The second-quarter earnings season is here, and on July 25, Big Tech giant Amazon (AMZN) is scheduled to report its financial results. As a long-term AMZN stock bull, I’m confident the company’s positive momentum will persist in Q2, driven by its shift to higher-margin services, advancements in AI, and Amazon Web Services (AWS), its crown jewel.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this article, I’ll focus on expectations for the June quarter, and I’ll answer the following questions: how strongly has Wall Street projected Amazon’s top and bottom-line growth? What are the main topics investors should be paying attention to? And finally, is the stock a buy before earnings day?

Amazon’s Q1 Recap and Wall Street’s Outlook

Over the past few quarters, it’s become clear that under CEO Andy Jassy, Amazon has shifted its focus to higher-margin services like cloud computing and advertising, moving away from first-party retail sales.

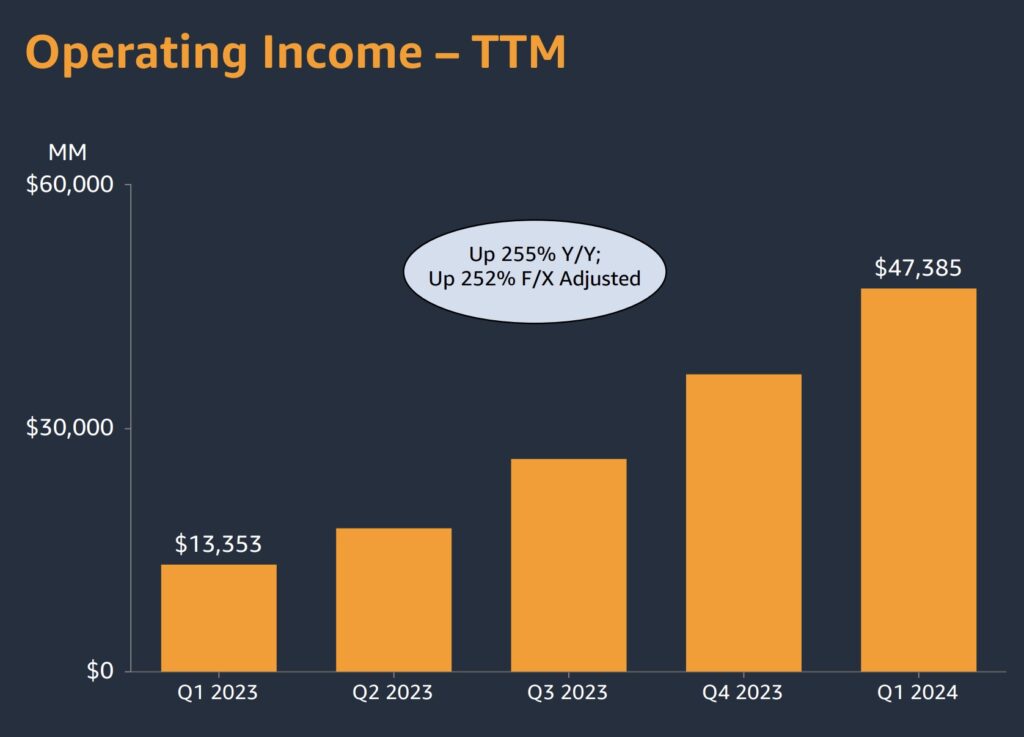

Since taking over, Jassy has been dedicated to reducing costs, streamlining operations, and restructuring Amazon’s fulfillment network by eliminating thousands of jobs. He has also maintained a strong focus on AWS, which remains a crucial and highly profitable segment of Amazon’s business. Over the last year, these segments have become significantly more profitable, and Q1 2024 was no different.

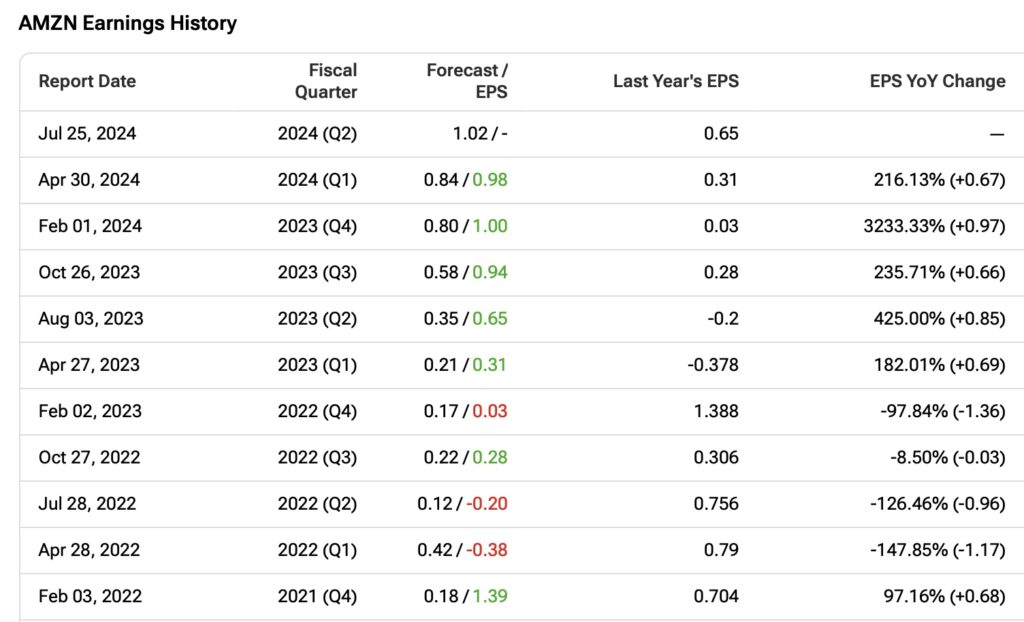

In the last quarter, reported in April, Amazon impressed the market by beating expectations for EPS by 18.6% and revenues by $764 million.

