Last week, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) posted its Q2 results, marking an explosive performance that, in my view, strengthened its bull case.

Until recently, investors were still skeptical regarding the prospects of the online advertising behemoth in an ever-evolving landscape. The emergence of ChatGPT and Microsoft’s (NASDAQ:MSFT) new Bing AI posed potential threats to Google’s Search dominance, while TikTok’s unwavering traction posed a risk to Youtube Shorts’ success. These factors explain the market’s prevailing uneasiness prior to Alphabet’s quarterly report.

However, Alphabet impressed investors and analysts alike, defying skeptics and leaving a lasting impression. The company not only exceeded Wall Street’s estimates by a substantial margin but also demonstrated remarkable strength across all its products, even in the face of intensifying competition across the board. Accordingly, I remain bullish on the stock, which currently inhabits one of my largest positions.

Q2 Breakdown: Strength in All Product Lines

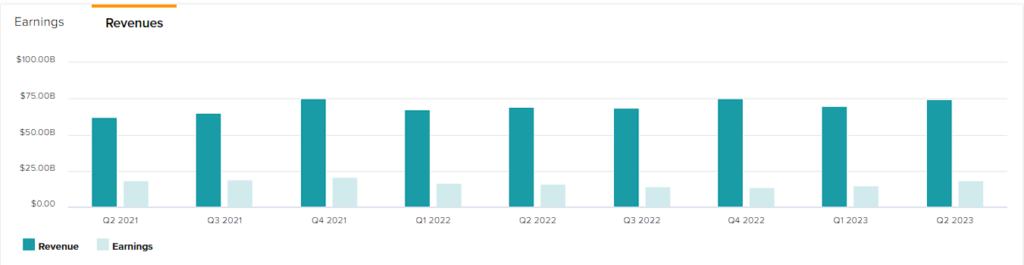

Alphabet’s Q2 results were robust, with revenues growing by 9% (in constant currency) to $74.6 billion and earnings per share rising by 19% to $1.44 compared to last year. The company exceeded Wall Street’s top-line consensus estimate by 2.5% and bottom-line estimate by 7.3%, demonstrating strength across both its ad business and Google Cloud. Let’s take a deeper look!

The Ad Business

Alphabet’s advertising business is not immune to the forces of the global economy. In times of economic uncertainty, enterprises tend to tighten their purse strings, leading to potential declines in consumer spending. Additionally, rising interest rates add another layer of concern for Alphabet’s ad revenues, leaving the company exposed to macroeconomic headwinds.

However, due to these challenging circumstances, Alphabet’s ad business has displayed an impressive level of resilience. Despite contending with the impact of unfavorable foreign exchange rates and being measured against the strong performance of Q2 2022, when global ad spending was riding high, the company managed to achieve a remarkable 3.2% growth in ad revenues, reaching a substantial $58.1 billion.

Google Search: In the Google Advertising & Search division, revenues experienced notable 4.7% year-over-year growth, primarily driven by a rebound in the retail industry. Remarkably, Search maintained its status as the flagship revenue contributor for the company, continuously expanding even in the face of rapid advancements in the AI industry.

While ChatGPT has garnered incredible adoption with numerous users harnessing its exceptional capabilities, and Microsoft’s newly-introduced Bing AI did manage to attract some user attention, Google’s search platform once again showcased its unparalleled resilience against potential competition.

Interestingly, it may seem like Alphabet is one of the more quiet players when it comes to promoting its AI developments. That said, management highlighted that almost 80% of its advertisers already use at least one AI-powered Search ads product. Hence, I wouldn’t be fast to underestimate its potential in the AI space.

Youtube/Shorts:

Alphabet’s Youtube division within its ad business also performed well, with Shorts capturing lots of consumer attention despite TikTok’s continuous success. YouTube advertising revenues came in at $7.7 billion, up 4% year-over-year. Higher revenues were attributable to growing brand advertising, followed by strong consumer response (ad conversion), resulting in improved advertiser spending.

In this division, management proudly announced that YouTube Shorts are now captivating an impressive 2 billion logged-in users every month, a remarkable surge from 1.5 billion merely a year ago. It’s essential to highlight that Shorts ads were only introduced a year ago, and it wasn’t until Q2 that brand advertisers could finally begin testing Shorts ads and awareness campaigns. Hence, Shorts has a massive runaway for ad revenue growth ahead.

Google Cloud

Alphabet’s Cloud segment also posted an outstanding quarter, with revenues growing 28% year-over-year to $8.0 billion. Importantly, this was the second consecutive quarter of positive Cloud operating profits, with the company solidifying that its rapidly-growing segment can remain consistently profitable. In particular, Google Cloud posted an operating income of $395 million, implying an operating profit margin of 5%.

Alphabet continues to integrate its AI capabilities within its Coud offerings, which should continue to drive growth in this segment. For instance, through such integrations, the company was able to land Pfizer as a client, which is now using Google Cloud to transform its security operations. Given that the company hasn’t even started cross-selling its different AI offerings, I remain highly optimistic regarding Google Cloud’s growth prospects.

Is Alphabet Stock a Buy, According to Analysts?

As far as Wall Street’s sentiment goes, Alphabet features a Strong Buy consensus rating based on 31 Buys and five Holds assigned in the past three months. At $149.45, the average Alphabet stock forecast implies 12.6% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell GOOGL stock, the most accurate analyst researching GOOGL (on a one-year timeframe) is Doug Anmuth of JPMorgan (NYSE:JPM), boasting an average return of 23.72% per rating and a success rate of 87%. Click on the image below to learn more.

The Takeaway

Alphabet’s Q2 performance was nothing short of impressive, defying skepticism and solidifying its position as a continuously growing tech behemoth that is also highly profitable. The company showcased remarkable strength across all its product lines, especially in its ad business and Google Cloud segment.

Despite potential threats from emerging AI technologies and competing platforms like TikTok, Alphabet’s resilience and continued innovation set it apart. With its AI-driven solutions gaining traction and the potential for further growth, Alphabet remains an attractive investment opportunity, reaffirming my bullish stance on the stock.