In this piece, I evaluated two cloud and networking stocks, Arista Networks (NYSE:ANET) and Juniper Networks (NYSE:JNPR), using TipRanks’ comparison tool to see which stock is better. A closer look suggests neutral views for both. However, one has a much brighter outlook, calling for a wait-and-see approach.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Arista Networks is a computer networking company that designs and sells multilayer network switches to provide software-defined networking for data centers, cloud computing, high-performance computing, and high-frequency trading computers. Similarly, Juniper Networks develops and markets networking products like routers, switches, network-management software and security products, and software-defined networking technology.

Shares of Arista Networks are up 123% over the last year following a three-month rally of 30%. Meanwhile, Juniper Networks stock has skyrocketed over the last three months, climbing an impressive 47%, although it’s up only 20% over the last 12 months.

JNPR is also up 26.6% for the year already. However, that massive gain is entirely due to the recent acquisition announcement, which has set a firm $40/share price on the stock (more on that below). On the other hand, Arista Networks has enjoyed a fairly steady upward march over the last year or so. Thus, a closer look is needed to see whether fair value has been reached.

Arista Networks (NYSE:ANET)

At a P/E of 41.2, Arista Networks is trading slightly higher than its mean P/E of 36.7 since February 2019. Due to a mix of positive and negative factors, a neutral view seems appropriate, pending a better entry price into the stock.

First, Arista Networks has received quite a few analyst upgrades recently in connection with its AI-related technology. Melius Research upgraded the stock for the AI “halo effect,” while JPMorgan (NYSE:JPM) upgraded it and added it to its Focus List, also due to its AI offerings. Piper Sandler named Arista Networks one of the best-positioned AI names, and Argus Research named Arista one of its top picks for 2024.

While some analysts do get carried away during high-momentum periods for tech stocks, receiving multiple upgrades is definitely worth noticing. On the other hand, the higher Arista Networks rises, the further it ventures into overbought territory. With a Relative Strength Index of 73.6, the stock has already surpassed the overbought threshold of 70, meaning it could be overdue for a correction.

Additionally, a review of insider trading activity for Arista Networks reveals a significant number of Auto Sell transactions. When a stock price has been moving steadily higher over an extended period of time, it makes sense for insiders to start taking profits.

In fact, company insiders typically establish pre-set trading plans with prices at which to automatically sell their company’s stock. Thus, a large number of auto-sell transactions suggests insiders are taking profits because they don’t see much more upside left in the near term.

There’s one last bullish note to point out for Arista Networks. It would be an excellent buy-and-hold position, but only for the ultra-long term. The shares are up 213% over the last three years, 347% over the last five, and 1,711% since June 2014.

Thus, investors who can stomach buying a stock in overbought territory near its 52-week high while insiders have been selling shares may still consider buying a few shares — as long as they plan to hold the stock for many years. However, I personally would just wait for the next correction and buy shares then.

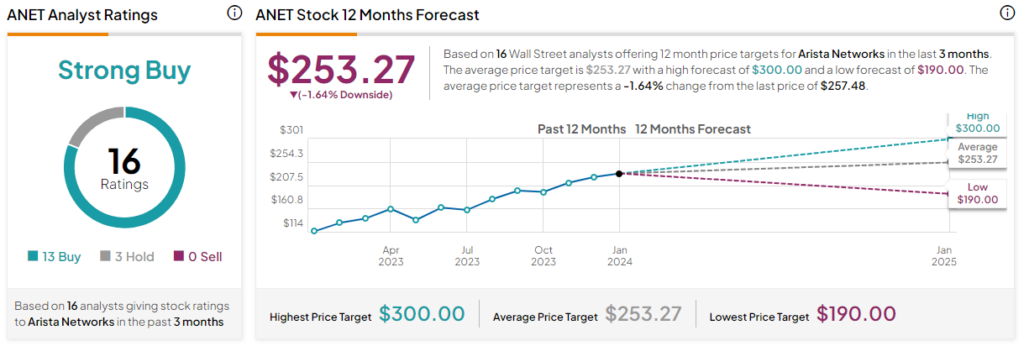

What is the Price Target for ANET Stock?

Arista Networks has a Strong Buy consensus rating based on 13 Buys, three Holds, and zero Sell ratings assigned over the last three months. Nonetheless, at $253.27, the average Arista Networks stock price target implies upside potential of 1.64%.

Juniper Networks (NYSE:JNPR)

The recent acquisition offer for Juniper Networks has set a hard value of $40/share for the company’s stock, so at current levels just below that price, little upside is left. Thus, a neutral view seems appropriate — with the possibility of a more constructive merger-arbitrage view if the price drops meaningfully.

Hewlett Packard Enterprise (NYSE:HPE) has offered to buy Juniper Networks for $40/share or $14 billion in cash, with the deal expected to close late this year or in early 2025. As a result, while that transaction is pending, it may not be wise to buy Juniper shares unless they drop significantly below that price for some reason.

The deal is aimed at enhancing HPE’s artificial intelligence prowess through Juniper’s AI-related networking gear. However, the window before the transaction is expected to close is quite long, so it may be worth monitoring Juniper for the possibility of an attractive merger-related play in the meantime.

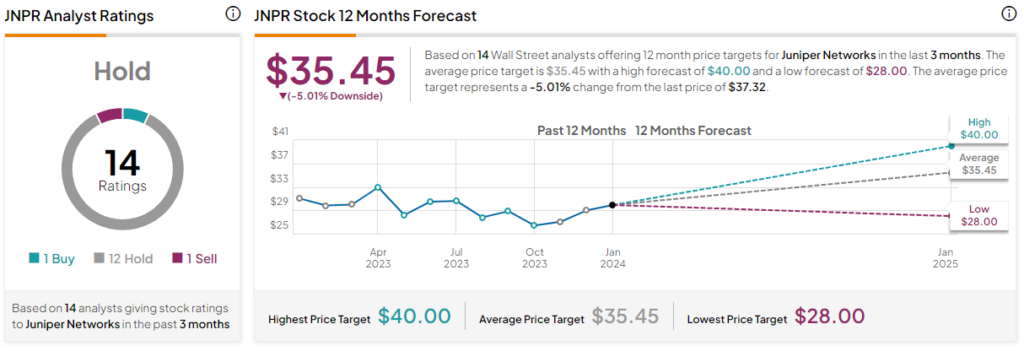

What is the Price Target for JNPR Stock?

Juniper Networks has a Hold consensus rating based on one Buy, 12 Holds, and one Sell rating assigned over the last three months. At $35.45, the average Juniper Networks stock price target implies downside potential of 5%.

Conclusion: Neutral on ANET and JNPR

Although Arista Networks and Juniper Networks both receive neutral ratings, the reasons are entirely different. In fact, Arista is the clear winner of this pairing because the likelihood of a more attractive entry point materializing seems far greater.