Johnson & Johnson (JNJ) will release its first-quarter 2022 financial results on April 29.

The corporation has been in the healthcare industry for a long time and provides products across the Consumer, Pharmaceutical, and Medical Devices segments.

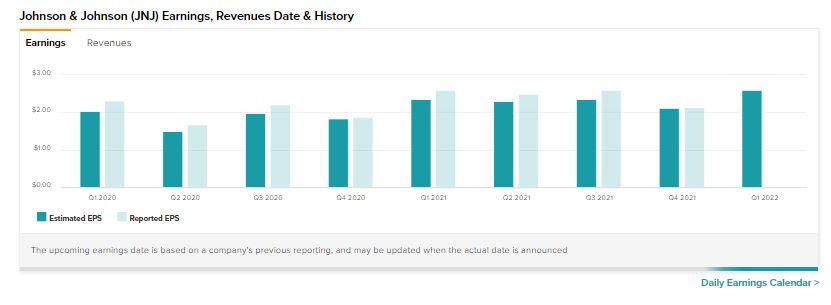

The company recorded strong profit results in the most recent fourth quarter, with both the top and bottom lines increasing year-over-year. Sales increased by 10.4% year-over-year to $24.8 billion, while adjusted EPS improved by 14.5% to $2.13.

With a market capitalization of $473.7 billion, JNJ stock has grown 14% in value over the last year. Let’s examine how the company is expected to perform this quarter.

Q1 Expectations

According to analysts, Johnson & Johnson is expected to report adjusted earnings of $2.59 per share and revenues of $24.8 billion in Q1.

JNJ CEO Joaquin Duato expressed his confidence in the company’s performance this year. During the Q4 conference call, Duato stated, “Given our strong results, financial profile, and innovative pipeline we are well-positioned for success in 2022 and beyond.”

Analyst’s Positive View

Raymond James analyst Jayson Bedford is optimistic about Johnson & Johnson ahead of the first-quarter reports.

Johnson & Johnson’s growth profile, according to the analyst, is bolstered by strong pharmaceutical growth and improving technology growth in the field of medicine. In addition, Bedford feels that JNJ’s diverse portfolio provides downside protection in a volatile market.

Bedford maintained his Buy rating on the company and increased the price target to $195 from $185.

Investors also remain upbeat about the stock. Per the Stock Investors tool, 3.2% of the investors holding portfolios on TipRanks have accumulated JNJ stock in the last 30 days. Meanwhile, hedge funds increased their holdings of JNJ stock by 449.5K shares in the last quarter.

Wall Street’s Take

However, not all experts believe that the stock is a good investment right now.

On TipRanks, Johnson & Johnson stock commands a Moderate Buy consensus rating based on 6 Buys and 5 Holds. As for price targets, the average JNJ price target of $188.73 implies almost 5% upside potential from current levels.

Bottom Line

Johnson & Johnson’s stock is doing well, thanks to a solid product portfolio and a profitable revenue mix. However, macro events such as the Russia-Ukraine conflict and recent COVID-19 lockdowns in China may have had an impact on JNJ’s upcoming first-quarter performance.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure