Amazon (AMZN) was another Big Tech giant and key AI player to disappoint investors with its second-quarter earnings. Although the company beat earnings estimates, it missed revenue expectations, experienced a slowdown in advertising growth, and provided a weak Q3 outlook. High capital expenditures also contributed to the bearish tone post-Q2. However, the strong performance of Amazon Web Services (AWS) reinforces my bullish thesis and long-term optimism on AMZN.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite the short-term decline in Amazon shares, which dropped below $180 per share and experienced a sharp decline in the days following the Q2 results due to weaker macroeconomic news, my positive outlook remains based on AWS’s performance.

Amazon Mixed Q2 Results and Soft Guidance

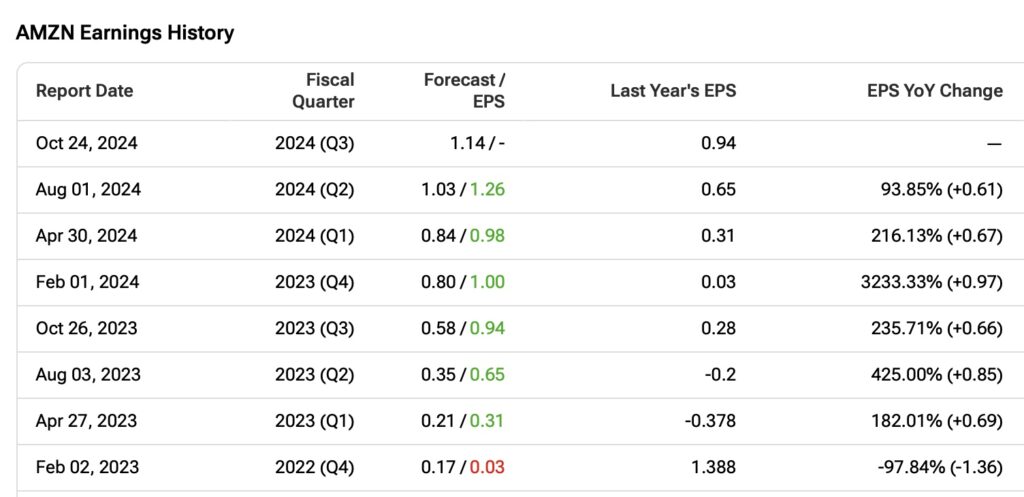

Amazon’s June quarter was a bit of a mixed bag. The Seattle-based giant beat EPS estimates for the sixth consecutive quarter, delivering $1.26 per share—a 93.8% increase year over year—versus the expected $1.03. On the other hand, revenue missed expectations, coming in at $148 billion compared to the forecasted $148.8 billion.

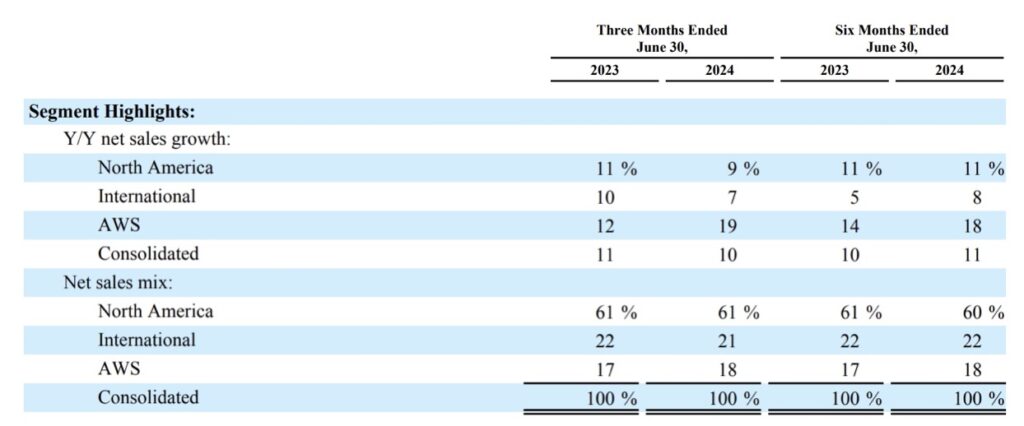

Operating income surged to $14.7 billion, nearly double the $7.7 billion reported in the same quarter last year. A big shoutout to AWS, which contributed $9.3 billion to this figure. The cloud segment grew 19% year over year, exceeding Wall Street’s 17.5% growth estimate.

