The blockbuster Barbie movie has raked in over $1 billion at the box office. Given the film’s massive success, it could light up the shares of Mattel (NASDAQ:MAT), Warner Bros. Discovery (NASDAQ:WBD), and Crocs (NASDAQ:CROX), according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Considering the potential benefits these companies may receive from their association with the highly successful movie, let’s explore further to check their stocks’ upside potential from current levels.

What is Mattel’s Stock Price Prediction?

Toy manufacturing and entertainment company Mattel, the originator of the Barbie doll, has launched a wide range of Barbie movie-related toys and products. Thus, the success of the Barbie movie will support its financials. The company highlighted during the recent quarterly conference call that the product releases related to the film have sold out across all of its major distribution channels. Moreover, the company will expand the range in the second half of 2023.

Thanks to the movie’s incredible success, Mattel also gained market share in the doll category on a year-to-date basis.

Goldman Sachs analyst Stephen Laszczyk pointed out that Mattel may benefit from Barbie toy sales, producer fees, third-party merchandise licensing fees, and participation fees related to the box office and streaming performance. The analyst reiterated a Buy rating on MAT stock on July 27 and termed it his “favorite way to invest in the toy industry.” After the release of the Barbie movie, three more analysts kept their Buy recommendations, in addition to Laszczyk.

Overall, Mattel stock sports a Strong Buy consensus rating on TipRanks, reflecting five Buy and one Sell recommendations. Analysts’ average price target of $24 implies 17.36% upside potential from current levels.

What is the Future of WBD Stock?

The phenomenal performance of the Barbie movie will support the financials of the media and entertainment conglomerate Warner Bros. Discovery, the producer and distributor of the Barbie movie.

The company’s Studio segment’s performance has been inconsistent with Q2, underperforming management’s expectations. Nonetheless, WBD’s management expects the movie’s success to positively impact its Q3 performance and support its overall growth.

Brett Feldman of Goldman Sachs maintained his buy recommendation on WBD stock on August 3. The analyst said the outlook for the company’s Studio business remains clouded due to the Hollywood strikes. However, the second-half outlook is “supported by Barbie and lower costs.” Apart from Feldman, two additional analysts maintained their Buy ratings after the release of the Barbie movie.

Including Feldman, WBD stock has received nine Buy recommendations. At the same time, it has received three Holds. Overall, it has a Strong Buy consensus rating on TipRanks. Analysts’ average price target of $22.10 implies 58.20% upside potential.

What is the Future of Crocs?

Besides for MAT and WBD, shares of the casual and comfortable footwear maker Crocs will also benefit from the movie’s success. The company launched the Barbie collection, including Clogs sandals, and Jibbitz. The company said during the Q2 conference call that these products quickly sold out.

Williams Trading analyst Sam Poser maintained a Buy recommendation on Crocs stock but reduced the price target on August 1, reflecting a lower HAYDUDE product-related revenue outlook. The analyst noted that the new items in Barbie Pink are performing well. Poser recommends buying the dip in Crocs stock. Other than Poser, five analysts maintained their Buy ratings following the release of the Barbie movie.

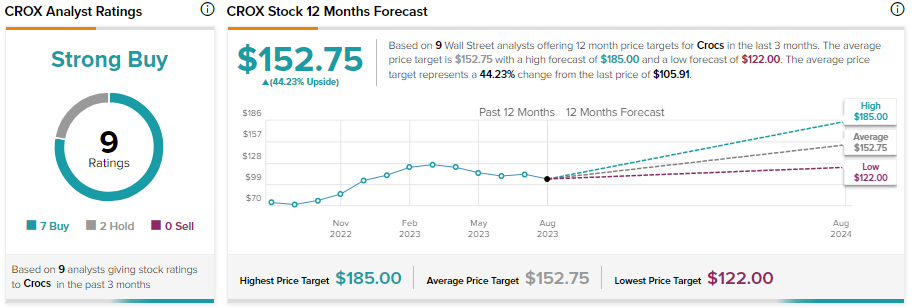

Overall, CROX stock has seven Buy and two Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $152.75 implies 44.23% upside potential.

Conclusion

Barbie is one of the six post-corona films to have grossed more than a billion dollars in sales of tickets. Given the ongoing momentum of interest in the movie, its profits could continue to climb. The three stocks mentioned above, plus other stocks in the movie industry, could feel the positive effects of the Barbie movie for a long time.