We’ve received some mixed messages from the market recently. The S&P 500 finished April with a 4% loss, its first monthly loss after five straight months of gains. But the month of May has started with gains in trading, and the earnings season for 1Q24 has turned out better than expected.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In addition, the Federal Reserve has indicated that it will be keeping interest rates ‘higher for longer,’ while inflation remains stubborn. A rate cut this year is still considered possible, but not likely until the fourth quarter of the year.

Watching the situation unfold, Bank of America’s head of U.S. equity and quantitative strategy, Savita Subramanian, sees reason for optimism. “I think we’re going to a soft landing, with a reasonable market environment, maybe better growth ahead than what we’re used to, higher rates, and a little bit higher inflation,” she said.

Subramanian’s outlook gives us a template for gains; she is sticking to her S&P target of 5,400 by year’s end, or a gain of 5.5% from current levels.

Embracing her bullish sentiment, Bank of America analysts are urging investors to seize opportunities, pinpointing two specific stocks. After running both tickers through TipRanks’ database, it’s clear the rest of the Street is in agreement, with each earning a ‘Strong Buy’ consensus rating. Let’s take a closer look.

KKR & Co. (KKR)

We’ll start in the world of global finance and asset management, with KKR & Company. KKR is an investment firm and asset manager that works with clients around the world, moving third-party capital into the capital markets. The company makes capital resources available to enterprise clients, working with them on debt and equity investments, public underwriting of new market deals, and other financial transactions. KKR puts long-term capital to work and creates a sound base of returns for its own investors and stockholders.

Some numbers will show the scale of KKR’s business. As of March 31, the company had $578 billion in total assets under management, a figure that included approximately $183 billion in private equity investments, $260 billion in credit, $61 billion in infrastructure, and $71 billion in real estate. The total AUM was up 13% year-over-year and included $31 billion in new capital raised during 1Q24.

Also in the first quarter, KKR reported solid earnings. The company’s adjusted net income came to $864 million, or $0.97 per share – an EPS figure that was 2 cents better than expected and was up 20% year-over-year. In another important metric, the fee-related earnings, KKR generated $669 million, or $0.75 per share, for a 22% year-over-year gain.

This stock falls under Craig Siegenthaler’s coverage for Bank of America, and the 5-star analyst is impressed by the company’s overall position and outlook for the future. He writes, “We reiterate our Buy rating as we are bullish on KKR’s fundraising cycle, its income statement’s asymmetrical upside into a recovery and the potential for the S&P 500 Index add. KKR’s business is highly diversified with robust scaling opportunities in multiple verticals (infra, real estate, credit), broadly strong investment performance, core competency in product innovation and a best-in-class Asia privates franchise. Additionally, KKR’s business model is the most offensive in the group, which caused its EPS revisions to underperform in the 2022 bear market. However, we believe this will lead to a significant profit growth accelerator as markets continue to recover.”

That Buy rating is accompanied by a $134 price objective that points toward a one-year upside potential of 41%. (To watch Siegenthaler’s track record, click here)

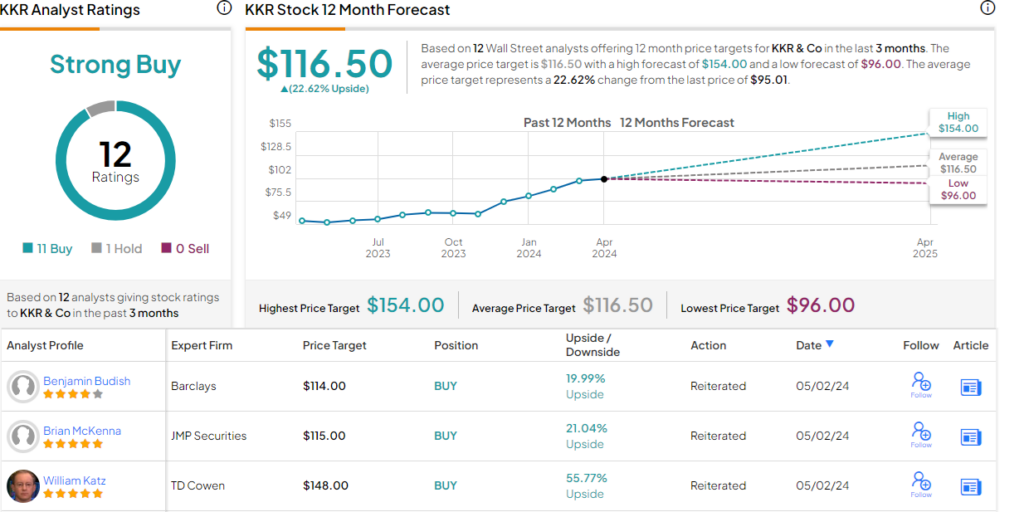

The bulls are out in force for this stock, as is clear from the 12 analyst reviews – including 11 Buys to 1 Hold – that support the Strong Buy consensus rating. The shares are trading for $95.01, and their $116.50 average price target implies a 22.5% gain for the coming year. (See KKR stock forecast)

Avis Budget Group (CAR)

From global finance we’ll switch over to the car rental business and look at Avis Budget Group. This company is one of the world’s largest auto rental firms, and operates through multiple brands with a worldwide reach. Avis Budget’s brands include its eponymous car rental subsidiaries, as well as Payless Car Rental and Zipcar. Together, these operations form a network with activities in 180 countries. Avis Budget has over 24,000 employees working at more than 10,000 locations. The company has a rental fleet of ~655,000 vehicles, and realized $12 billion in revenue during the calendar year 2023.

While this company has a strong position in the car rental niche, it has also seen difficult times this year. The used car market is facing headwinds from oversupply and high interest rates. This hit Avis Budget in the pocketbook recently when the company sold off a record number of used vehicles.

In the company’s most recent quarterly financial results, for 1Q24, the company showed a 5% increase in rental days compared to the same quarter of the previous year. This fed into the $2.6 billion in quarterly revenue, which beat the forecast by $80 million. At the bottom line, Avis Budget saw a net EPS loss of $3.21, 33 cents per share lower than expectations.

Despite the earnings loss, Bank of America’s John Babcock remains upbeat on the car rental agency, explaining why, he writes, “We reiterate our Buy rating on CAR. The company has historically been the stronger and better performing public US rental car company. We think the stock is trading at an attractive valuation and risks associated with higher fleet costs appear to be in the stock. Further, CAR should see an earnings recovery in 2025 supported by solid volume growth, relatively stable pricing and its productivity and efficiency efforts. Additionally, it could gain share from HTZ, which may be challenged by its liquidity position.”

Babcock’s Buy rating on the stock is complemented by a $140 price objective that suggests a 21% one-year upside potential. (To watch Babcock’s track record, click here)

There are 8 recent analyst reviews on CAR shares, and they break down to 6 Buys and 2 Holds for a Strong Buy consensus rating. The stock has a $169.5 average price target, implying a 46.5% upside from the current share price of $115.6. (See CAR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.