AMC Entertainment (NYSE:AMC) features blockbuster films from time to time. However, the company’s shareholders should not expect a happy ending in 2023. I am neutral on AMC stock, as I wouldn’t dare to bet against it because the meme stock traders could return at any moment. At the same time, there’s also too much risk involved for me to consider buying the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Kansas, AMC Entertainment owns and operates a chain of movie theaters in the U.S. Short-term traders sometimes buy AMC stock in hopes of a short squeeze, but serious investors should consider the company’s long-term recovery prospects.

As we’ll see, analysts on Wall Street aren’t overwhelmingly optimistic about AMC Entertainment. I understand their concerns and recommend that prospective investors should conduct their due diligence before jumping into a trade they might regret.

Can Barbie and Taylor Swift Save AMC Entertainment?

I’ll be the first to admit that I saw dollar signs when the Barbie movie gained traction in America’s movie theaters. I even published a bullish opinion on AMC stock during the peak of the Barbie buzz.

The problem is that these movie trends are “transitory,” to borrow a term from the Federal Reserve. Lately, the buzz has been about the Taylor Swift The Eras Tour concert film, which generated $26 million worth of ticket sales in a single day. This event prompted a quick surge in the AMC share price.

Yet, Barbie couldn’t prevent AMC stock from collapsing in August, so it doesn’t look like the Taylor Swift movie will precipitate a share-price recovery, either. The stock is down substantially in 2023, a year when the major U.S. stock-market indexes are up.

Unfortunately, AMC Entertainment’s investors have lost a lot of money since the summer of 2021, regardless of Spider-Man sequels or prequels, or whatever fads came and went. In the long term, the company’s debt load was bound to have a negative impact on the AMC share price.

Frankly, I can’t blame Credit Suisse (NYSE:CS) analysts for publishing an Underperform rating on AMC stock. They cited that AMC Entertainment is left overwhelmed by its “$5B of net debt, including $3B of which comes due in 2026.” That’s an awful lot of debt for a company with a roughly $2 billion market cap.

Share Dilution is a Serious Issue for AMC Stock

As you can probably tell by now, I have doubts that occasional blockbuster movies can solve AMC Entertainment’s problems. One of those problems, as already mentioned, is AMC’s heavy debt burden. Another issue is the company’s willingness to print and sell millions of shares.

Not long ago, AMC Entertainment converted a large number of its “APE” Preferred Equity Units (NYSE:APE) into common AMC stock shares. As I see it, once a company has done this, it’s likely to repeat this capital-raising tactic again in the future. This is especially true of AMC Entertainment, as CEO Adam Aron has vociferously defended the share-printing (or I should more accurately say, share-conversion) strategy.

In other words, AMC Entertainment’s investors ought to think about the likelihood of future share-diluting activity. This possibility is clearly on the mind of TD Cowen strategist Chris Colpitts, who anticipates that, even after the recent share conversion, “AMC will likely do a large capital raise to improve its liquidity position.”

Is AMC Stock Expected to Go Up?

On TipRanks, AMC comes in as a Moderate Sell based on zero Buy ratings, three Holds, and three Sell ratings assigned by analysts in the past three months. The average AMC Entertainment stock price target is $18.50, implying 35.6% upside potential.

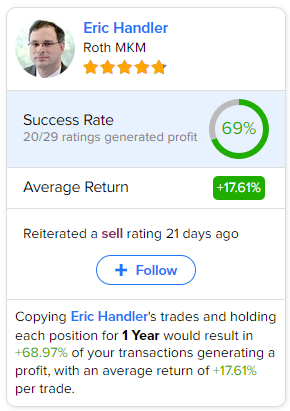

If you’re wondering which analyst you should follow if you want to buy and sell AMC stock, the most accurate analyst covering the stock (on a one-year timeframe) is Eric Handler of Roth MKM, with an average return of 17.61% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider AMC Stock?

Analysts generally aren’t very bullish about AMC Entertainment, and I don’t blame them for their trepidation. The company may get brief capital boosts from hit movies now and then, but AMC’s debt load is too deep for cautious investors to ignore.

Moreover, AMC Entertainment is unapologetically willing to increase the company’s share count, and this raises concerns about dilution. When all is said and done, I’m not considering buying or shorting AMC stock, as I believe this is a movie to watch but not to participate in.