Alphabet (NASDAQ:GOOGL) stock has lost over one-fourth of its value so far this year. A slowdown in ad spending amid macro challenges and uncertainty and tough year-over-year comparisons have led to a moderation in its growth, dragging the stock price of this internet giant down. However, its recent quarterly performance (Q2FY22) showed resilience, with strength in the search business and momentum in the cloud segment. This has restored analysts’ and investors’ faith in GOOGL stock, highlighting an opportunity for investors interested in buying the dip.

According to TipRanks, analysts seem to have a bullish outlook on GOOGL stock. Further, 1.2% of the investors tracked by TipRanks increased their exposure to GOOGL stock in the past 30 days, indicating their positive stance on the stock.

But before deciding what to do with GOOGL stock, let’s examine its recent performance and understand what’s in the store for it in the upcoming quarter.

Bumpy Road Ahead

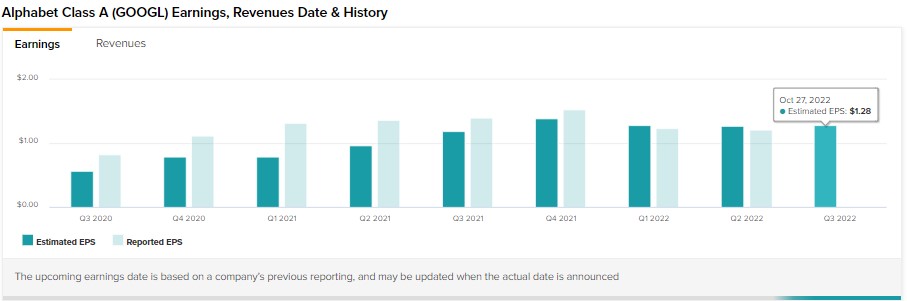

GOOGL missed analysts’ earnings expectations in the first two quarters of FY22. In the last reported quarter (Q2), GOOGL delivered earnings of $1.21 per share, compared to $1.36 per share in the same quarter last year. Further, Google’s Q2 earnings per share fell short of Street’s expectations of $1.27 per share.

As for Q3, Wall Street expects GOOGL to deliver earnings of $1.28 per share, which reflects a continued decline on a year-over-year basis. Moderation in growth led by tough comparisons, decelerating ad revenues, and headwinds from fee changes could remain a drag for Google. Further, higher costs could put pressure on the company’s Q3 earnings.

What Is GOOGL’s Price Target?

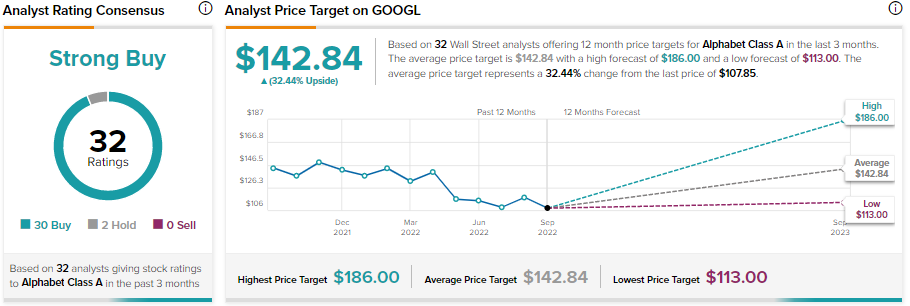

GOOGL’s average price target of $142.84 implies 32.4% upside potential. Analysts are optimistic about GOOGL’s prospects despite moderation in its growth rate. GOOGL stock commands a Strong Buy consensus rating on TipRanks based on 30 Buys and two Holds.

Tigress Financial analyst Ivan Feinseth, who is bullish on GOOGL stock, recently raised his price target to $186 from 183. Feinseth said, “Strength in Cloud and Search continues to highlight the resiliency of its core business lines and ongoing investments in AI (Artificial Intelligence) computing continue to drive increased customer value and increasing shareholder value creation.”

Further, the analyst sees Google’s $70 billion share repurchase plan, announced in April, as a positive catalyst for its stock.

Bottom Line

Undeniably, GOOGL is facing challenges due to the pullbacks in spending by some advertisers, adverse currency movement, and tough year-over-year comparisons. However, the company’s fundamentals remain intact with strength in its search and cloud segments.

Read full Disclosure