Benjamin Toms from RBC Capital is an analyst who is mainly focused on the UK banking sector and also covers big Spanish banks – below, we’ve picked out some banking stocks he has rated.

Toms is a director at RBC Capital Markets, and previously worked with Barclays (GB:BARC) and Deloitte.

Many analysts expect a slightly dull performance for the banks in the second half of 2022, due to inflation and interest rate rises.

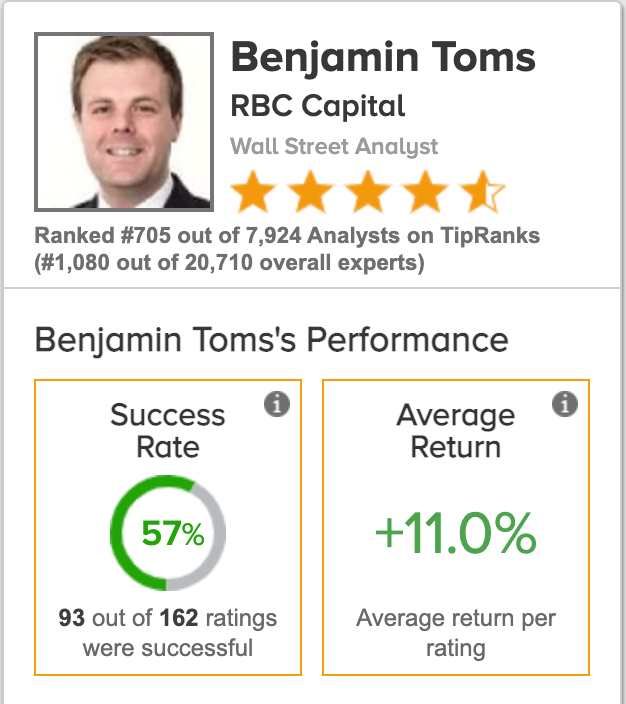

Toms is ranked 705 out of 7924 analysts on TipRanks and has generated an average return of 11% per rating. He has a success rate of 57% with 93 out of 162 ratings being successful.

Let’s see two banking stocks that have a Buy rating from Toms.

Banco Bilbao Vizcaya Argentaria

Banco Bilbao Vizcaya Argentaria SA (GB:BVA) is a multinational financial services company based in Spain. It has been Toms’ most profitable pick, generating a 144% gain between the period of November 2020 and November 2021.

However, RBC has now reduced the target price from €6.40 to €6.00. Toms adjusted the assessment, “To take account of inflation in Turkey. The resulting burdens for the major Spanish bank would only be partially offset by favorable exchange rate.”

Toms feels that the bank’s financial position is strong and it has enough flexibility to deal with uncertainties.

Toms said, “BBVA has consistently outperformed its peers in improving its cost-efficiency.” Toms noted that BBVA is, “well positioned with digital banking technology, and its exposure to Mexico and Turkey provides access to markets with relatively young populations, providing the potential for long-term banking growth outperformance.”

Wall Street’s take

According to TipRanks’ analyst rating consensus, BBVA stock is a Moderate Buy. Out of 12 analyst ratings, there are six Buy recommendations, and six Hold recommendations.

The average BBVA price target is €6.22 with a high forecast of €7.50 and a low forecast of €4.98. The price target implies upside potential of 28%.

Close Brothers Group

Another banking stock covered by Toms is Close Brothers Group (GB:CBG). It is a UK-based merchant banking group dealing in lending, deposits, and wealth management services.

Toms has assigned a Buy rating to Close Brothers at a target price of 1300p, which is 26.7% higher than the current price. RBC has recently upgraded their recommendation and increased the target price from 1250p to 1300p. With the shares trading down at 28% YTD, analysts feel it is a good entry point.

They added, “Close Brothers’ consistency of earnings has meant that the stock has historically been defensive through recessions.”

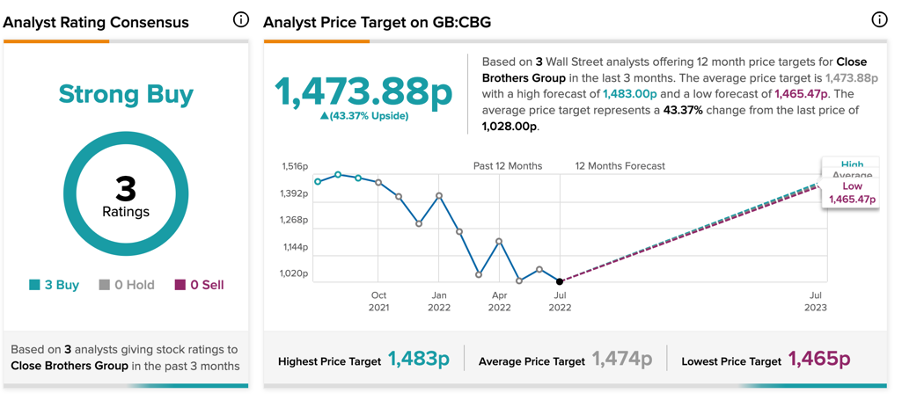

The stock has two more buy ratings from the other analysts. The average target is 1473.8p, implying 43.7% upside potential.

Conclusion

Both banking stocks, BBVA, and Close Brothers, are feeling the heat of the economic downturn, but Toms has faith in the fundamentals of both companies and is bullish on the stocks.