While the regional banking crisis still raises questions over the viability of smaller financial enterprises, the top dogs should be alright. Still, if you must include a bank in your portfolio, Bank of America (NYSE:BAC) could be relatively attractive and looks like the “Goldilocks” of bank stocks (meaning that it’s “just right”). Featuring a balance between market size and a reasonable valuation, the financial stalwart has pleasantly demonstrated resilience in the post-pandemic ecosystem. Therefore, I am cautiously bullish on BAC stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BAC Stock Bolsters Investor Sentiment Following Q2 Beat

For obvious reasons, the second quarter represented a litmus test for the banking sector and the broader economy. Following a worrying implosion of three regional banks earlier this year, investors looked for clues regarding the financial industry’s health. For its part, Bank of America demonstrated that the biggest players should perform reasonably well, moving forward.

Last month, BofA announced better-than-expected earnings results. As TipRanks reporter Kailas Salunkhe stated, revenue increased by 2.9% on a year-over-year basis to $25.2 billion. This tally beat Wall Street’s consensus target by $260 million. Further, the financial giant posted earnings per share of 88 cents, beating the average analyst estimate by four cents.

During the quarter, wrote Salunkhe, “higher interest rates and loan growth helped BAC increase its net interest income by 14% to $14.2 billion. Further, higher sales and trading revenue resulted in the non-interest income of the company rising by 8% to $11 billion. Additionally, its Global banking and consumer banking segments continued to track well with a growth of 29% and 15% respectively.”

Significantly, with management encouraged by its strong balance sheet position, BofA “is also planning to hike its quarterly dividend by 9% in the third quarter.”

On the charts, BAC stock is down about 11.6% since the beginning of this year. However, in the trailing one-month period, the security has stayed flat, indicating a possible sentiment shift.

Bank of America Offers a “Goldilocks” Play

To be quite frank, against the bigger picture, not much separates BAC stock from its big-bank counterparts. Nevertheless, for investors that appreciate a nuanced argument, BofA arguably offers a “Goldilocks” play — not too big, not too small, but just right, as mentioned earlier.

For those who are concerned about the stability of the financial industry but still want to invest in the space, JPMorgan Chase (NYSE:JPM) seemingly offers the best choice. Right now, JPM commands a market capitalization of nearly $432 billion. That dwarfs BAC’s market cap of roughly $233 billion – and BofA is no slouch.

However, a glaring drawback of JPM is its valuation. Trading at a price/book multiple of 1.5x, that’s conspicuously above the sector average, which sits at around 1x. To be fair, the book multiple for BAC stock at 0.9x isn’t dramatically undervalued. Nevertheless, it offers better value than JPM.

On the other hand, one could look at the smallest name of the big four, Citigroup (NYSE:C), and make the argument that it’s significantly undervalued. In April of this year, TipRanks reporter Michelle Jones stated that C stock traded at a book multiple of 0.5x. Now, the latest data shows that Citigroup trades at 0.46x.

However, Citi might be too undervalued. Keep in mind that in Q2 2022, the company suffered a 27.2% year-over-year loss in non-interest income, in part due to erosion in its Institutional Clients Group unit.

What about Wells Fargo?

As for Wells Fargo (NYSE:WFC), the company suffered a significant reputational blow from its fake accounts scandal. Unfortunately, the problems keep piling up for WFC. Earlier this year, Wells incurred more legal problems related to improper banking practice accusations.

That’s not to say that BofA is a perfect angel. It, too, got caught regarding junk fees and fake accounts. However, the scale of fraud on Wells’ side is just so much more massive. In February 2020, the beleaguered bank agreed to pay $3 billion to resolve criminal and civil investigations involving the opening of millions of accounts without customer authorization, per the U.S. Department of Justice.

On the other hand, Bank of America must fork over $250 million in fines and customer compensation for deceptive business practices. Again, neither side looks great. However, the scale involved makes BAC stock appear the relative winner.

Is BAC Stock a Buy, According to Analysts?

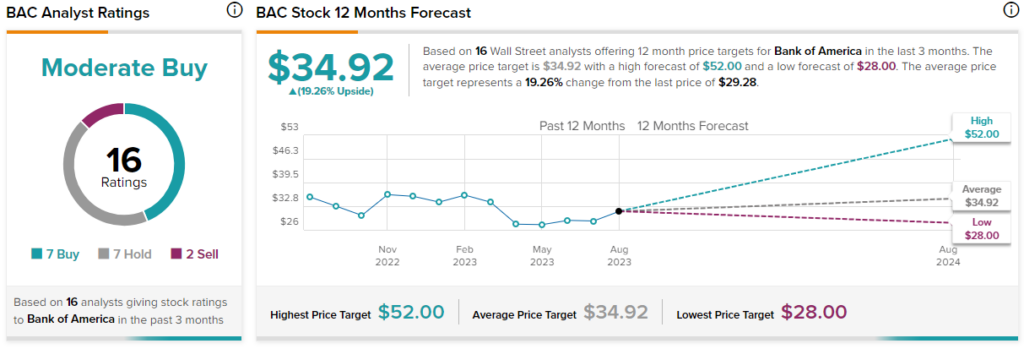

Turning to Wall Street, BAC stock has a Moderate Buy consensus rating based on seven Buys, seven Holds, and two Sell ratings. The average BAC stock price target is $34.92, implying 19.3% upside potential.

The Takeaway: BAC Stock Offers a Sensible Middle Ground

While banking-related investments continue to carry a dark cloud over them, for those interested in the space, BAC stock arguably offers a sensible middle ground. While it’s massive, it’s also comparatively undervalued. Also, although it’s not the cheapest bargain available, BofA’s non-interest income performance implies more resilience, which deserves a more premium multiple. As well, it’s also keeping its nose clean just enough to avoid excessively damaging scrutiny.