Among the devastating impacts of COVID-19 on businesses, advertising budgets have been hit hard. Even Wall Street heavyweight Facebook’s (FB) advertising business has been battered by the pandemic, with an advertiser boycott also weighing on the segment.

In the second quarter of 2020, the company’s top 100 advertisers accounted for 16% of its revenue, which is a lower percentage compared to a year ago. That being said, based on recent data, the tide could be turning for the social media giant.

Writing for Oppenheimer, 5-star analyst Jason Helfstein points to 3P data and recent checks as indicating a stronger-than-expected recovery in advertising is taking place. According to Gupta Media, global CPMs for September are trending 7% above the average pre-COVID-19 rate. Additionally, Q3 quarter-to-date global CPMs are -16%, compared to the pre-COVID average. This is an improvement from Q2’s -37%, and an impressive rebound from the March low of -70%.

On top of this, checks suggest that budgets allocated to FB advertising could return to Q1 2020 levels in FY21. Helfstein added, “We see this further supported by Standard Media Index’s August digital spending 18% year-over-year, the first month of growth since February, and positive SMB survey results from Borrell Associates.”

Representing another major component of Helfstein’s bullish thesis, he argues FB Shops is benefiting from the COVID-19 tailwind, and could ultimately be a $25–50 billion revenue opportunity. To support this claim, he cites the shift to online shopping that was accelerated by COVID-19. Based on U.S. census data, online share gains accelerated by 250 basis points, with it now accounting for 17% of total retail spending excluding food. Shops has also been capitalizing on a faster SMB web-presence build-out, in Helfstein’s opinion.

Helfstein further noted, “We see near-term upside from transaction fees and long-term WhatsApp/Messenger integration for CRM/payments opportunities.”

Wrapping it all up, Helfstein opined, “Shares trading 5% below upper-bound of 24-month historical standard deviation NTM EBITDA at 16x. We see upside to Street FY21 revenue/EBITDA estimates on headcount growth decelerating and Shops could be FY21 revenue catalyst.”

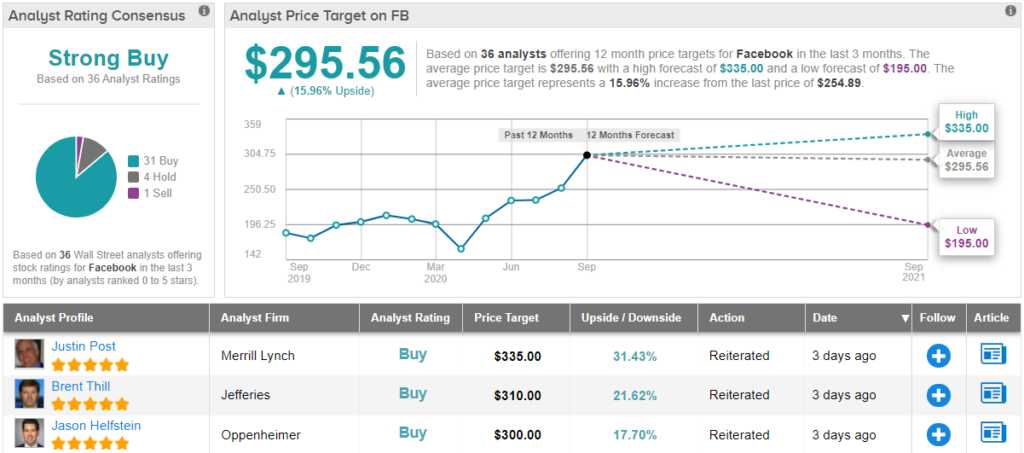

Based on all of the above, Helfstein keeps an Outperform rating on the stock. Not to mention he bumped up the price target from $270 to $300. Should his thesis play out, a potential twelve-month gain of 18% could be in the cards. (To watch Helfstein’s track record, click here)

Turning now to the rest of the Street, few analysts beg to differ. FB’s Strong Buy consensus rating breaks down into 31 Buys, 4 Holds and 1 Sell. The $295.56 average price target brings the upside potential to 16%. (See Facebook stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.