What exactly is “Barbieheimer,” and how could it boost AMC Entertainment’s (NYSE:AMC) bottom line? As a buzzworthy double-feature gathers steam in the headlines, AMC Entertainment is poised to entice kids and grown-ups into its theaters across the U.S. That’s the type of catalyst AMC’s shareholders have been waiting for. I’m bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AMC Entertainment owns and operates a vast chain of movie theaters. The company was dealt a huge blow during the onset of the COVID-19 pandemic. However, in 2021, meme stock traders banded together to push the AMC share price sky-high while the short sellers ran for cover.

However, waiting around for another meme stock pump isn’t an ideal investment strategy in 2023. That’s not a problem, though, as a pair of seemingly unrelated films are all the rage now, and that’s great news for AMC Entertainment and its loyal shareholders.

An Actors’ Strike… and a Forced Shareholder Meeting?

People have varying opinions about AMC Entertainment, but one thing’s indisputable – you never know what to expect in Hollywood. This has been brewing for a while, but now it’s a major news item as the Hollywood actors union, known as SAG-AFTRA, recently voted to go on strike.

That’s bad for AMC Entertainment, albeit indirectly. If big-name actors and actresses aren’t actively promoting movies because they’re on strike, AMC’s box office receipts could take a hit.

There’s really not much investors can do about this except to watch from the sidelines for further developments. Rest assured, though, that strikes tend to get resolved since people don’t want to be out of work for too long. Then, when a strike is resolved, a company’s stakeholders will typically breathe a sigh of relief.

Meanwhile, in a plot twist that sounds like it’s straight out of a movie, an AMC Entertainment shareholder is reportedly suing the company in a Delaware court, alleging (according to Reuters) that AMC “is late in holding its annual meeting where shareholders elect members of the company’s board.” Apparently, this shareholder is asking the court to force AMC Entertainment to “hold its next annual meeting by Aug. 18.”

I’m not sure whether this turn of events will materially affect AMC Entertainment or its stock. Lawsuits can last for quite a while and incur substantial costs. Still, if worse comes to worst, AMC Entertainment may have to hold its annual shareholder meeting by the 18th of August, which shouldn’t be a terrible outcome for anyone concerned.

A Double Feature of Potential Profits for AMC

As you can see, there’s a lot going on with AMC Entertainment in the summer of 2023. Yet, the news item that everyone’s talking about now isn’t about actors’ strikes or forced shareholder meetings. Rather, it’s about a double feature of films that are bound to fill seats at AMC’s theaters.

They’re calling it “Barbieheimer,” which refers to two films that moviegoers are often planning to see one after the other: the live-action Barbie film and Oppenheimer (which is about a famous scientist from the World War II era). Those two movies might sound like an odd combination, but folks are evidently flocking to both films at once. Reportedly, Ryan Noonan, AMC Theatres vice president of corporate communications, disclosed that over 40,000 AMC Stubs members purchased tickets to see Barbie and Oppenheimer on the same day.

The two “Barbieheimer” movies are slated for wide release on July 21. It’s been said that some filmgoers are even planning to wear costumes (I’m guessing there will be more Barbie costumes than Oppenheimer costumes, but you never know).

What really matters here, though, is that consumers are excited about movies again. It’s certainly in AMC Entertainment’s interest to have people think of films as events rather than just something to pass the time. This could translate to a big-time revenue opportunity. Stifel Nicolaus analyst Drew Crum suggests that just the Barbie movie, by itself, might generate domestic box office opening weekend receipts in a range of $90 million to $100 million.

Is AMC Stock a Buy, According to Analysts?

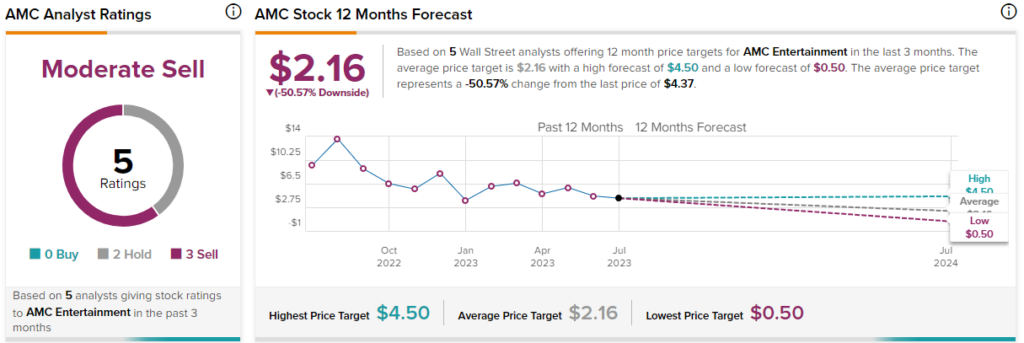

Turning to Wall Street, AMC stock is a Moderate Sell based on two Holds and three Sell ratings. The average AMC Entertainment price target is $2.16, implying 50.6% downside potential.

Conclusion: Should You Consider AMC Stock?

This isn’t the first time that support for AMC Entertainment came from an unexpected source. In 2021, AMC got a shot in the arm from meme-stock traders; this time around, it’s Barbie to the rescue. Either way, there’s renewed excitement for feature films, and that’s AMC’s bread and butter.

So, there’s no need to get caught up in meme dreams when AMC Entertainment can succeed from its core business in 2023. With that in mind – and regardless of likely temporary issues like the actors’ strike and a shareholder’s lawsuit – I’ll give my stamp of approval to anyone currently considering AMC stock.