Altria Group (NYSE: MO) is a giant in the tobacco industry and the highest-yielding Dividend King. It’s a true champ in the world of dividend stocks. As one of the only 48 “Dividend Kings,” an honored group of stocks that have raised dividends for more than 50 years in a row, Altria has proven its commitment to returning value to shareholders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

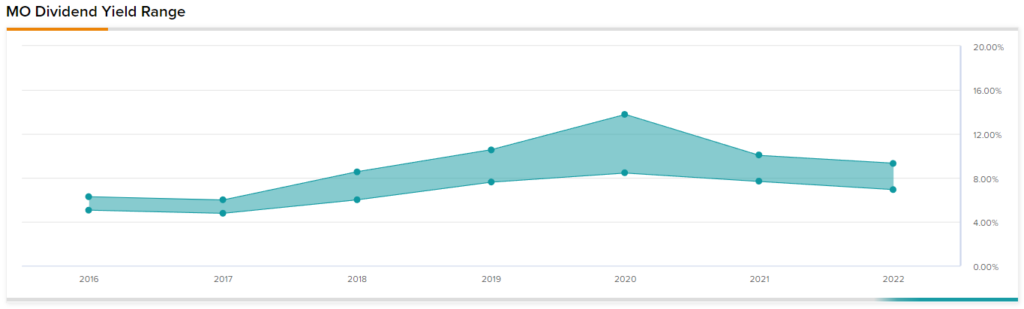

However, the company isn’t just any Dividend King. It’s currently the highest-yielding stock among Dividend Kings, which instantly makes it a striking option for income-seeking investors. With Altria’s dividend now yielding a tremendous 8%, it’s hard to pass on the stock solely on the fact that this is a tobacco, and thus undesirable, business.

But before you rush to buy shares, it is crucial to evaluate if Altria’s performance is strong enough to support its dividend growth in the long run and at what rate.

Altria Set to Achieve Record Earnings This Year

Altria is set to post record earnings for Fiscal 2022, which goes against the narrative of tobacco giants suffering, and which is certainly quite encouraging when it comes to the company’s dividend-growth potential.

Specifically, Altria is coming off of a strong Q3, which was a quarter that greatly showcased the strength and durability of the company’s operations.

Stable Revenues

Revenues net of excise taxes came in at $5.41 billion, just 2.2% lower year-over-year. While it’s true that Altria’s revenues took a small hit, it’s important to understand that this decline was not entirely due to a weakness in the company’s core smokeable and oral tobacco segments.

In fact, a significant portion of the drop can be attributed to the divestment of Altria’s wine business, which took place last year. Despite this one-time impact, the underlying fundamentals of the company’s core operations remained solid. Altria’s smokeable products segment essentially remained stable, with sales down just 1.6% year-over-year, even though cigarette shipment volumes fell by 9.2%.

This is because Altria has the power to increase prices significantly due to its products being highly inelastic, which is a key advantage in terms of maintaining profitability. Additionally, to further challenge the argument of tobacco sales being on the decline, it’s worth noting that cigar shipment volumes actually grew 3.3% over the same period last year.

Growing Profits

When evaluating Altria’s dividend-growth potential, it’s important to focus on its profitability rather than just revenues. As the company’s top-line growth may not be significant in the future, profitability is the key factor to consider.

Despite a relatively steady revenue performance, Altria has been able to deliver growing profits. Altria’s adjusted diluted earnings-per-share rose by 4.9% to $1.28, mainly powered by a lower share count, higher operating income, and a reduction in interest expenses. Following another highly-profitable quarter, Altria is now positioned to end the year with record profits in its books.

In particular, management narrowed its full-year 2022 outlook, forecasting adjusted diluted earnings per share to land in the range of $4.81 to $4.89, which implies a growth rate between 4.5% and 6% compared to last year. Therefore, Altria’s capacity to produce substantial profits is in excellent shape, which is encouraging when it comes to sustaining and growing its already substantial returns to shareholders.

Is Dividend Growth Going to Slow Down?

The primary draw for Altria investors is the substantial capital the company returns to its shareholders – particularly the stock’s current massive 8.0% dividend yield. Altria’s management team is well aware of this and has made it a top priority to maintain and grow these returns. Indeed, Altria increased its quarterly dividend rate once again by 4.4% in 2022. That said, the 4.4% increase was softer than 2021’s increase of 4.7%, which could indicate that dividend growth is going to remain softened in the coming years.

Its payout ratio, based on the midpoint of management’s guidance, stands at 78%, so it makes sense that the company won’t want to push it to unsustainable levels.

Still, another dividend increase, especially considering that this occurred amid a highly-uncertain environment, is a clear indication that the company is dedicated to maintaining its position as a Dividend King and a top choice for income-seeking investors.

Is Altria Stock a Buy, According to Analysts?

As far as Wall Street’s sentiment goes, Altria Group has a Hold consensus rating based on one Buy, three Holds, and two Sells assigned in the past three months. At $45.00, the average Altria Group stock forecast implies about 0.9% downside potential.

The Takeaway

While it’s hard to sell Altria’s investment case as a great one due to various polarizing reasons – one of them being that it’s a tobacco giant – it’s worth recognizing that the company’s performance remains robust. With Altria set to report record profits this year and dividends continuing to grow consistently, income-oriented investors are likely to appreciate this Dividend King – especially with its yield now at a tremendous 8%.