How much higher can Amazon (NASDAQ:AMZN) stock possibly go? So far, Amazon looks like the ultimate winner as Americans shop ’til they drop. I am bullish on AMZN stock because Amazon is demonstrating its dominance — not only as an e-commerce platform but also as a package delivery juggernaut.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon is, by far, the best-known e-commerce company in America. However, the company also has redoubtable positions in the grocery delivery and healthcare market segments.

Not only that, but Amazon is also a powerful contender in the cloud computing space. As we’ll see, the experts on Wall Street heavily favor Amazon, and there are plenty of reasons to consider a share position in AMZN stock today.

Don’t Obsess Over Amazon’s Valuation

Bargain seekers might not feel comfortable investing in Amazon after the stock’s amazing rally this year. After all, Amazon’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 76.4x is much higher than the sector median P/E ratio of 15.7x.

On the other hand, Amazon’s seemingly high valuation may be justified since the company is highly profitable and continues to grow despite the doubters’ reservations. As you may recall, Amazon earned $0.94 per share in the third quarter of 2023, easily beating the consensus estimate of $0.58 per share.

Furthermore, Amazon offers value to its shareholders because the company is diversified beyond its e-commerce platform. In particular, Amazon is well-regarded for its Amazon Web Services (AWS) cloud business.

As evidence of this, customer relations management (CRM) software provider Salesforce (NYSE:CRM) just expanded its partnership with Amazon. Through this collaboration, Salesforce will “select Salesforce products on the AWS Marketplace.”

This sounds like a win-win arrangement for Salesforce and Amazon. Salesforce could potentially generate more sales, while Amazon gets a cut of the revenue that will be generated through the AWS Marketplace.

Amazon is Now America’s Biggest Package Shipper

Most people would probably assume that the biggest package delivery company in the U.S. is either Federal Express (NYSE:FDX) or United Parcel Service (NYSE:UPS). That may have been true not too long ago, but now, that title goes to the almighty Amazon.

That’s an important title for Amazon to earn, as a whole lot of packages are being delivered this holiday season. According to an Adobe Analytics report, Black Friday (the day after Thanksgiving) e-commerce spending in the U.S. increased 7.5% year-over-year and hit a record of $9.8 billion.

Today is also a significant shopping day in the U.S. It’s Cyber Monday, and as the name implies, it’s a time when people are busy looking for shopping deals online. This makes sense since many people are at work instead of out shopping at bricks-and-mortar store locations.

Yet, they can still shop on their smartphones. Naturally, many people will go directly to Amazon’s e-commerce app and look for the best deals they can find. Sure, Thanksgiving is over, but not everyone has completed their shopping for the December holidays.

This isn’t just my personal opinion. A survey conducted by Goldman Sachs (NYSE:GS) indicated that Amazon remains one of the top destinations for U.S. shoppers.

Is Amazon Stock a Buy, According to Analysts?

On TipRanks, AMZN comes in as a Strong Buy based on 41 unanimous Buy ratings assigned by analysts in the past three months. The average Amazon stock price target is $175.50, implying 18.8% upside potential.

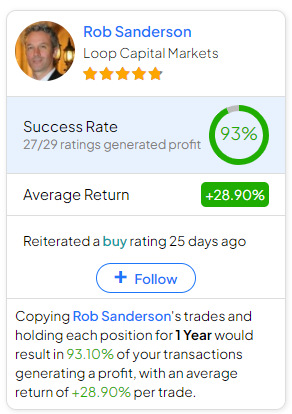

If you’re wondering which analyst you should follow if you want to buy and sell AMZN stock, the most accurate analyst covering the stock (on a one-year timeframe) is Rob Sanderson of Loop Capital Markets, with an average return of 28.9% per rating and a 93% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Amazon Stock?

It’s easy to get hung up on Amazon’s valuation, especially if you use traditional metrics like the P/E ratio. There’s nothing wrong with citing these metrics, but they don’t tell the full story when it comes to Amazon’s true value.

Amazon dominates multiple market segments, including package delivery. The company looks unstoppable now, and betting against Amazon would be downright foolish, in my opinion.

So, don’t spend too much time obsessing about Amazon’s P/E ratio. I believe that investors ought to consider AMZN stock now, especially since Black Friday sales were so strong in the U.S. This means that more packages are being shipped, more products are being bought online, and Amazon can continue to provide excellent value to its loyal shareholders.