Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) stock lost considerable value this year. The tough year-over-year comparisons, currency headwinds, and moderation in ad growth remained a drag. However, Monness analyst Brian White maintains a Buy recommendation on GOOGL stock, as the company’s long-term fundamentals remain intact. Moreover, his price target of $145 represents 46.9% upside potential.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

White said that the internet giant is poised to gain from “long-term digital ad trend.” Further, the “shift of workloads to the cloud and benefit from digital transformation” will accelerate its growth.

Alphabet’s continued investments in AI (artificial intelligence), cloud, and search provide a solid base for long-term growth. Meanwhile, growing deal volume in the cloud business and large addressable market will support its growth.

While Alphabet’s long-term prospects remain solid, White is skeptical about regulatory headwinds. For instance, TipRanks’ data shows that GOOGL stock’s legal & regulatory risks account for 22.6% of its total risks. Further, its legal & regulatory risks are higher than the sector average of 20.2%.

Is GOOGL Stock a Buy, Hold, or Sell?

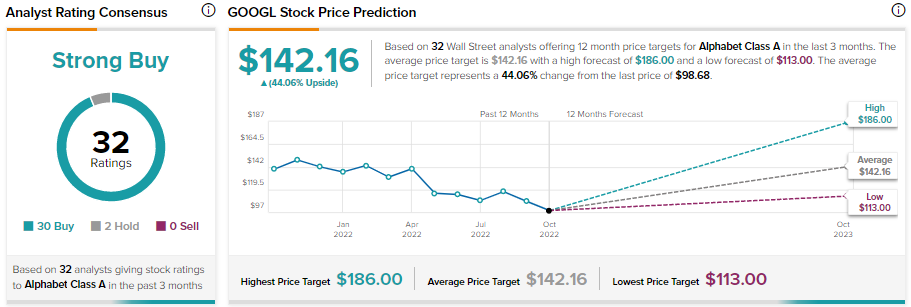

On TipRanks, Alphabet stock commands a Strong Buy consensus rating based on 30 Buys and two Hold recommendations. Further, analysts’ average price target of $142.16 implies 44.1% upside potential.

While analysts are bullish about GOOGL’s prospects, hedge funds have a negative outlook. Hedge funds sold 132.1 million GOOGL shares last quarter. Further, Alphabet stock has a Neutral Smart Score of 6 out of 10 on TipRanks.

Conclusion

The ongoing macro headwinds impacting advertising spending, adverse currency movement, and pressure on near-term earnings could restrict the upside in GOOGL stock. However, momentum in its cloud business, strength in google search, digital transformation, growing engagement in short-form YouTube videos, and recovery in ad spending will support its long-term growth.