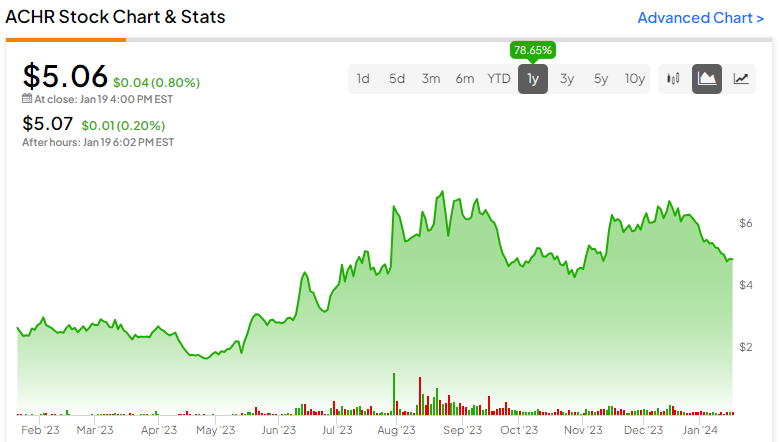

Have you ever thought about investing in the market for air taxis? Archer Aviation (NYSE:ACHR) is a premier player in an awesome, potentially hyper-growth industry. Sure, there are risks involved, but I am bullish on ACHR stock for the long term.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Archer Aviation manufactures what’s informally known as flying cars or air taxis. The technical name for them is electric vertical takeoff and landing (eVTOL) vehicles. So, get your boarding pass ready as we’re about to take an informative trip with Archer Aviation.

Archer Aviation is a Respectable Business

There are risks involved when you’re investing in a new, untested market. Consequently, I won’t recommend that anyone should over-invest in ACHR stock. On the other hand, Archer Aviation is a respectable business enterprise and not just a fly-by-night operation.

I’ll acknowledge that Archer Aviation isn’t a profitable company. However, as of September 30, 2023, Archer Aviation had a decent capital runway with nearly $600 million of liquidity, including cash and cash equivalents totaling $461 million.

Furthermore, Archer Aviation is collaborating to help build eVTOL infrastructure in California, New York, and Florida. In addition, the company earned the “Transportation Design of the Year” award for 2023 from the MUSE Design Awards.

Archer Aviation Has International Ambitions

Archer Aviation has also successfully completed test flights for its Midnight eVTOL aircraft. This is a legitimate air taxi company, and Archer Aviation is preparing to plant its flag on more than one continent.

While Archer Aviation has substantial operations in the U.S., the company is also eyeing the Middle Eastern market. Notably, Archer Aviation displayed its Midnight eVTOL aircraft at the 2023 Dubai Air Show. Speaking of Dubai, a major client there ordered 100 Midnight eVTOL aircraft in a deal worth approximately $500 million.

Meanwhile, Archer Aviation disclosed its plans to launch an air taxi service in India in 2026. That’s a region with a population of 1.4 billion, so just think about the revenue-generating potential for Archer Aviation in India.

Is ACHR Stock a Buy, According to Analysts?

On TipRanks, ACHR comes in as a Strong Buy based on four Buys and one Hold rating assigned by analysts in the past three months. The average Archer Aviation price target is $8.13, implying 60.7% upside potential.

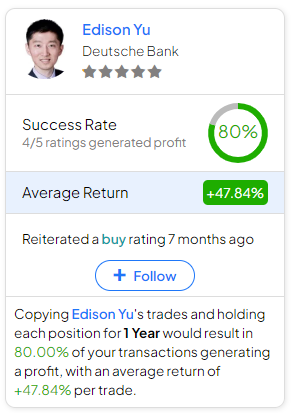

If you’re wondering which analyst you should follow if you want to buy and sell ACHR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Edison Yu of Deutsche Bank (NYSE:DB), with an average return of 47.84% per rating and an 80% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ACHR Stock?

While it’s risky to invest in a still-new niche industry, Archer Aviation is a legit company with a multinational presence. Hence, for a small share position in the exciting eVTOL market, I’m considering a position in ACHR stock.