The Utility sector is a popular safe haven for investors seeking shelter, as the global economic outlook worsens and recession looms. AGL Energy Limited (ASX:AGL) and Contact Energy Limited (ASX:CEN) are among analysts’ favourite utility shares, according to TipRanks insights.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why utilities appeal to investors in tough times

As central banks rush to combat soaring inflation with interest rate hikes, investors fear a looming recession. In a recession, widespread job losses often lead to households cutting their spending. That can in turn reduce sales for businesses across the board.

Even as they slash their budgets in recession belt-tightening, households still need to pay for electricity and water. As a result, utility companies can fare better than others even in an economic downturn.

Indeed, there has been a move to utilities stocks in recent times amid a darkening economic outlook. The S&P/ASX 200 Utilities (XUJ) index rose more than 1% on Wednesday and has gained about 2% in the past week, at a time when most sectors are down. Moreover, Utilities is also analysts’ top sector, containing the most number of stocks with Buy ratings, according to TipRanks insights. Let’s take a closer look at ASX utility shares AGL Energy and Contact Energy.

AGL Energy’s share price prediction suggests 28% upside potential

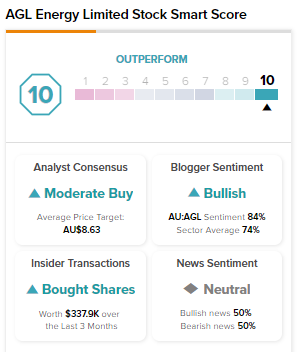

AGL Energy is an Australian electricity and gas wholesaler and retailer. Its shares have climbed about 10% since the beginning of the year. According to TipRanks’ analyst rating consensus, AGL Energy stock is a Moderate Buy based on four Buys and three Holds. The average AGL Energy share price prediction of AU$8.60 implies over 27% upside potential.

Moreover, AGL Energy scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Contact Energy share price forecast indicates 58% upside potential

Contact Energy is a New Zealand electricity generator and distributor, operating in wholesale and retail market segments. According to TipRanks’ analyst rating consensus, Contact Energy stock is a Moderate Buy. The average Contact Energy share price forecast of AU$10.29 implies over 58% upside potential.

Closing remarks

In the event of a recession, AGL Energy and Contact Energy may not completely go unscathed. However, analysts believe they are a good defensive play in rough times.