Let’s talk about electric vehicles, EVs. Electrically powered cars are not a new concept – they’ve been around since the earliest days of the automobile. But in the past decade, several factors have combined to make them more competitive with the industry-standard internal combustion engine. Chief among these factors are improving battery technology, with reductions in weight and improvements in power and range, and reduced cost as manufacturers ramp production up to scale. Globally, EV makers are on a path to spend more than $515 billion by 2030, scaling up production and marketing, and introducing new EV models.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The expansion of the EV market is supported by a combination of government subsidies and social pressures, and the effect has been strong. EVs’ market share in 2022 was 14% globally, having more than tripled since 2020. Putting that into unit numbers, EV sales reached 10.5 million last year, and are expected to hit 27 million by 2026. It’s an expansion that is certain to bring powerful investment opportunities along for the ride.

With this in mind, we used the TipRanks database to pinpoint two EV stocks that have earned Strong Buy ratings from Wall Street’s pros, and at least one of them may show an upside of up to 100% going into next year. Let’s dive in.

Li Auto, Inc. (LI)

We’ll start with Li Auto, a leader in China’s EV market. Li was founded in 2015, and started full-scale production in 2019. Currently, the company has several EV models on the market. These include the L9, a six-seat family SUV, the L8, a six-seat premium model SUV, and the L7, a five-seat SUV. The company’s vehicles are targeted at the family demographic, and as of this past August, the company has delivered a cumulative total of 208,165 vehicles in 2023.

A look at Li’s recent production update shows that the company had a banner month in August – deliveries for each of the L-series vehicles exceeded 10,000, and the company’s August deliveries totaled 34,914. Sales and deliveries of the L9 were particularly gratifying for Li, as the model continues to be a top seller in its category and has seen more than 100,000 deliveries since it was introduced in August of last year.

Solid deliveries are powering Li’s solid financial results. The last quarter reported was 2Q23, which ended before the August delivery report, but the results showed that Li is delivering on the financial end. The company’s revenues in Q2 came to $3.95 billion, well above the $3.8 billion forecast – and up by an impressive 228% year-over-year. The bottom line EPS showed an even more impressive beat, coming in at 36 cents per share, or triple Wall Street expectations of $0.12.

Li Auto is covered by Nomura Analyst Joe Ying, who is impressed by the automaker’s ability to generate sales. He predicts that the company will see further gains in earnings, and writes in his recent note, “We expect Li Auto to continue enjoying strong y-y growth ahead within 2023. Meanwhile, its upcoming BEV models staring from 2024F may further enlarge its business scale and help it gain shares, which we believe is the key for all players in the China EV market. We forecast Li Auto to deliver 72% CAGR for auto shipment during FY22-25F, with 68% revenue CAGR… We believe market share is the key target for all OEMs in the China market and Li Auto is running ahead of peers, which should help them underpin a long-term business development.”

Along with these upbeat comments, Ying gives Li a Buy rating. His price target, set at $54, implies a 41% upside potential for the coming year. (To watch Ying’s track record, click here)

Li Auto’s unanimously positive Strong Buy consensus rating, based on 9 positive analyst reviews, shows that Ying’s bullish view is no outlier. The stock’s average price target of $51.81 suggests a 22% one-year increase from the current trading price of $38.4. (See LI stock forecast)

ChargePoint Holdings (CHPT)

Next up, ChargePoint Holdings, is not an EV maker – but it is an EV-related stock, just the sort of company that is primed to directly benefit from a rapid expansion of the EV market. ChargePoint, as its name says, builds and installs the charging infrastructure that EVs depend on. The company offers a wide range of charging stations, to suit the needs of businesses, auto fleet providers, and private vehicle owners.

Since it entered operation in 2007, ChargePoint has become a leader in the charging station market, and has built up a market share of approximately 70%, at least 7x greater than its nearest competition. Across the North American and European markets, ChargePoint has more than 240,000 stations available on its network, and its corporate clients include 76% of the Fortune 500 companies. The company is solidly positioned to see further gains as the EV charging niche expands in the coming years; the EV charging station business is expected to reach $60 billion by 2030, and an impressive $192 billion by 2040.

