Roku (ROKU) and Amazon (AMZN) – via its Amazon Fire TV and Prime offerings – represent the two biggest cord-cutting platforms. It appears, however, that Amazon has now gotten one up on Roku.

Starting in 2023, Amazon Prime has gained the exclusive rights to stream the NFL’s Thursday Night Football. The company will pay $1 billion a year, in a deal which will run until 2033 and amounts to the first ever all-digital package.

So, bad news for main competitor Roku, right? Not so, says Deutsche Bank analyst Jeffrey Rand.

“We view Amazon’s new agreement to exclusively stream Thursday Night Football on Amazon Prime as a positive for the entire streaming industry, including Roku,” the analyst said. “With the only way to watch Thursday Night Football on a TV requiring a streaming device or a smart TV, we believe this deal will even further increase connected TV (CTV) ownership.”

What’s more, as live sports have so far mostly been the preserve of broadcast or cable TV, Rand thinks sports fans have been reluctant to join the cord-cutting trend. The deal could finally see these consumers join the streaming crowd.

There are other positives. Streaming TV’s ad market could benefit as advertisers who had previously resisted allocating dollars to the streaming segment could be more likely to do so, in fear of missing out on the NFL’s large viewership.

“Longer-term,” Rand opined, “we believe this should help further accelerate the move of ad dollars from linear TV to streaming.”

Additionally, the deal could open the floodgates for other sports to move across to streaming only channels.

However, Rand also points out the scale of Amazon’s investment signals it is serious about its streaming business.

“While we continue to believe that Roku is well positioned in the streaming market long-term,” the analyst summed up, “We remain cognizant of the challenges that Roku faces as its main competitor has significantly more resources to put back into the business.”

Overall, there’s no change to Rand’s ROKU rating or price target, which stay at Buy and $500, respectively. Upside from current levels is 46%. (To watch Rand’s track record, click here)

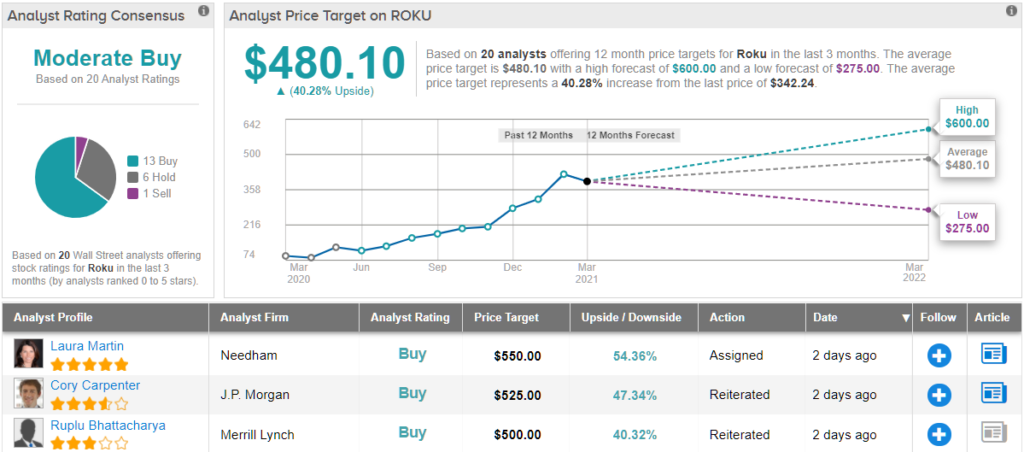

The rest of the Street forecasts decent upside, too; the average price target currently stands at $480.10, suggesting gains of 40% over the next 12 months. The analyst consensus rates this stock a Moderate Buy, based on 13 Buys, 6 Holds and 1 Sell. (See Roku stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.