Shares of oil and gas producer Antero Resources (NYSE:AR) are among the most-discussed stocks on the social media platform Reddit. While this trending Reddit stock has underperformed the broader markets so far this year, analysts’ average price target implies that AR could witness a recovery and deliver notable gains over the next 12 months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this backdrop, let’s understand what’s in store for Antero Resources shareholders in the future.

Is Antero Resources a Good Stock to Buy?

Antero’s financials and stock price took a hit from the decline in average realized prices and lower demand for crude and natural gas. Antero stock is down about 19% year-to-date. Despite this, analysts hold a cautiously optimistic perspective, anticipating a potential rise in its stock price. Notably, macroeconomic concerns eased in the first half of 2023. Further, fresh geopolitical concerns in the Middle East have increased the risk premium in the market. These factors suggest a potential upturn in crude oil prices, which will support AR’s financials.

The company noted that Propane export demand has been consistently strong. Moreover, Antero’s management expects exports to increase further in 2024 due to the potential tightness in U.S. Gulf Coast stock capacity. Additionally, management anticipates that a significant reduction in rigs and completion crews will constrain production growth next year, which will help balance the U.S. natural gas market.

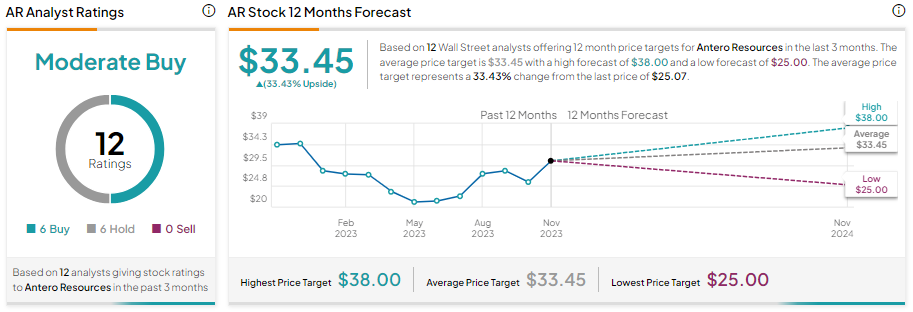

Overall, Antero is poised to benefit from the improvement in the operating environment and increase in its production. With six Buy and six Hold recommendations, Antero stock sports a Moderate Buy consensus rating. Further, the average AR stock price target of $33.45 implies 33.43% upside potential from current levels.

Bottom Line

Antero stock has disappointed investors so far this year. However, the improving operating environment, positive demand signals from China, and higher production could lead to a recovery in AR stock, as reflected in the analysts’ average price target.