Drum roll, please! The main event is about to begin. After most of its big tech colleagues have already reported their latest quarterly statements, today, as the market closes, Apple (NASDAQ:AAPL) will deliver its fiscal fourth quarter of 2023 (September quarter) results.

As acknowledged by J.P. Morgan’s 5-star analyst, Samik Chatterjee, recent sentiment around Apple has been driven by several bearish developments. The analyst cites “increasing concerns around the lower demand for the iPhone 15 Series in China, as well as lackluster consumer spending momentum globally” that have been affecting the momentum of its recently launched products (i.e., smartphones and smartwatches).

As such, based on a lack of momentum around consumer spending on smartphones, PCs, and tablets offset by double-digit growth in Services, Chatterjee sees F4Q23 revenue falling by 1% year-over-year to $88.9 billion. That lands below consensus at $89.3 billion. At the other end of the spectrum, though, accounting for “tight cost control and robust gross margins,” he anticipates EPS of $1.40 (vs. consensus of $1.39).

As for the outlook for F1Q24 (December quarter), Chatterjee thinks it will be “underwhelming, but still leave open the opportunity to return to growth.”

Once again, Chatterjee’s top-line forecast is below that of the Street. On account of expecting lower-than-consensus revenue in iPhones and products, somewhat offset by better results in Services, he expects revenue to rise by 1% YoY to $118.7 billion, below consensus at $123.1 billion. “We expect the competitive dynamics in the China market as well as a challenging macro backdrop globally to drive lower iPhone volumes year-over-year, offset by modestly better price/mix,” the analyst explained his stance. However, despite anticipating a more modest haul on the revenue side, Chatterjee is calling for EPS of $2.10, slightly above the Street’s forecast of $2.09.

So, down to business, what does it all mean for investors? Ahead of the print, Chatterjee maintained an Overweight (i.e., Buy) rating on Apple shares to go alongside a $230 price target. There’s potential upside of 35% from current levels. (Watch Chatterjee’s track record)

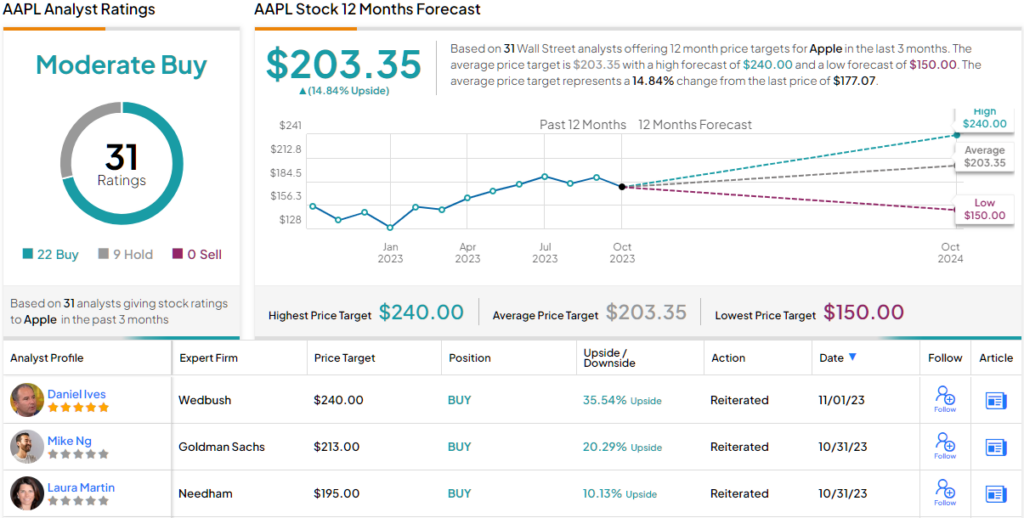

Overall, 21 analysts join Chatterjee in the bull camp and with the addition of 9 fencesitters, the stock claims a Moderate Buy consensus rating. The average target currently stands at $203.35, implying shares will post growth of 15% in the months ahead. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.