ASML Holding (NASDAQ:ASML) isn’t the most familiar tech name for American stock traders. However, the stock is suddenly trending on financial social media, and there are valid reasons for this. I am bullish on ASML stock and expect it to provide good value for investors with a long time horizon.

ASML Holding is a Dutch company that provides equipment to manufacture semiconductors. In other words, investing in ASML offers an indirect path to global chip market exposure, as it’s a “chip-equip” (chipmaking-equipment) stock instead of a typical chipmaker stock.

Of course, you’ll want to conduct extra due diligence on ASML if you’re just hearing about the company now. That’s perfectly fine, as ASML could be a secret pick for stock investors who like to find hidden gems that many U.S. traders don’t know about.

ASML Holding Stock Hits a Resistance Level

Today, ASML Holding stock zoomed about 9% higher, at one point reaching the crucial $860 resistance level where the stock was rejected a couple of times in 2021. Yet, it feels like a breakthrough may be in progress since there are legitimate reasons for stock traders to bid up the ASML share price now.

ASML just published its fourth-quarter and full-year results for 2023. The fourth quarter offered up a truly remarkable statistic, as ASML’s net bookings increased to €9.186 billion (around $9.98 billion) versus just €2.602 billion in the prior quarter. Analysts, furthermore, only expected ASML’s quarterly bookings to total €5.6 billion.

In other words, the demand for ASML’s chipmaking equipment was quite intense in last year’s final quarter. Furthermore, ASML has a big advantage; as Bloomberg explains, ASML is the “only company that produces equipment needed to make the most sophisticated semiconductors.”

This presents the possibility of a terrific picks-and-shovels play for savvy investors. Sure, you can try to pick out the winners among a slew of semiconductor makers, or instead, you can bet your money on the company that builds the equipment needed to manufacture all of these semiconductors.

More Great Results from ASML, Plus a Warning

While ASML Holding’s fourth-quarter bookings were truly impressive, that’s not the only startling stat that you need to know about. There are other great results to consider, but there’s also a warning from ASML.

Here’s the rundown for Q4 2023. ASML’s revenue of €7.24 billion ($7.66 billion) easily beat Wall Street’s consensus estimate of €6.68 billion. Moreover, for the full year of 2023, ASML’s net sales grew 30% year-over-year to €27.6 billion.

Turning to the bottom-line results for last year’s fourth quarter, ASML’s earnings of €5.21 euros ($5.66) per share surpassed the analysts’ consensus estimate of €4.76 per share. This is actually pretty amazing, especially since Cantor Fitzgerald analysts considered ASML to be a major underperformer in 2023. Nevertheless, the Cantor Fitzgerald analysts initiated their coverage of ASML stock with an Overweight rating, so they’re probably not too worried about the company’s near-term growth prospects.

On the other hand, ASML’s management may be only moderately optimistic about this year. ASML CEO Peter Wennink warned, “We maintain our conservative view for the total year and expect 2024 revenue to be similar to 2023.” Thus, on a year-over-year basis, investors shouldn’t anticipate another year of 30% revenue growth for ASML; actually, there might be no growth at all in 2024.

That’s not just my opinion, as Wennink basically said this himself. “2023 was our top year… We won’t see another 30% growth in 2024,” the ASML CEO reportedly cautioned.

Still, this warning doesn’t apply to the following year, 2025. Wennink declared, “We also expect 2024 to be an important year to prepare for significant growth that we expect for 2025.”

It’s too early to know exactly what that “significant growth” might look like. Given ASML’s recent results, however, there’s undoubtedly a strong long-term case for robust demand and growth. As the CEO put it, “Our strong order intake in the fourth quarter clearly supports future demand.”

Is ASML Stock a Buy, According to Analysts?

On TipRanks, ASML comes in as a Strong Buy based on five unanimous Buy ratings assigned by analysts in the past three months. The average ASML Holding price target is $863, implying 1.9% upside potential.

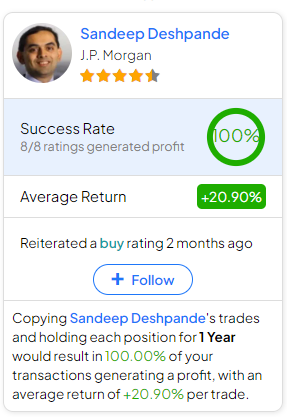

If you’re wondering which analyst you should follow if you want to buy and sell ASML stock, the most accurate analyst covering the stock (on a one-year timeframe) is Sandeep Deshpande of JPMorgan Chase (NYSE:JPM), with an average return of 20.90% per rating and a 100% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ASML Stock?

ASML Holding has called itself “the most important tech company you’ve never heard of.” I’d actually concur with that claim and would add that ASML should easily be able to withstand a challenging 2024 and thrive in 2025.

Besides, I encourage prospective investors to go over ASML Holding’s fourth-quarter 2023 results if they’re doubtful of the company’s long-term growth prospects. Consequently, for an underappreicated picks-and-shovels play in the global semiconductor market, I’m certainly considering ASML stock today.