Equipment manufacturer Weir Group (GB:WEIR) and Swedish engineering group Sandvik AB (GB:0HC0) are two stocks from analyst Max Yates’ list that have more than 20% upside potential.

Max Yates is an executive director at Morgan Stanley where he is focused on mechanical engineering companies. Yates has recently joined Morgan Stanley after spending 11 years at Credit Suisse.

At Credit Suisse, he had a lead coverage on 14 stocks in the equipment manufacturing segment. He is mainly bullish on the sector as 55% of his ratings are Buys.

Yates is ranked 1,350 out of 7,947 analysts on TipRanks and 2,309 out of a total of 20,942 experts on the website. He has a success rate of 67%, with 64 out of 95 of his ratings successful. He has an average return of 8.2% per rating.

Let’s discuss the stocks in detail.

Sandvik AB: Solid demand growth, but rising prices are a concern

Sandvik AB develops products and services for the manufacturing, mining, and infrastructure industries.

Recently, the company posted the interim report for Q2 of 2022. Revenue at fixed rates grew by 25% and total revenues were up by 34%. The order intake at fixed rates grew by 22%. The company saw good growth in its top line.

Sandvik’s business was negatively impacted by the closing of operations in Russia. The organic growth in both revenues and orders was at 10%, excluding the impact of Russia.

The operating profit was slightly below expectations at SEK 4.7 Billion. Rising costs, high air freight charges, and supply chain disruptions put a dent in profitability as well as cash flow for the company.

To overcome this, the company announced a restructuring initiative which will lead to expected savings of SEK 600 Million. This is the company’s top priority to mitigate the impact of inflation on the business.

Stefan Widing, Sandvik’s President and CEO, said, “We have delivered another strong growth quarter and, despite the wide-scale macro imbalances, we continued to see solid demand in our businesses. Many acquisitions were successfully completed last year, all of which strengthen our offering and positions. These too have contributed to the solid growth of the top line,”

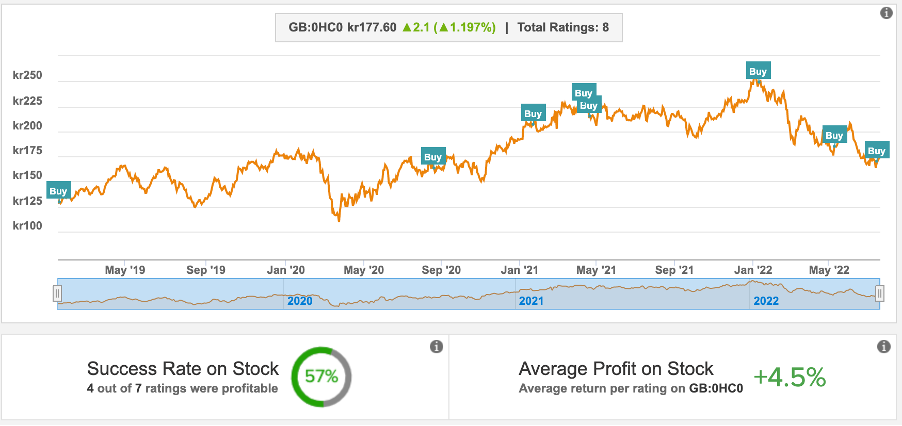

Recently, Yates maintained his Buy rating on the stock at a price target of kr215 which is 21.2% higher than the current price.

Overall, the analysts have a Moderate Buy rating on the stock. The average price target is kr212 with a high forecast of kr240 and a low forecast of kr185.

Weir Group: Rising commodity prices – a favourable point

Weir Group manufactures and sells engineered equipment to various industries.

The stock is down by 21% in the last year, mainly due to the economic turmoil affecting the industrial sector.

As per its last reported results for Q1 of 2022, the company had a good start to the year. Weir’s group order growth gained momentum back after the COVID shutdowns. The growth was mainly driven by aftermarket orders.

The company has suspended its activities in Russia and will wind up the complete business in 2022. The loss of sales from the region will impact the operating profit of £20 million this year.

Weir Group is positive about the full-year performance of 2022. The rising commodity prices will lead to increased production output, which in turn will drive the demand for the company’s solutions.

According to TipRanks’ analyst rating consensus, Weir Group’s stock is a Strong Buy. This is based on ratings from seven analysts, including six Buy and one Hold recommendation.

The average price target is 1,810p, which implies a 19.7% upside potential.

As for Yates, his price target is 1,900p, which is 25% higher than the current price. He has an 88% success rate on the stock, with an average profit of 10.3%.

Conclusion

Amid all the volatility, investors are sceptical about investments. However, analysts are looking at the long-term prospects and making recommendations.

The above mentioned two stocks have backing from Yates. Considering his successful rating history on the stocks, these could be viable options for investors.