It’s almost time for Nvidia (NASDAQ:NVDA) to report its first quarter of fiscal 2024 results (April quarter). After the market action ends on Wednesday (May 24), the chip giant will step up to the earnings plate.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The latest quarterly readout comes in the wake of the stock making some huge moves this year. NVDA shares are up 113% year-to-date and that is primarily down to the fact the company is set to be one of the prime beneficiaries of 2023’s biggest buzz trend: AI.

As such, ahead of the print, Deutsche Bank’s Ross Seymore believes the opportunity will already manifest itself. “We expect a solid report/guide qtr from NVDA with room for upside vs. the Street in both as the ever-growing list of potential applications for AI has driven strong demand for NVDA’s leading AI compute processors,” the 5-star analyst said. “This upside is likely only to be partially offset by supply limitation in Data Center and the potential for a somewhat slower rebound in Gaming/Proviz.”

Seymore expects Nvidia to dial in revenues of $6.51 billion, amounting to an 8% sequential increase and coming in at the midpoint of the guide. That is just above the Street at $6.50 billion. Given “strong near-term demand” in AI, albeit offset by a potentially slower recovery than hoped for in Gaming, there’s “potential for upside.” On the bottom-line, Seymore expects PF EPS of $0.92, the same as the consensus estimate.

While Seymore thinks the “magnitude of estimate revisions”could be somewhat tempered by the“near-term offsets,” in data center and gaming, it is the ongoing buzz around AI that Rosner expects will win the day and likely continue to provide a “strong safety net” for the share price, despite the dazzling year-to-date gains. As such, even accounting for the stock’s lofty valuation, Seymore thinks the AI-frenzy is “unlikely to subside in the near term and therefore view investor optimism as likely to persist.”

Rosner is more circumspect, however. In fact, despite the AI catalyst, the analyst appears to believe the stock is clearly overvalued. Along with a Hold (i.e., Neutral) rating, Seymore’s $220 price target suggests the shares will be changing hands for a 29% discount a year from now. (To watch Seymore’s track record, click here)

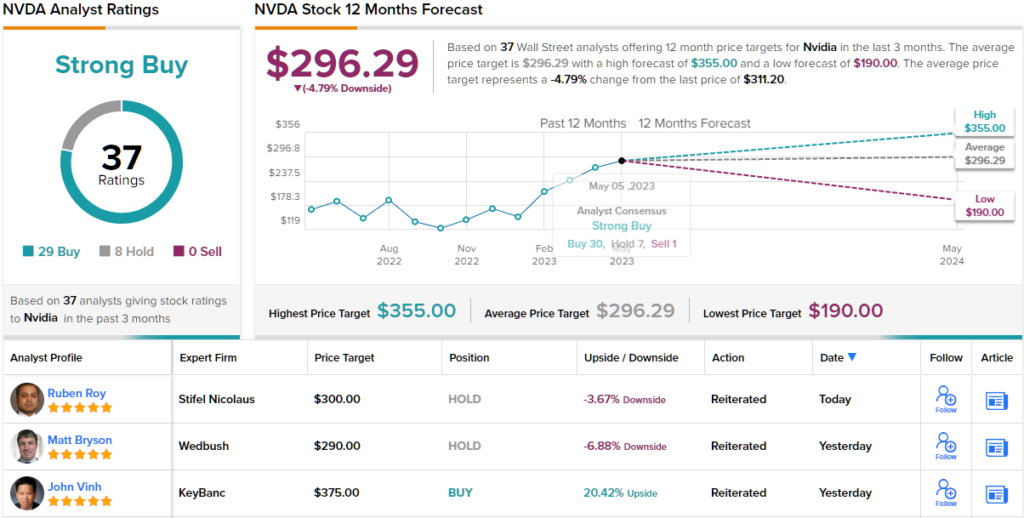

That said, on Wall Street, Seymore is part of a minority. While 7 other analysts join him on the sidelines, with an additional 29 Buys, NVDA stock claims a Strong Buy consensus rating. Still, given this year’s surge, the $296.29 average target implies shares are currently overvalued by ~5%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.