That said, the stock has been on the receiving end of a severe beating recently, having missed expectations in its latest earnings report, for the second quarter of fiscal 2024. While revenue rose by 39% vs. the same period last year to reach $150.49 million, it missed the consensus estimate by $2.34 million. Likewise, EPS of -$0.35 came in $0.14 below the analysts’ forecast.

The outlook didn’t improve matters, either. FQ3 revenue is anticipated to hit the range between $150 million to $165 million, with annual revenue guidance expected between $605 million to $630 million. Wall Street was looking for quarterly revenue of $182 million and $678 million for the year.

Nevertheless, J.P. Morgan analyst Bill Peterson is keeping the faith, and has an explanation for the disappointing readout.

“We believe the near-term financial results are largely being impacted by unfavorable market trends rather than company-specific issues, with the company’s competitive position well-intact in our view,” Peterson said. “For example, we do not believe ChargePoint is losing market share (and may in fact be outperforming the market). We would also note ChargePoint (and its partners/customers) strong win rate with NEVI (National Electric Vehicle Infrastructure) projects thus far, albeit in the early stages. We think the setup into next year is favorable with margin headwinds abating further and based on expectations of continued solid passenger EV sales growth with commercial vehicle growth likely to inflect strongly.”

“Thus, with utilization trends continuing to increase (likely to unsustainable levels in some instances within the commercial segment) and the likelihood of fleet to inflect meaningfully, we see the potential for revenue growth to accelerate in CY24 relative to CY23 levels,” the analyst went on to add.

Looking ahead, Peterson has an Overweight (Buy) rating on CHPT shares, with a $10 price target that implies a gain of 75% on the one-year time frame. (To watch Peterson’s track record, click here)

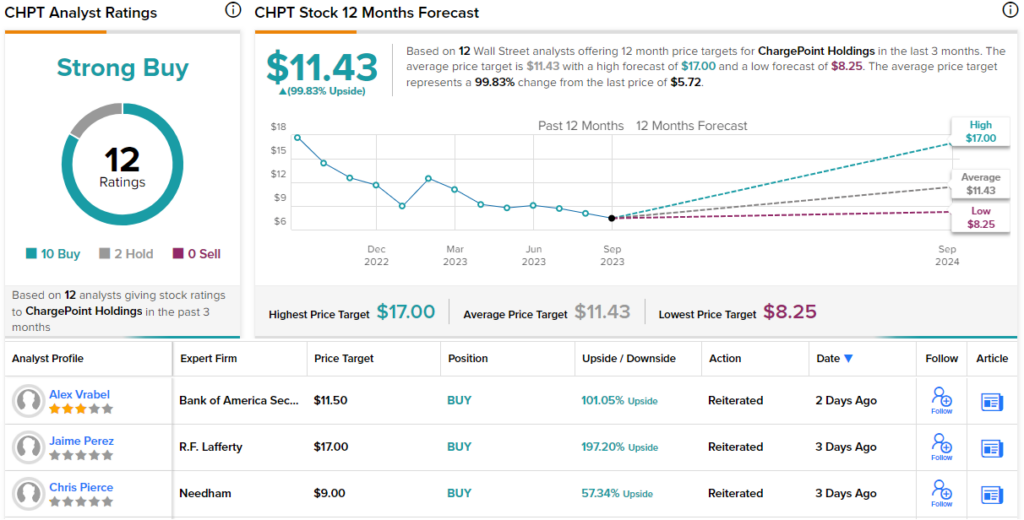

Overall, the Street’s view of ChargePoint is just as bullish. The stock holds a Strong Buy consensus rating, based on 10 positive Buy reviews against 2 Holds, while the $11.43 average price target suggests a robust 100% gain in store for the next 12 months. (See CHPT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.