After tech and semiconductor stocks — like ASML, AMAT, and MU — took heavy hits to the chin during last Friday’s session, there’s some worry that the AI stock boom as we know it is about to crumble. The AI trade may have been overdue for a cooldown or mild valuation reset, but don’t expect the fundamental tailwinds to dissipate anytime soon — not while so many enterprises may be striving to one-up each other to get the most AI firepower.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

For instance, software titan Microsoft (NASDAQ:MSFT) has not shied away from sharing its plans to back up the truck on AI hardware over the next year. According to Business Insider, Microsoft is targeting 1.8 million GPUs by December 2024. The cash-rich firm is going to be opening its wallet pretty wide to acquire that much firepower to help fuel its AI software ambitions.

Thus, I view Microsoft’s GPU spending spree as a sign that AI-related semiconductor demand is not cooling; it may heat up further as we move into year’s end, with new hardware and ambitious AI strategies (some of which entail greater AI infrastructure spending).

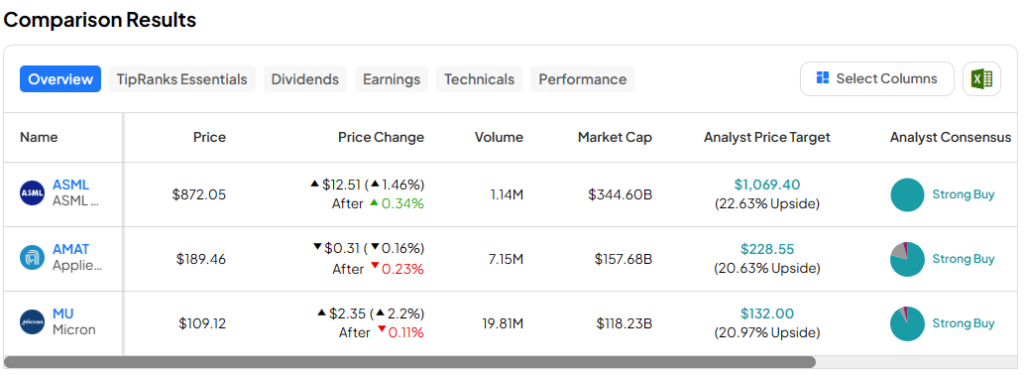

With that, let’s use TipRanks’ Comparison Tool to check out the three aforementioned semiconductor stocks that I view as cheap and buyable on recent market weakness.

ASML (NASDAQ:ASML)

Shares of extreme ultraviolet lithography (EUV) machinery maker ASML recently saw their multi-year stock rally end with a steep 18% plunge from their peak of just over $1,000 per share. The broader semiconductor scene, which has been quite weak of late, is partly to blame for the recent bout of weakness. However, ASML bears part of the blame for coming up short in orders in its latest (first) quarter.

Though the quarter was technically a slight earnings beat, expectations for booming demand in all things semiconductor-related were too hot going into the number. Now that expectations have come down a bit, longer-term thinkers may just have a chance to capture a slightly better price of admission for a company that’s still expected to post strong growth over the longer term. For this reason, I’m staying bullish on the stock.

ASML expects revenue to be between €44 billion and €60 billion at the end of the decade, up from €30 billion to €40 billion expected in 2025. Indeed, it’s the long-term game that could yield the most rewards as the AI boom, which could span many years, continues. Add the potential for booming China demand into the equation, and ASML’s current revenue forecasts may prove overly conservative.

At 38.7 times forward price-to-earnings (P/E), ASML stock may be on the pricy side of the historical range. Given the magnitude of longer-term AI tailwinds, however, the premium seems worth paying, especially if it gets slimmer in a continuation of the stock’s sell-off.

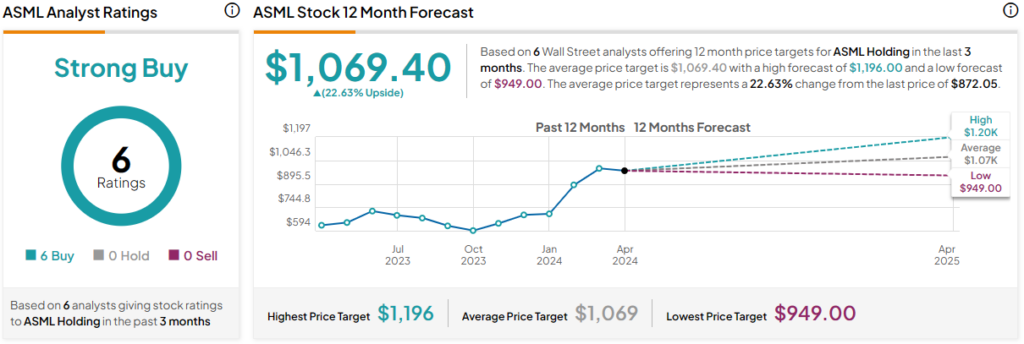

What Is the Price Target for ASML Stock?

