In mid-October, I wrote a bullish piece on American Tower (NYSE:AMT), suggesting that the stock could be a dividend growth powerhouse. The REIT, owning and leasing 225,000 communication towers and 28 data centers, was trading near its five-year-lows at the time. Since then, the stock has surged, leading to a current dividend yield of roughly 3%, notably lower than the pre-rebound figure of 4%. Despite this, I believe AMT remains a solid dividend growth Buy at its current levels, and I maintain a bullish outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Has Caused AMT Stock to Surge?

AMT stock has experienced a remarkable upswing, surging by nearly 38% from its October 52-week low of ~$153/share. This notable surge is likely a result of investors anticipating interest rate cuts in 2024, a development that could significantly benefit AMT and the broader REIT market. Specifically, interest rate cuts should benefit the company in two ways: improved profitability and more exciting growth prospects.

Regarding improved profitability, this is primarily due to the potential decrease in interest expenses on the company’s heavily indebted balance sheet. To elaborate, despite a decrease in AMT’s total debt from $52.0 billion at the end of 2021 (Q4) to $46.8 billion by the end of Q3-2023, the company witnessed a surge in interest expenses from $224.1 million to $359.2 million over this period.

This escalation can be attributed to the swift interest rate hikes that took place in between these quarters. The inverse effect is anticipated with rate cuts, with lower interest expenses set to improve AMT’s overall profitability.

Secondly, lower rates should make management more comfortable with undertaking additional debt, which, in turn, should improve the company’s growth prospects. Remember that REITs primarily fuel their growth through a combination of debt and equity, given their regular distribution of earnings in the form of dividends. Consequently, the ability to access cheaper debt, as was the case before rates surged, should reignite AMT’s growth trajectory.

As the demand for AMT’s equity premium decreases and stock valuation multiples rise in the face of lower interest rates, the stock will likely gain positive momentum upward. This already appears to be the case, which, in turn, should foster more beneficial equity raises and thus contribute to a healthy funding mix along with debt issuances.

Based on the signals emanating from the Federal Reserve’s December meeting, which strongly indicate the possibility of three imminent rate cuts in the upcoming year, investors’ anticipation of a shift in stock sentiment to bullish in mid-October was, in fact, prescient. Thus, the scenario described above, including improved profitability and growth prospects, as described earlier, seems increasingly probable.

Robust Results Support Exciting Dividend Growth Potential

While interest rate cuts should be a strong tailwind for the stock next year, my enthusiasm for AMT extends beyond this, fueled predominantly by its promising dividend growth prospects. To elaborate, let me give a quick overview of the company’s most recent results, as well as its future anticipated results.

