Shares of American Express (NYSE:AXP) have been gravitating lower again following a sub-optimal quarter and a notable downgrade courtesy of an analyst who sees student loan headwinds on the horizon. Undoubtedly, American Express stock was already a tough buy in the face of a potential economic recession.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Consumer spending is expected to grind lower in the second half, threatening to drag down the broader basket of payments plays. In any case, I do think the bar has already been lowered quite a bit for American Express going into what’s shaping up to be a headwind-filled couple of quarters.

Indeed, travel and entertainment already had its moment to recover from the worst of the pandemic. In that regard, the easy gains already seem to have been made.

Regardless, longer-term thinkers still have plenty of reasons to hang onto the stock, even if analysts begin to turn their back on the name. My bull case isn’t just about timing the macro headwinds that may lie ahead. American Express has plenty of intriguing growth levers it may wish to pull as the payments space collides with cutting-edge fintech technologies and AI.

For that reason, I’m staying bullish on American Express stock and continue to see it as one of the better value offerings in the market right now.

American Express Stock Slapped with a Downgrade

American Express posted a pretty mixed bag for its second quarter. The company beat on earnings (EPS of $2.89 vs. $2.81 estimate) but missed on revenue ($15.05 billion vs. $15.5 billion estimate). The post-earnings reaction was quite negative despite management’s guidance reiteration, which calls for 15-17% revenue growth for the year. Many investors may be feeling the initial chilly breeze of that potentially-looming recession.

Piper Sandler’s Kevin Barker slapped the stock with a “Sell,” while slashing AXP’s price target to $149 from $172, implying downside of over 10% from current levels. Barker sees growth and margin pressures at the hands of student loan debt repayments coming due later in the year.

Indeed, it’s a notable headwind but one that may be offset by a softer-than-expected landing for the economy. At this pace, a soft landing does seem likely. However, whether the student loan headwinds weigh down AXP stock further remains to be seen.

For now, the tough quarter and significant downgrade have made AXP stock that much cheaper, and I’m a fan while shares trade at 16.9 times trailing price-to-earnings, well below the credit services industry average of 22.4 times.

Inheriting Apple’s Partnership from Goldman Sachs Could be a Shot in the Arm

Just a month ago, a Wall Street Journal report noted investment banking behemoth Goldman Sachs (NYSE:GS) was looking to offload its Apple (NASDAQ:AAPL) Card and Savings products, possibly to American Express. Indeed, we haven’t heard anything new about the matter since.

Still, one has to view a potential partnership with Apple as a sizeable opportunity to catch up to the likes of its larger credit card and payment peers. Right now, it’s hard to tell if American Express and Apple will form a relationship as Goldman Sachs looks to take a walk. However, the fact that Warren Buffett‘s Berkshire Hathaway (NYSE:BRK.B) owns a hefty stake in each firm makes such a partnership that much more interesting.

Further, Apple’s tech expertise and more than one billion iPhone userbase could come in handy as American Express looks to extend its reach across the U.S. and abroad.

For now, an American Express-backed Apple Card doesn’t seem to make a lot of sense, given that it’s not exactly the most accepted credit card in the world. It seems like nearly everybody has an iPhone, but very few folks actually have an American Express card. Still, this could change if American Express takes over for Goldman at some point in the near future.

Over the years, American Express has made huge strides regarding acceptance across the U.S. market. Reportedly, around 99% of American merchants now accept American Express cards. Also, if the credit card giant can increase acceptance internationally, possibly with some help from Apple, I do see a scenario where American Express may have a pathway to really close the gap with its credit card peers.

Is AXP Stock a Buy, According to Analysts?

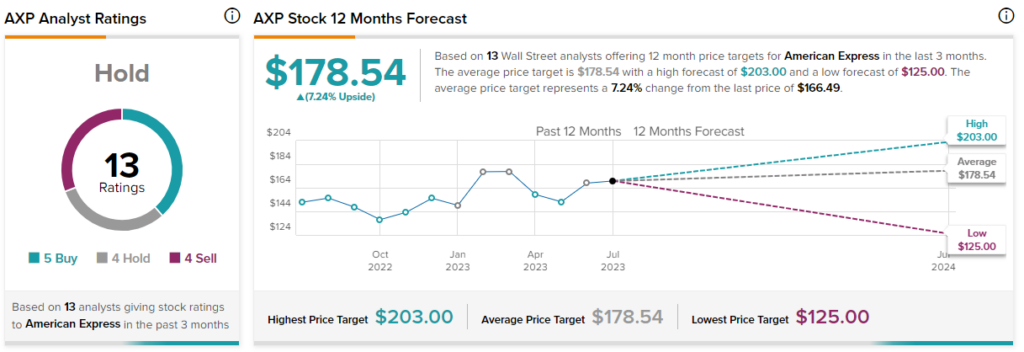

Turning to Wall Street, AXP stock comes in as a Moderate Buy. Out of 13 analyst ratings, there have been five Buys, five Holds, and four Sell recommendations assigned in the past three months.

The average American Express stock price target is $178.54, implying upside potential of 7.2%. Analyst price targets range from a low of $125 per share to a high of $203 per share.

The Bottom Line on American Express Stock

Even if American Express doesn’t end up backing Apple’s financial products, expect the credit card firm to continue staying on its toes on the front of innovation.

Indeed, American Express is just another old-school company dabbling with generative AI through its Amex Digital Labs division. Over the next few years, there’s hope that AI innovations could help American Express widen its moat and give its growth a jolt.

For now, I think investors and analysts are too nearsighted when it comes to the name following an underwhelming quarter and a remarkable quarterly downgrade from Piper Sandler.