been the company’s customer for many years, along with Meta Platforms and Amazon. The latter left for another supplier in 2017, taking almost 50% of AAOI’s revenue away (and causing its stock to crash).

Another factor behind this year’s exceptional rally in Applied’s stock was high short interest, reaching almost 25% of its total float. So, when the good news reached investors’ ears and the stock took off, it produced a short squeeze (that’s when a sharp rise in the price of a share forces traders who previously sold short to buy it to close out their positions).

All three factors combined produced a huge gain in the stock this year, but analysts aren’t too optimistic going forward, with an average downside of 7.3% on the cards for the coming year:

In stark contrast to the pessimism of the analysts, however, the company’s managers clearly believe that Applied Optoelectronics will continue on its path upward, as they have made sizable stock purchases in the past three months:

Carvana Co (CVNA)

The third place in the performance match of 2023 goes to Carvana, an online platform for buying and selling used cars. As recently as 2022, the company was on the verge of bankruptcy because of its huge debt burden, and its stock lost 97% over the last year. At the beginning of this year, however, Carvana reached a debt-restructuring agreement with its debtors, which gave it some breathing room.

In addition, the company, albeit still unprofitable despite running for a decade, beat analysts’ EPS expectations for three quarters in a row and reported a revenue surge of almost 80% year-on-year in the third quarter of 2023. These hugely improved numbers forced analysts to take CVNA more seriously.

The stock surged by 1,035% year-to-date, with Carvana becoming a large-cap company thanks to the jump in its shares. If you are dubious that an improved burn rate on its own could lift a stock by this much, you are correct. Most of the upward move in CVNA is due to an extremely high short interest: about 40% of its stock float was borrowed to sell short. Naturally, when the market mood began to brighten this year and long investors returned to a better-standing Carvana, a strong short squeeze was bound to happen.

The fact that CVNA’s outperformance doesn’t have much to do with its improved financial results is underscored by analysts’ negative stance toward the stock, which is rated as “Hold” with the average outlook pointing towards a downside of over 25% for the next 12 months:

As for insider activity, there’s not much to talk about, with all of it being uninformative automatic transactions. However, if the analysts’ opinion is not enough for investors to keep a distance from this highly speculative stock, here is the stance of the professional money managers at hedge funds:

The Takeaway

Stocks are moved by fundamentals, sentiment, rumors, and a myriad of other things. Of course, there is nothing wrong with speculative short-term bets and taking advantage of stock melt-ups, disregarding the reason for their surge and just riding the wave, as long as you fully acknowledge the risks you are taking.

On the other hand, investors who are too risk-averse to try and time the market or a specific stock are strongly advised to “check under the hood” of the company of their interest. This checkup should include not only the review of factors moving their stocks of interest, but even more importantly, the analysis of the companies’ financials, market position, earnings outlook, and other fundamental metrics. Of course, it is not an easy task – but do not despair, help is on the way.

TipRanks has a vast amount of data to enlighten discerning investors on every stock that piques their interest, including financial reports, dividend history, ownership status, insider and hedge fund actions, and more. In addition, investors can use the TipRanks Stock Screener, slicing and dicing the database of stock data according to their preferences, or employ the Stock Comparison tool, which allows them to easily compare stocks and choose accordingly. Alternatively, investors can leverage the existing analysis, utilizing research done by Wall Street’s leading analysts, collected and made accessible by TipRanks.