It seems like Airbnb (NASDAQ: ABNB) is set to have a perfect year. For the vacation rental platform company, 2021 proved to be the best year in its history, and this was reflected in the company’s Q4 and FY21 results. Investors have also been optimistic about the stock as indicated by its share price which has risen by 5.3% in the past month, over a period which has seen many other tech names falter.

So how was 2021 for the company? Let’s take a look.

In 2021, the company delivered $47 billion of Gross Bookings Value (GBV), 23% higher than 2019 before the pandemic started. The company’s revenues soared to $6 billion in 2021, up by 25% more than in 2019.

What’s more, ABNB reported an adjusted EBITDA margin of 27%, a huge improvement from the negative adjusted EBITDA margin of 5% in 2019.

Key Growth Trends

So, what drove this growth for ABNB in 2021? Airbnb’s Chairman, CEO, and Co-Founder, Brian Chesky had some answers on the company’s Q4 earnings call.

He commented that not only has a massive shift occurred in the travel industry, but “Remote work has untethered many people from the need to be in an office, and as a result, people are spreading out to thousands of towns and cities, staying for weeks, months, or even entire seasons at a time.”

This trend was reflected in ABNB’s results, too, as guests are staying for a longer duration on average at Airbnb’s vacation rentals. The company stated in its letter to shareholders that over the last two years, the average trip length has increased by around 15%, with stays of more than a week making up almost 50% of all the gross nights booked.

Moreover, long-term stays of 28 nights or more remained its fastest-growing category in terms of trip length and accounted for 22% of gross nights booked in the fourth quarter, up 16% from Q4 2019.

Other key trends that underpinned ABNB’s growth in 2021 included higher domestic and non-urban travel, guests planning to travel more despite different COVID-19 variants, and an elevated supply of hosts.

Analyst’s Take

Currently, ABNB has more than 4 million hosts and offers 5.7 million active listings. Tigress Financial analyst Ivan Feinseth views these listings as offering a distinct competitive advantage as ABNB’s offerings provide a variety of accommodations to travelers.

According to the analyst, the company’s “biggest appeal and value proposition is the concept of living like a local and offering additional local experiences that enhance a Guest’s travel experience and drive additional revenue and fees.”

Moreover, Feinseth is of the opinion that the company is poised for “accelerating revenue growth” and has forecast revenues to increase further by 37.6% to $8.25 billion over the next twelve months.

ABNB has pointed out that in 2022, a key priority for the company is recruiting more hosts. Feinseth believes that a major advantage for ABNB versus other traditional lodging providers is that the company “can add lodging capacity through the ongoing expansion of Hosts with little or no acquisition costs.”

The analyst also approves of ABNB’s “asset-light” model that could lead to growth in revenues, “significant increases in Return on Capital, driving growing Economic Profit and greater shareholder value creation.”

As a result, Feinseth remains bullish on the stock with a Buy rating and raised his price target from $206 to $214. This higher target now represents a possible 12-month 35.9% upside on the stock.

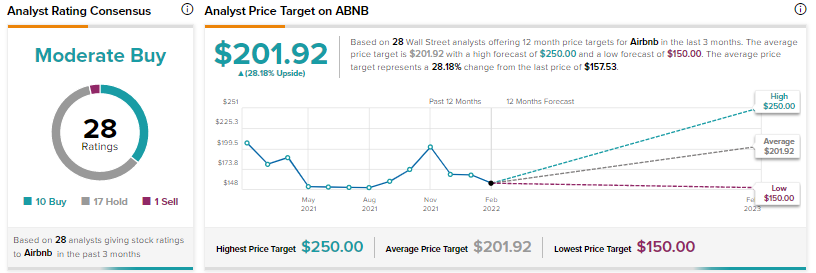

Other analysts on Wall Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys, 17 Holds, and 1 Sell. The average ABNB stock prediction is $201.92, which implies upside potential of approximately 28.18% from current levels for this stock.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.