Dismal demand in certain end markets and high inflation are expected to drag down global semiconductor revenue by 10.3% in 2023, per the latest World Semiconductor Trade Statistics (WSTS) report. However, WSTS expects the industry to rebound in 2024 with an estimated growth rate of 11.8%. Growing demand for generative artificial intelligence (AI) and the continued transition to the cloud bodes well for the long-term growth of chip stocks. We used TipRanks’ Stock Comparison Tool to place Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), and Intel (NASDAQ:INTC) against each other to pick the most attractive chip stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Advanced Micro Devices (NASDAQ:AMD)

Chip giant Advanced Micro Devices reported market-beating first-quarter earnings last month, even as revenue declined 9% year-over-year to $5.35 billion due to continued weakness in the PC market. First-quarter adjusted earnings per share (EPS) fell 47% to $0.60. Also, the company issued weak Q2 guidance.

Nonetheless, CEO Lisa Su assured investors that the company is confident about its growth in the second half of the year, as the PC and server markets strengthen. Moreover, AMD sees significant long-term opportunities to strengthen its data center and embedded segments and accelerate the adoption of its artificial intelligence (AI) offerings. Currently, rival Nvidia is stealing the spotlight when it comes to AI chips.

AMD also claimed in its Q1 earnings press release that it continues to lead the market in “confidential computing,” with major cloud service providers, including Microsoft (MSFT) Azure, Google (GOOGL) (GOOG) Cloud, and Oracle (ORCL) Cloud Infrastructure announcing new capabilities based on AMD EPYC processors.

Is AMD Stock a Good Buy?

On May 31, Bank of America Securities analyst Vivek Arya increased the price target for AMD to $135 from $120, citing rising sector multiple. However, the analyst reiterated a Hold rating due to total addressable market (TAM) headwinds related to x86, a chip architecture used in PCs and servers. Moreover, Arya believes that the company’s data center GPU portfolio remains in its early stages.

Overall, Wall Street’s Moderate Buy consensus rating on Advanced Micro Devices is based on 18 Buys and eight Holds. The average price target of $102.81 implies a possible downside of nearly 13% following a strong year-to-date rally of about 82%.

Nvidia (NASDAQ:NVDA)

Nvidia recently reported better-than-anticipated earnings for the first quarter of Fiscal 2024 (April 30, 2023), despite a decline in the top line due to weakness in the gaming unit. The company’s blowout Q2 guidance ignited an impressive spike in the stock. Nvidia expects Q2 FY24 revenue of $11 billion, plus or minus 2%, with the outlook being more than 50% higher than analysts’ consensus estimate of $7.15 billion.

Even prior to the Q2 outlook announcement, Nvidia shares advanced significantly on expectations of strong demand for its chips due to the buzz around OpenAI’s ChatGPT and the aggressive initiatives by tech behemoths to capture the opportunities in AI. NVDA stock has skyrocketed over 156% year-to-date.

Is NVDA Stock a Buy, Hold, or Sell?

On Wednesday, JPMorgan analyst Harlan Sur reiterated a Buy rating on Nvidia following an investor group meeting with Simona Jankowski, the company’s VP of investor relations.

The analyst said that Nvidia’s H100 shipments continue to generate higher volumes in Q2 and into the second half of 2023, even as the market for its A100 offering remains robust. Given the solid demand for its data center products and the impressive demand pull from generative AI, Nvidia has multi-quarter order visibility.

Additionally, Sur highlighted that the company’s auto revenue pipeline stands at $14 billion and will unfold over the next six years. Sur thinks that Nvidia’s automotive franchise should see a revenue inflection in the next two to three years, thanks to the revenue-sharing partnerships with Mercedes-Benz and Jaguar.

Nvidia scores Wall Street’s Strong Buy consensus rating based on 32 Buys and four Holds. The average price target of $449.92 implies 20% upside.

Intel (NASDAQ:INTC)

Despite a steep decline in revenue and earnings, Intel managed to surpass analysts’ expectations for the first-quarter results for Fiscal 2023 (April 1, 2023). Q1 FY23 revenue declined 36% year-over-year to $11.7 billion and the company slipped to an adjusted loss per share of $0.04 from an adjusted EPS of $0.87 in the prior-year quarter.

Over the past few years, Intel has lost ground to players like AMD due to limited innovation, strategic missteps, and manufacturing delays. The company’s turnaround efforts could improve its prospects in the quarters ahead.

Recently, investors cheered Intel CFO David Zinsner’s comments on the Q2 outlook at TD Cowen’s 51st Annual Technology, Media & Telecom Conference held on May 31. Zinsner said that the company sees Q2 revenue at the upper end of its previous guidance range of $11.5 to $12.5 billion, tracking to reach $12 billion to $12.5 billion.

What is the Price Target for Intel Stock?

Following the recent CFO update, Deutsche Bank analyst Ross Seymore reiterated a Hold rating on Intel and a price target of $32. The analyst said that he was pleased with this “mid-quarter update” striking a more positive tone, further showing that the company is turning the cyclical corner.

The analyst believes that the core debate for INTC will revolve around not only its ability to achieve five nodes in four years, but also its ability to drive improved revenue growth and profitability from these nodes. Seymore highlighted several concerns, including intense competition and the magnitude of investments required, which could impact Intel’s ability to improve its top and bottom line.

While Seymore was encouraged by the CFO’s favorable update on near-term trends, he maintained a Hold rating and a price target of $32, as he waits to gain more confidence in the longer-term structural questions about Intel.

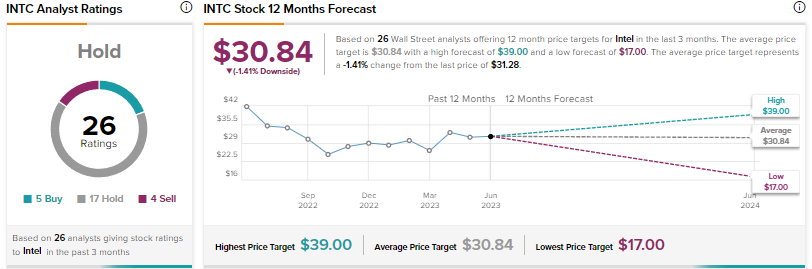

Overall, Wall Street is sidelined on INTC stock, with a Hold consensus rating based on five Buys, 17 Holds, and four Sells. The average price target of $30.84 implies a possible downside of 1.4%. Shares have advanced over 18% since the start of 2023.

Conclusion

Despite a stellar year-to-date rally, Wall Street continues to see further upside in Nvidia. Analysts are more upbeat about Nvidia than AMD and remain sidelined on Intel. Robust potential for Nvidia’s GPUs due to AI-powered demand is expected to drive the stock higher. As per TipRanks’ Smart Score System, Nvidia scores a “Perfect 10,” implying that the stock could outperform the broader market over the long term.