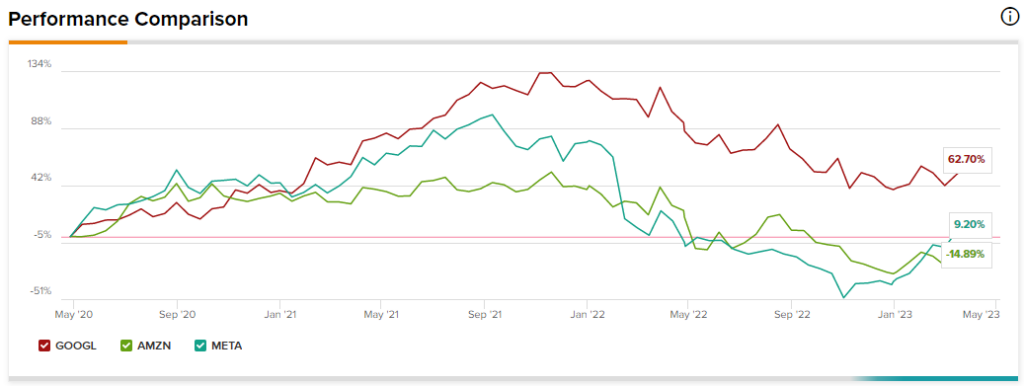

The so-called “AI revolution” has been going on for years now, but it wasn’t until OpenAI unleashed the advanced language model ChatGPT to the world that the technology truly took off. Though there are numerous ways to play the rise of artificial intelligence (AI), I view the following trio of FAANG stocks as poised for success.

Therefore, in this piece, we’ll use TipRanks’ comparison tool to stack up three FAANG firms that can leverage powerful network effects to become successful players in the AI space.

Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG)

No surprises here. Search and cloud kingpin Alphabet is a FAANG company that seems the most AI-savvy of them all. Google’s generative AI Bard, which aims to duke it out with rival ChatGPT and Bing AI, may have had a slow and rocky beginning. However, I still think Alphabet is one of the top AI companies to own for the long haul.

The tech titan may not have the most impressive consumer-facing AI platform at this moment in time. Still, the company has profound AI capabilities, which may fly under the radar until the firm finally does launch an AI product that changes the way people view the company. For these reasons, I remain bullish.

Alphabet has been busy working on AI projects for decades now. Apart from the AI tech behind the scenes of its popular search engine, the firm also has its hands in many pies, including self-driving tech with Waymo and its AI lab DeepMind, which is probably working on tech that’ll help drive AI tech for years to come.

Only time will tell if Bard is the product that brings forward a considerable amount of multiple expansion that sends the stock’s price-to-earnings (P/E) multiple from a modest 23.1 times to something closer to 30 times. Regardless, I think Alphabet has an innovative AI pipeline that’s not getting the full respect it deserves from Mr. Market.

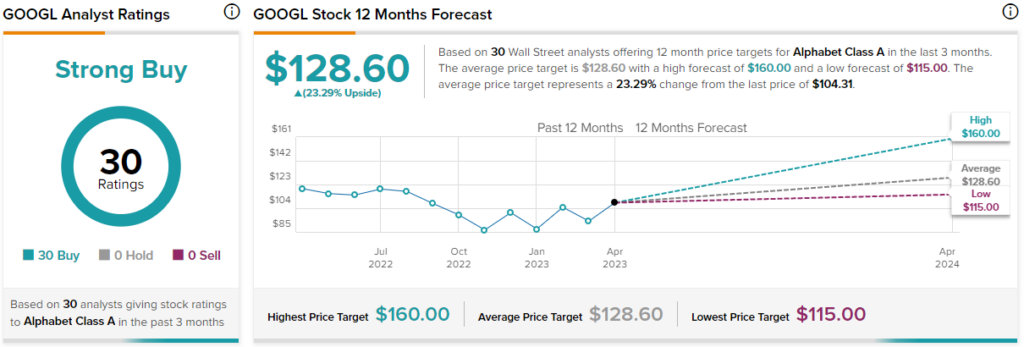

What is the Price Target for GOOGL Stock?

Alphabet sports a Strong Buy, with 30 unanimous Buy ratings. The average GOOGL stock price target of $128.60 implies 23.3% upside potential.