Comparing Q1 2023 to Q1 2024, Amazon’s operating margins have greatly improved. AWS was the highlight, as Amazon managed to improve its operating margin to 10.7% from 3.7% in Q1 2023, with the cloud segment reporting operating margins going from 24% to 37.6% (although this was partly due to changing the estimated useful life of their servers). In North America, the operating margin jumped from 1.2% to 5.8%. The International segment went from -4.3% to 2.8%.

Faced with this shift in margins, Wall Street has raised the bar, especially regarding Amazon’s bottom line. The e-commerce giant is expected to report annual EPS growth of 56% in the second quarter, with 29 analysts revising their projections upwards and only 6 downwards in the last three months.

Regarding revenues, Amazon is expected to increase them by 10.6% to $148.64 billion compared to Q2 last year. However, this figure reflects greater skepticism, as only four analysts have revised their projections upwards, and 34 have revised them downwards.

According to Amazon’s management, net sales for Q2 are expected to grow between 7% and 11%, already accounting for unfavorable foreign exchange impacts. Additionally, weaker consumption trends in Europe compared to the U.S. could prove to be a headwind.

Compared to the consensus revenue estimate of $148.7 billion, Amazon guided net sales to be between $144 billion and $149 billion. Analysts seem to be betting on the high end of the range, possibly signaling that the company’s top-line projections are too conservative.

But even with the bar set high, Amazon has beaten Wall Street’s EPS estimates seven times in the last 10 quarters. If it beats them again in Q2, it will be the sixth consecutive quarter topping estimates.

Key Areas for Investors to Focus On

It’s highly likely that analysts and investors will focus heavily on AWS’s performance. Amazon has been significantly growing AWS in recent quarters, consistently beating expectations. The company’s plans to ramp up capital expenditures (CapEx) highlight the robust demand for generative AI within its cloud computing segment. In Q1 alone, Amazon spent $14 billion on CapEx, with total investments reaching $48.4 billion last year.

A key point of interest will be how AWS defends its market share against competitors like Microsoft’s (MSFT) Azure and Alphabet’s (GOOGL) Google Cloud, both of which have been strong performers with proprietary models.

There’s also interest in whether enterprises are favoring open-source models, potentially benefiting AWS more than its competitors. CEO Andy Jassy emphasized that customers prefer to bring their models to their data instead of the other way around, differing from Azure and Google Cloud’s approach.

Two other critical areas for investor satisfaction will be demonstrating AI’s impact on revenue growth beyond AWS, particularly in Advertising, where last quarter saw a strong 24% year-over-year increase in ad sales.

Also, investors will closely watch Amazon’s ability to execute its strategy of fast and efficient deliveries for Prime members, which aims to improve consumer experience and drive higher margins.

Last quarter, Amazon guided that it expects operating income between $10 billion and $14 billion, up from $7.7 billion a year ago, including seasonal stock-based compensation expenses.

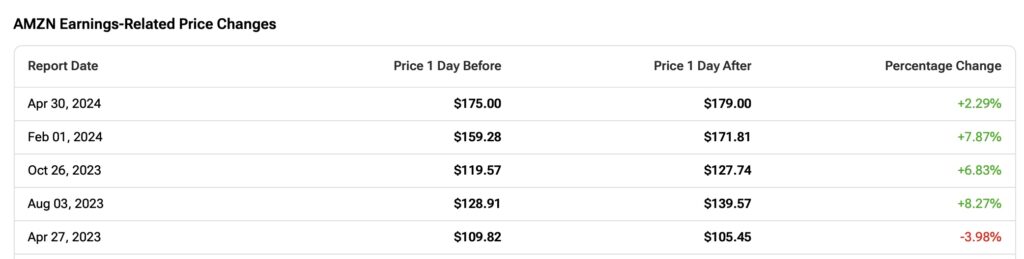

In my view, if Amazon delivers growth in AWS bolstered by AI, expands Advertising revenue, and improves operating income through efficient Prime deliveries, it should report a stable quarter. Historically, Amazon guides investors conservatively to avoid overpromising, suggesting little chance of disappointment this quarter. This also increases the likelihood of positive surprises. Looking back at the last five quarters, AMZN shares have typically shown a positive reaction the day after earnings results.

Is AMZN Stock a Buy, According to Analysts?

Wall Street is extremely bullish on Amazon stock, and it seems that the Q2 results are set to please investors. Every analyst on Wall Street covering AMZN has given it a Buy recommendation, forming a Strong Buy consensus rating. The average AMZN stock price target among the 44 bullish analysts is $223.76 per share, suggesting upside potential of 22.6%.

Key Takeaway: Bullish on Amazon Ahead of Earnings

Although analysts have set high expectations for Amazon to achieve the upper end of its Q2 guidance, given the company’s conservative track record, I believe this shouldn’t pose a problem. If Amazon shows investors strong AWS growth, robust revenue trends from AI investments, and a solid performance in Advertising revenue, it’s likely to have a strong Q2.

At present, I don’t foresee any obstacles that could contradict these points, making me bullish on AMZN stock before its earnings report. In fact, management’s tone last quarter was overly optimistic about the company’s growth trajectory in AI, particularly with AWS, suggesting its growth story is still in its early stages.