American Express (NYSE:AXP) is scheduled to report its second-quarter 2023 results on July 21 before the market opens. The company might have benefited from improved payment volumes and strong loan trends during the quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a research note to investors on July 13, analyst Jon Arfstrom from RBC Capital suggested that AXP may see moderate year-over-year volume comparisons. However, he believes that the company’s strong customer acquisition activity, value-added card products, and the strength of its customer base will support its fundamentals during the quarter.

Overall, Wall Street expects American Express to post earnings of $2.81 per share in Q2, up from $2.57 in the prior-year period. Furthermore, revenue expectations are pegged at $15.41 billion, representing a year-over-year jump of 11.3%.

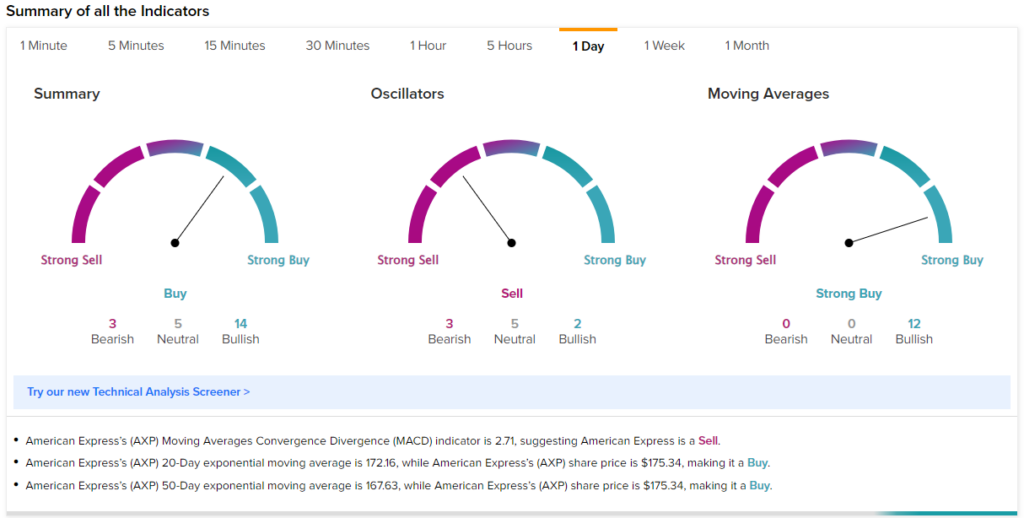

Technical Analysis on AXP Stock Signals a Buy

Ahead of the Q2 earnings release, 14 of the 22 technical indicators indicate that AXP stock is a Buy. According to TipRanks’ easy-to-understand technical analysis tool, the stock’s 50-Day EMA (exponential moving average) is 167.63, while the stock’s price is ~$175, making it a Buy. Further, AXP’s Price Rate of Change is 6.22, which also signals an uptrend.

Is AXP Stock a Buy, According to Analysts?

Currently, Wall Street has a Hold consensus rating on the stock. This is based on five Buy, five Hold, and three Sell recommendations assigned in the past three months. The average AXP stock price target of $180 implies 2.2% upside potential from current levels. Shares of the company are up about 18% in the past six months.

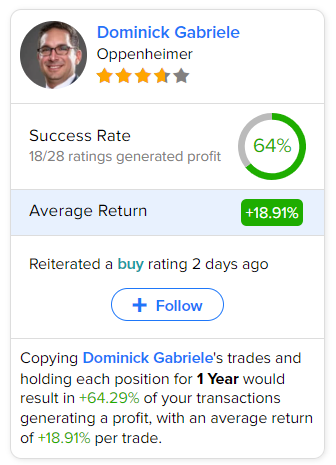

As per TipRanks’ data, the most accurate and profitable analyst for AXP is Oppenheimer analyst Dominick Gabriele. Copying the analyst’s trades on this stock and holding each position for one year would have resulted in 64% of your transactions generating a profit, with an impressive average return of 18.91% per trade.