While most investments rise on directly positive data, for Huntington Ingalls (NYSE:HII), the otherwise awful news of worsening U.S.-China relations could actually benefit the naval shipbuilder. With trust between the top two economies fading rapidly from an already low point, this latest fissure may take considerable time to heal. Fundamentally, such a framework bodes well for military contractors based on the power projection thesis. I am bullish on HII stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As TipRanks contributor Steve Anderson stated, “Relations between the U.S. and China have long been on the rocky side. However, the latest incident involving an alleged spy balloon hasn’t even slightly helped matters.” While Anderson focused on the negative impact on publicly-traded Chinese companies, HII stock represents the opposite scenario: an investment that can rise due to geopolitical tensions.

However, what made the crisis all the more bizarre was how senseless it was. According to CNN, both U.S. and Chinese officials looked forward to Secretary of State Antony Blinken’s planned visit to Beijing. While separated ideologically, the two economic juggernauts largely depend on each other for commercial prosperity. As well, both sides recognized that tensions had ratcheted up, thus requiring a cooling of the accrued bitterness.

Unfortunately, the alleged spy balloon incident shifted the narrative. While the altitude of the balloon raises ambiguities regarding the violation of international sovereignty, Beijing also took an unnecessary risk. By angering the U.S. at a geopolitically sensitive time, Americans have little reason to trust the Chinese administration.

As a result, tensions will likely continue rising, which cynically favors HII stock.

Supporting the bull thesis, on TipRanks, HII stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

Bad News is Good News for HII Stock

At the most basic level, bad news is good news for HII stock and military-related investments. To be clear, Huntington would likely not benefit from an outbreak of actual war between the U.S. and China. Under a globalized, interdependent economy, the two biggest powerhouses going at it would yield no favorable outcome.

Rather, HII stock benefits from the projection of power; that is, demonstrating through a show of strength what might happen if adversarial nations cross certain red lines. It’s part of the reason why tensions regarding Taiwan – though wildly intense – have yet to yield actual warfare. The U.S. and China recognize the steep costs awaiting them should shots be fired in anger.

Plus, once a war breaks out, there’s nothing to threaten to escalate to. Therefore, the two nations prefer building their war machines, with each new weapon posing a fallback option (without actually falling back to it). Such a framework of war without bloodshed bolsters HII stock.

Indeed, HII’s recent market performance confirms its relevance. At a time when the major equity indices fell on Monday due to fears of continued rising interest rates, HII stock popped up over 2%. It’s likely no coincidence. After all, the U.S. military shot down the balloon on Saturday.

A Quantifiably Intriguing Opportunity

Despite rising relevancies, reading the geopolitical tea leaves presents incredible challenges. Fortunately, the narrative for HII stock doesn’t just focus on interpretative factors. Rather, the underlying financial metrics suggest it’s a reasonable, bullish idea.

Currently, the market prices HII stock at a trailing earnings multiple of 15.4, ranking better than 77.46% of sector players. Also, HII trades at 14.9 times forward earnings, ranking better than nearly 78% of its peers.

Operationally, the naval shipbuilder’s three-year revenue growth rate stands at 8.2%, above nearly 72% of the industry. Also, its book growth rate during the same period pings at 24.7%, outpacing over 83% of the competition. Further, its net margin of 5.46% outflanks 58% of its rivals.

Further, Huntington has been consistently profitable over the past several years. Given the renewed tensions between the U.S. and China, this trend probably won’t end anytime soon.

Is HII Stock a Buy, According to Analysts?

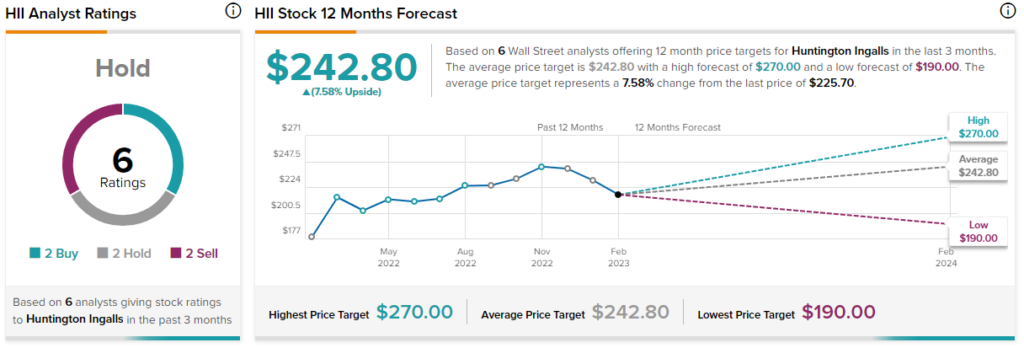

Turning to Wall Street, HII stock has a Hold consensus rating based on two Buys, three Holds, and two Sell ratings. The average HII price target is $242.80, implying 7.6% upside potential.

The Takeaway: HII Stock Smiles on Enflamed Tensions

On a year-to-date basis, HII stock looked set to print a poor return in 2023. As mentioned earlier, the U.S. and China eagerly awaited a cooling of tensions. However, the bizarre balloon incident reset relations back toward a negative trajectory.

Certainly, Huntington Ingalls won’t be hoping for an outright military conflict. However, the lack of trust and the motivation to build new weapons systems bodes very well for HII stock.