Adobe (NASDAQ:ADBE) will announce its third-quarter Fiscal 2023 results after the market closes on September 14, 2023. Prior to the Q3 earnings release, eight analysts reaffirmed their Buy recommendations on the stock, which demonstrates their confidence in ADBE’s potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

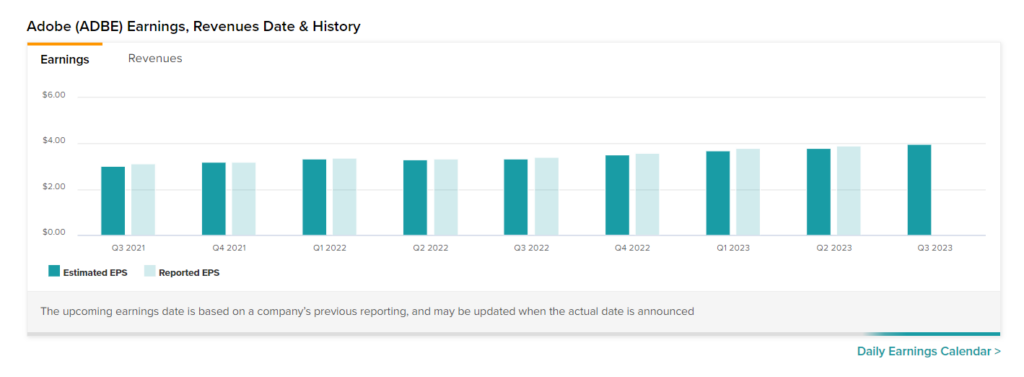

Interestingly, Adobe has a consistent history of delivering strong quarterly performances. The company beat earnings expectations for 15 consecutive quarters, indicating the potential for it to outperform estimates again in the to-be-reported quarter.

This time, Wall Street expects ADBE to post earnings of $3.97 per share in Q3 compared with earnings of $3.40 per share reported in the prior-year period. Meanwhile, revenue is expected to rise by 11.2% from the year-ago quarter to $4.87 billion.

Q3 Earnings: Here’s What Analysts are Saying

Among the bullish analysts, Keith Bachman from BMO Capital anticipates that generative AI could bolster Adobe’s net new annual recurring revenue in the coming years. Also, the analyst expects Adobe to implement price increases of 10% to 15% and is confident that the company will continue to attract new users across all user categories.

Bachman boosted his price target for ADBE stock to $640 from $600 while reaffirming the stock’s Buy rating.

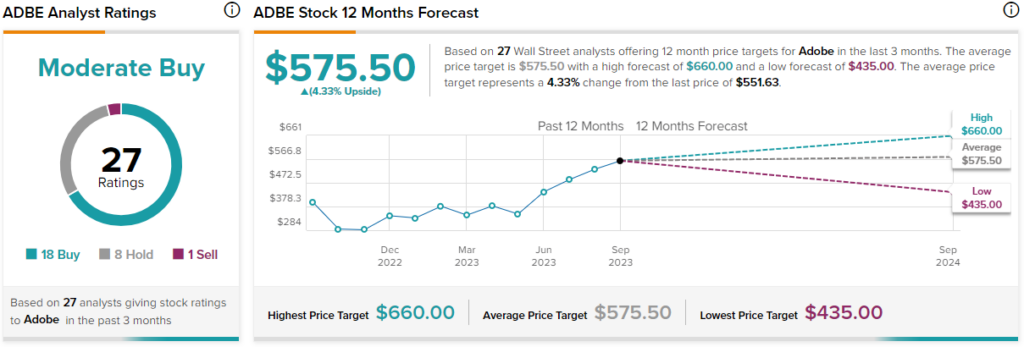

Moving on, Jefferies analyst Brent Thill reaffirmed a Buy rating and also raised the price target on Adobe to $660 from $600. Thill expects Adobe to have benefited from a healthier demand environment during the quarter. Moreover, the analyst sees ADBE to be reasonably valued despite a year-to-date rally of over 60%.

Is Adobe Stock Expected to Go Up?

Wall Street is cautiously optimistic about Adobe. ADBE stock has a Moderate Buy consensus rating based on 18 Buys, eight Holds, and one Sell rating. The average ADBE stock price target of $575.50 implies 4.3% upside potential.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in ADBE stock to move by +/-5.18% after reporting earnings. The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Ending Thoughts

Adobe’s artificial intelligence tool, Firefly, holds the promise of attracting new customers and driving revenue growth. Also, its impressive earnings history instills confidence that it could easily exceed expectations for the upcoming reporting quarter. Furthermore, the acquisition of Figma, which is expected to close this year, has the potential to expand Adobe’s total addressable market, opening up new growth opportunities.