When it comes to boring investments that can help you ride out a storm, it doesn’t get much more boring than Home Depot (NYSE:HD). Sure, you can absolutely pick far more exciting market ideas. Nevertheless, under the current ecosystem of lingering stability concerns, the relevant and dependable home improvement retailer seemingly offers a wise approach and can warm up your portfolio this winter. I am bullish on HD stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

HD Stock Offers an Excellent ‘Parking’ Spot

Although the economy offers some bright spots – in particular, an overall surprisingly stout jobs market – other challenges, such as persistently high inflation and rising borrowing costs, present an ambiguous framework. While investors have reasons to be optimistic, they also have many reasons to be pessimistic. Given this lack of clarity, HD stock offers an excellent place to park your money.

For one thing, investors can depend on the company’s strong earnings track record. It rarely prints a stinker. Further, in its most recent disclosure for the third quarter of Fiscal Year 2023, Home Depot posted diluted earnings per share of $3.81, beating the consensus estimate of $3.75 per share. On the revenue front, the company rang up $37.7 billion, slightly beating expectations calling for $37.6 billion.

In fairness, both the profitability and growth figures represented a conspicuous decline on a year-over-year basis. As Ted Decker, Home Depot’s Chair, President and CEO stated, the business experienced pressure in certain big-ticket items listed under discretionary categories. However, the company did see continued customer engagement with smaller projects.

Put another way, when it comes to everyday needs – pipes breaking, walls that need repainting – consumers turn to Home Depot. That makes for a strong case for HD stock, given its underlying predictability.

Bad Weather Could be a Positive for Home Depot

Further, with the winter season bringing in colder temperatures, consumers will invariably need these everyday products to stay warm. From firewood to other heating solutions, Home Depot should benefit from increased demand. Even inclement weather conditions – within reason – may deliver an upside catalyst for HD stock.

Indeed, that was one of my arguments for Home Depot last year. With all the talk about climate change, emphasis has understandably shifted toward renewable energy solutions and sustainable practices. However, such infrastructural initiatives will likely take many years if not decades. In the meantime, households need to tactically mitigate the impact of climate change. That could help HD stock.

It’s not just random musings. Several years ago, Home Depot enjoyed a sales boost from disaster-prep demand as households prepared for hurricanes Harvey, Irma, and Maria. Further, the company actively promotes itself as a source to prepare for whatever Mother Nature throws at society.

Decent Value and Consistency Drive Home the Bull Case

Another compelling reason to consider HD stock amid rising questions about economic vitality is the underlying value proposition, along with the predictability and prominence of the brand. Again, while it might not be the most exciting entity out there, when people need home improvement products, they turn to Home Depot.

First, HD stock offers decent value for the money. Right now, shares trade at 20.5x trailing-year earnings. In all fairness, this multiple isn’t that remarkable compared to the broader retail sector. However, when stacked against other home improvement stores – which carry an average price-earnings (PE) ratio of 21.37x – HD offers a modest discount.

Second and more importantly, Home Depot offers a predictable business. Since at least Fiscal Year 2011, the company has posted annual top-line expansion. What’s more, the brand itself enjoys prominence with consumers, affording it a certain pricing power.

Specifically, in the latest quarter, the retailer’s gross profit margin landed at 33.78%. That’s close to the long-term gross margin average of around 34%. Despite various trials and tribulations, Home Depot’s sales are largely based on real demand, not fluctuations in monetary policy. This should add a high degree of confidence for would-be investors.

Is HD Stock a Buy, According to Analysts?

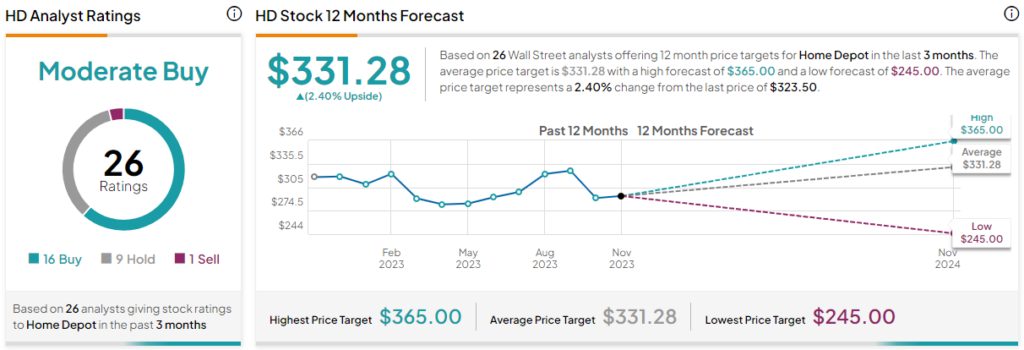

Turning to Wall Street, HD stock has a Moderate Buy consensus rating based on 16 Buys, nine Holds, and one Sell rating. The average HD stock price target is $331.28, implying 2.4% upside potential.

The Takeaway: HD Stock is Boring but Dependable

No amount of verbal gymnastics can dress up Home Depot as anything other than a boring investment. However, its pedestrian nature also stems from proven business predictability, which makes HD stock quite relevant. At this juncture, it may be more prudent to think about weathering the storm rather than hitting one out of the park.