Next Thursday (June 9), Advanced Micro Devices (AMD) will hold its Analyst Day, the first such event since March 2020.

That might only be 2 years ago, but much has changed in the interim; the world is now on the other side of a global pandemic and faced with a whole new set of concerns with the prospect of a recession very real.

In the meantime, despite suffering like most others in 2022’s volatile stock market, AMD has further cemented its place as a proper chip giant. As Deutsche Bank’s Ross Seymore puts it, “The strength of AMD’s execution since its March 2020 Analyst Day cannot be understated, as evidenced by the company ultimately beating Street 2021 revenue estimates by ~+60% and EPS estimates by +75%.”

The outsized gains are down to a combination of industry-wide and company-specific “tailwinds.”

For the former, see the pandemic-driven demand for PC/gaming and “strength” in Data Center spending. For the latter, astute leadership has steered the company superbly while AMD has also been quick to pounce when largest competitor Intel has stumbled. It has since closed the gap between the two companies considerably. The result is a market cap that has more than doubled since the previous Analyst Day.

So, what to look forward to at the event? Seymore expects AMD will “rightfully exhibit continued confidence in its future growth potential,” although there are now more “moving parts” to consider. These include the addition of newer “product offerings” (XLNX, Pensando) and an environment where competition has intensified beyond the rivalry with just Intel.

A relatively comprehensive roadmap detailing the plans for various segments – Data Center, PCs, Gaming, and Embedded – should also be provided, and one which will stress the “differentiations” compared to the product introduction plans issued by Intel earlier this year.

That said, despite expecting “continued strong revenue growth and solid profitability improvement” over the long term, the growing competition (Nvidia, Intel, ARM-based and so on), continued difficulty in achieving “incremental share gains,” and the overall “risk off” market mode regarding growth names, are why Seymore has a Hold (i.e. Neutral) rating for the shares. (To watch Seymore’s track record, click here)

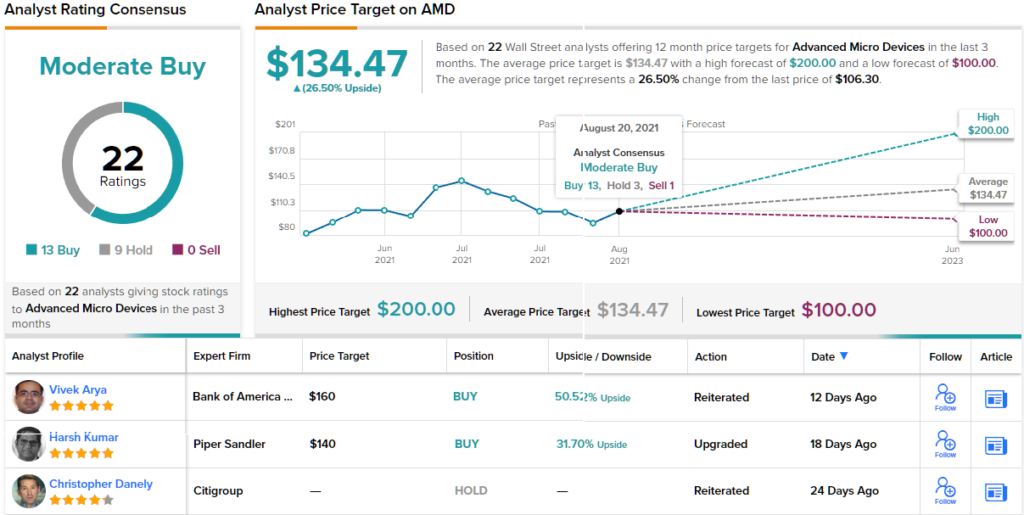

Overall, 8 other analysts join Seymore on the sidelines, but with an additional 13 Buys, the stock claims a Moderate Buy consensus rating. Going by the $134.47 average target, the shares are expected to climb 26.5% higher over the coming year. (See AMD stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.