ASML stock is a Strong Buy, according to analysts, with six unanimous Buys assigned in the past three months. The average ASML stock price target of $1,069.40 implies 22.6% upside potential.

Applied Materials (NASDAQ:AMAT)

Applied Materials is another semiconductor equipment supplier that’s been dipping in recent weeks. After falling more than 10% following a year-to-date melt-up (shares of AMAT are now up 17% for 2024 so far), the semiconductor play is a standout stock to consider picking up on weakness.

The latest first quarter came in well ahead of estimates, with robust growth coming out of the Chinese region. As China-based chipmakers do their best to meet sky-high AI chip demand with new foundry buildouts and increased investment in production, Applied Materials, a firm that provides the equipment vital to building such chips, seems destined for greater growth out of China.

Like other wafer fabrication equipment (WFE) firms, Applied Materials may experience a few years of steady growth rather than a sudden spike like those enjoyed by AI chip makers themselves. For investors seeking a low-cost semiconductor play, AMAT is nothing short of intriguing at 22.9 times forward P/E, well below that of ASML.

Of course, the company’s Chinese exposure is sure to be a source of geopolitical risks (think probes). As such, investors should evaluate the risks accordingly. Personally, I think the risks are worth the potential long-term rewards, and I’m inclined to stay bullish on the stock.

What Is the Price Target for AMAT Stock?

AMAT stock is a Strong Buy, according to analysts, with 19 Buys, four Holds, and one Sell assigned in the past three months. The average AMAT stock price target of $228.24 implies 20.5% upside potential.

Micron (NASDAQ:MU)

Finally, we have Micron, a memory chip maker that stands to benefit from an increased appetite for high-performance memory requirements of leading AI systems. The stock has been sinking since April began, now down nearly 17% from its early-April all-time high. After such a parabolic spike enjoyed in March, the April plunge seems like nothing to be overly hesitant over.

At the end of the day, Micron is a dominant memory supplier with AI tailwinds that aren’t going anywhere. As shares give up last month’s massive gains on the back of the firm’s latest quarterly blowout, I’m tempted to step in. I’m bullish on MU stock and will be inclined to pound to the table should it come down further over the coming weeks.

More recently, Micron announced that it’s poised to get $6.1 billion in funding for new chip plants in the New York and Idaho regions, thanks to the CHIPS Act. Undoubtedly, the extra cash will go a long way as Micron looks to keep up with firms that are looking to spend heavily on all things AI.

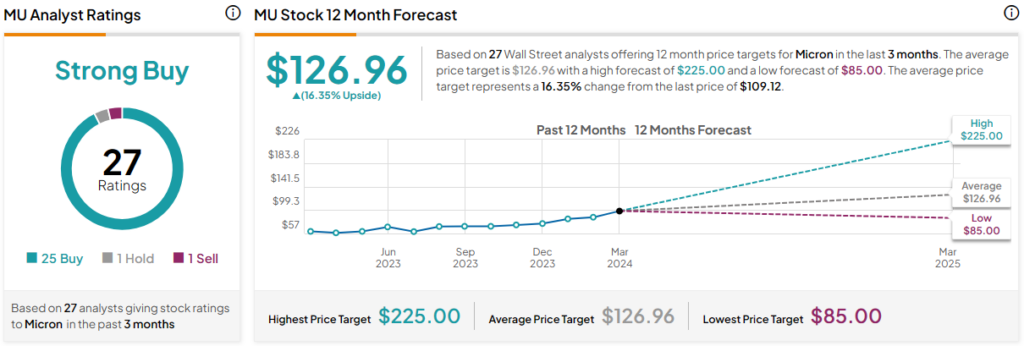

What Is the Price Target for MU Stock?

MU stock is a Strong Buy, according to analysts, with 25 Buys, one Holds, and one Sells assigned in the past three months. The average MU stock price target of $126.96 implies 16.4% upside potential.

The Bottom Line

Semiconductor stocks may have been caught up in the latest AI-focused sell-off. But the long-term growth trajectory still seems intact, granting dip-buyers a potential opportunity to snag some pretty decent prices. Of the trio, analysts expect ASML stock to have the most to gain (22.6%) over the year ahead.