Also noteworthy was the International segment, which posted a profit for the second consecutive quarter. Operating cash flow jumped by 75% to $108 billion for the trailing 12 months, up from $61.8 billion the previous year.

Despite these strong results, there were a couple of areas of concern. One was advertising revenue, which came in at $12.8 billion, showing a 20% annual growth but falling short of the 24% growth in the prior quarter.

The real issue, however, lies in Amazon’s future expectations. For the third quarter, the company is guiding for revenue between $154 billion and $158 billion, translating to 9.5% growth at the midpoint. This is slower than the double-digit growth many analysts had anticipated.

Additionally, Amazon’s operating income forecast for the next quarter is between $11.5 billion and $15 billion, up from $11.2 billion last year. Nevertheless, the growth rate is expected to be significantly slower due to tougher comparisons.

Amazon’s Q2 CapEx Raised Concerns

Another issue causing concern among Amazon investors is the company’s capital expenditures (CapEx).

In Q2, Amazon’s spending on property and equipment surged to $17.6 billion, up from $11.5 billion in the same quarter last year—an increase of about 54%. While Amazon’s strong performance has been largely attributed to high infrastructure investments made during the pandemic, it now appears the company needs to ramp up its spending even further to keep up with demand.

This quarter marked the second consecutive increase in spending. Including the first half of 2024, Amazon’s total CapEx for property and equipment has risen to $32.5 billion, compared to $25.7 billion for the same period last year. It’s worth noting that a significant portion of this investment is going into AI, which is key for sustaining AWS’s robust growth going forward.

Consequently, some investors might still be disappointed. The concern is that the substantial investments made between 2021 and 2022—totaling $113.7 billion in CapEx—would have allowed Amazon more time before needing to increase CapEx again. Given this context, rising CapEx alongside soft guidance, which does not necessarily indicate accelerated growth, understandably raises concerns.

Why AWS Matters Amid Amazon’s Q2 Concerns

While it’s clear that investors are disappointed with Amazon’s soft guidance and rising capital expenditures, the key takeaway from Amazon’s earnings, in my opinion, is AWS’s performance. Honestly, I see no reason to be disappointed here. AWS’s net sales growth is accelerating, rising from 12% to 19% over the past four quarters.

This is Amazon’s most critical segment because it boasts an impressive operating profit margin of 35.5%. Although that’s a slight drop from 37.6% in the previous quarter, it’s still more than 35 times as profitable as the International segment and about six to seven times as profitable as the North America segment.

I believe Amazon will continue to see growth in AWS, especially as more companies lean towards open-source models, which could give AWS an edge over its peers.

When comparing AWS to its main competitors, it’s clear that Amazon’s cloud business remains a leader. It’s growing in line with Azure, Microsoft’s cloud service. Results from Microsoft (MSFT) and Alphabet (GOOGL) show that the overall cloud market is strong and robust.

| Cloud Provider | Q2 2024 Revenue | Annual Run Rate | Year-over-year Revenue Growth | Market Share |

| AWS | $26.3 billion | $105.2 billion | 19% | 31% |

| Microsoft Azure | $28.5 billion | $114 billion | 18% | 25% |

| Google Cloud | $10.3 billion | $41.2 billion | 29% | 11% |

Is AMZN a Buy, According to Wall Street Analysts?

The Wall Street consensus on AMZN remains highly bullish, with a “Strong Buy” rating. Of the 42 analysts covering the stock, only one has a recommendation other than “Buy.” Itau Unibanco analyst Thiago Kapulskis downgraded AMZN to “Hold” following the Q2 results. The average price target is $223.58, indicating a 34.8% upside potential from Amazon’s latest share price.

Key Takeaway

Investor disappointment over key issues from Amazon’s Q2 results, such as weak guidance, is understandable. Additionally, concerns that high CapEx spending may not immediately lead to stronger top- and bottom-line growth for the next quarter could contribute to short-term volatility. Consequently, these missteps likely led investors, who have profited significantly from AI excitement over the past year, to take some profits.

However, long-term AMZN investors should focus on AWS’s performance, which has the potential to drive significant future profitability for the company. The reacceleration in AWS growth is a positive sign that keeps the bullish thesis intact. Therefore, I view the post-earnings sell-off as potentially overstated, creating an opportunity to increase exposure to Amazon at a more attractive share price.