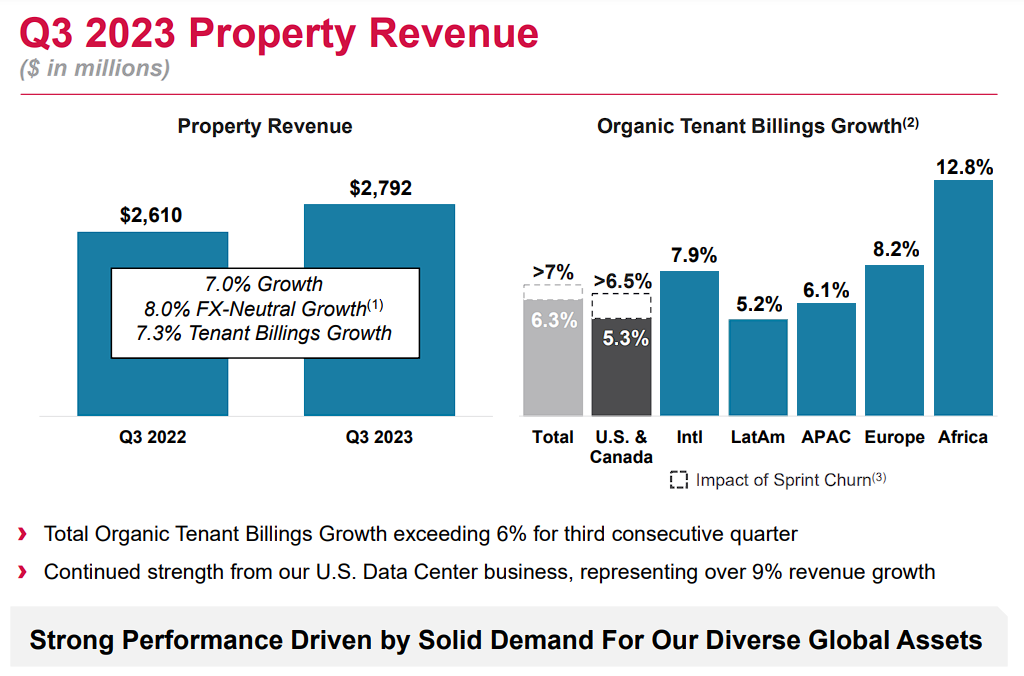

During the third quarter, AMT experienced sustained positive trends across its operations, resulting in a robust 7% increase in property revenue. This growth was fueled by a 7.3% increase in organic tenant billings within its tower business. Interestingly, organic tenant billings growth surpassed 6% for the third consecutive quarter. This solid performance was coupled with a notable rise of over 9% in its Data Center business.

Further, despite the significant year-over-year increase of 22.2% in interest expenses to $359.2 million due to rising rates, AFFO (adjusted funds from operations, a cash-flow metric used by REITs) grew by 9.5% to $1.2 billion due to prudent cost management. AFFO/share also grew by 9.3% to $2.58.

With results coming in better than expected, the company raised its guidance for the year, expecting its Fiscal 2023 AFFO/share to be between $9.72 and $9.85 billion. The midpoint within this range suggests modest year-over-year growth of only 0.3%, with profitability notably hampered by increased interest costs in AMT’s initial half of the year.

Nevertheless, consensus estimates indicate a more optimistic outlook for Fiscal 2024 and Fiscal 2025, with anticipated AFFO/share figures of $10.34 and $11.21, respectively. This reflects the market’s expectation of improved profitability, potentially driven by lower interest rates. The significant rebound in AFFO/share from 2024 onward should also allow the company to maintain its thrilling dividend growth track record.

For context, AMT has increased its dividend for 12 consecutive years, with its 10-year dividend growth CAGR standing at an outstanding 19.2%. With expectations for a strong reacceleration in AFFO/share and the payout ratio standing at about 2/3 of AFFO/share, double-digit dividend hikes will likely persist. Coupled with the current dividend yield of about 3%, AMT remains a highly attractive dividend growth powerhouse, in my view.

Is AMT Stock a Buy, According to Analysts?

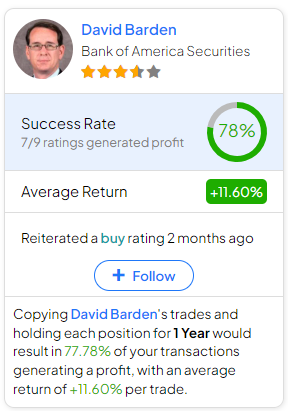

Checking Wall Street’s sentiment on the stock, American Tower Corp currently boasts a Strong Buy consensus rating based on 12 Buys and two Holds assigned in the past three months. At $221.85, the average AMT stock price target implies 5.1% upside potential.

If you’re wondering which analyst you should listen to if you want to buy and sell AMT stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Barden, representing Bank of America Securities. His track record is robust, with an average return of 11.6% per rating and a 78% success rate. Click on the image below to learn more.

The Takeaway

American Tower’s impressive surge from its October lows underscores the positive impact of anticipated interest rate cuts. Simultaneously, the company’s robust dividend growth track record and optimistic future projections are poised to support substantial dividend increases moving forward and reinforce its status as a dividend growth powerhouse. Consequently, I remain bullish on the stock.