Dollar General (NYSE:DG) has long made a name for itself as the store to shop when you want to save big on your shopping trips. However, a new report emerged that suggests that even Dollar General’s incredible value may not be enough to save it. The report caused the stock to slip fractionally in Friday’s trading session. Charles Grom, an analyst with Gordon Haskett, advanced the notion that Dollar General may have some serious structural problems, and its competitors may be in a better position to draw in shoppers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

First, Grom was concerned about the firm’s plans to drop $100 million to improve wages and store conditions at the chain. More specifically, that $100 million may not be enough. Further, Walmart (NYSE:WMT) plans to cut costs, and that could drive a wedge into Dollar General’s business as shoppers who might have downgraded to Dollar General remain at Walmart. Finally, Dollar Tree (NASDAQ:DLTR) expects to bring in a new CEO, who might be a winner. That, in turn, will further hurt Dollar General.

Here’s a potential problem Grom didn’t bring up, though. Reports from Dollar General note that more customers are shopping for groceries at the store, but other categories are fading fast as shoppers focus on only the most vital necessities. Cheap groceries were supposed to be a loss leader, getting shoppers to buy other things while they are in the store. Customers buying only loss-leaders is a grocery store’s nightmare.

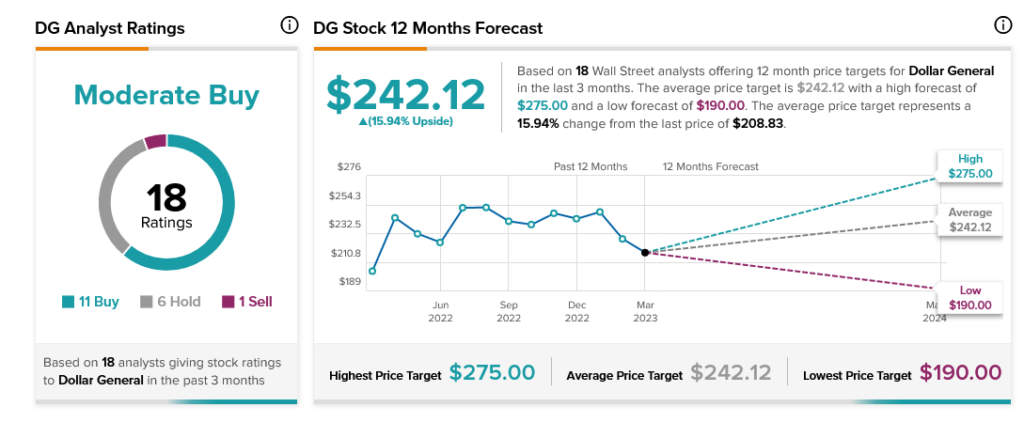

Despite all this, Dollar General still has plenty of analyst support. Analyst consensus calls Dollar General stock a Moderate Buy with 15.94% upside potential thanks to its average price target of $242.12.