Meta Platforms (NASDAQ:META)

Meta isn’t just a social media or metaverse company. It’s a firm that’s leveraging powerful AI technologies to help it gain an edge over rivals in the space. Criticize Meta for its slowed growth over at Facebook, if you will, but the company has shown it’s willing to reach to new horizons to unlock growth. With a seat to the AI and metaverse shows, I view Meta as an underdog that may very well be the cheapest or one of the cheapest of the FAANG basket right now. For this reason, I remain bullish.

Later today, the company will be making headlines for its quarterly earnings, and it’s also paying a $725 million settlement (related to the Cambridge Analytica scandal) and has laid off many employees. However, don’t let these news events make you lose sight of the long-term opportunity. Meta is very much a contender in the AI race, and it’s a contender that may be able to monetize AI better than its rivals.

Back in October, Meta’s CFO stated that AI would be responsible for most of the firm’s capital expenditure growth for the year. Part of the AI investments will be in driving ad growth over at its social platforms. However, what many may be overlooking is the potential for the firm to launch an AI innovation that brings a floodgate of users back to Facebook. Indeed, it’s the AI innovation not on Meta investors’ radars that could bring forth the most upside in the stock.

At a 25.1 times trailing price-to-earnings multiple, Meta stands out as one of the lowest-cost members of the FAANG group.

What is the Price Target for META Stock?

Meta sports a Moderate Buy rating, with 39 Buys, seven Holds, and three Sells. The average META stock price target of $236.50 implies 11.9% upside potential.

Amazon (NASDAQ:AMZN)

Amazon isn’t just an e-commerce or cloud company anymore. Arguably, it’s one of the better ways to play autonomous robotics. With an impressive line-up of AI-powered warehouse workers and a foot in the waters of cashier-less stores, the firm has shown that it has not lost its disruptive innovation edge. AMZN stock may still be off 44% from its peak, but it’s well-equipped to keep its disruptive streak alive, thanks to AI. That makes me very bullish.

Recently, Amazon flexed its AI muscles to the crowd, announcing Amazon Bedrock, a service that puts the power of AI into the palm of its users’ hands. The platform allows users to create generative AI apps with its libraries. Indeed, Bedrock and services like it could render ChatGPT as just another language model of many. In a few years, GPT may not even be the go-to generative AI that mainstream users flock to.

In any case, Amazon is very much a contender in the AI race. The company is also getting into the no-code race with CodeWhisperer, a code generator that touts its ability to build applications quickly and securely.

It’s hard not to be amazed by recent AI news surrounding Amazon. Such tech could help power the stock’s rebound to new highs, even as a potential recession weighs more heavily on e-commerce sales.

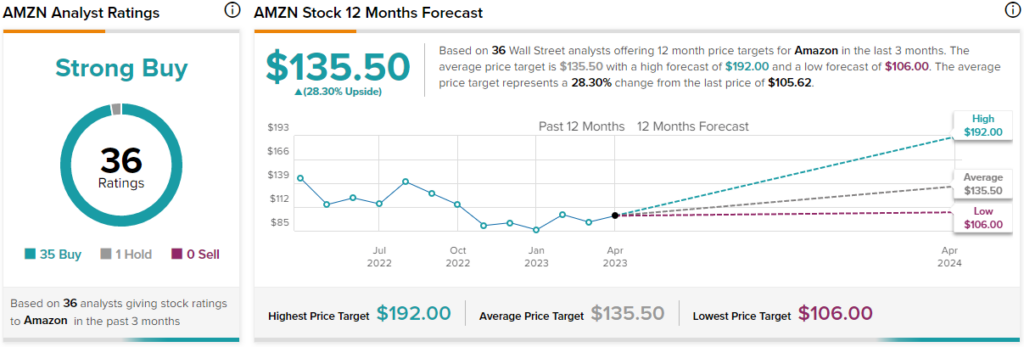

What is the Price Target for AMZN Stock?

Amazon has a Strong Buy, with 35 Buys and one Hold. The average AMZN stock price target of $135.79 entails a 28.3% gain from here.

Conclusion

While the trio of FAANG stocks may not be pure-play AI companies, they can use their size to their advantage, and over time, we may see AI contributing a bigger and bigger portion of each firm’s overall revenues.

For Apple (NASDAQ:AAPL), it was the iPhone that grew steadily until it contributed to a majority of the overall revenue pie, taking the throne away from the Mac and other technologies. The most AI-savvy FAANG companies can do the same with their AI-backed technologies as they look to advance in the field while exploring new ways to monetize AI and fit it in with existing businesses.