Adobe (NASDAQ:ADBE) will report its fiscal first-quarter earnings on March 15, after the market closes. Unfavorable exchange rates during the quarter might have impacted revenues from the company’s international business. Nevertheless, the company enhanced its product offerings with new capabilities, which might have spurred demand in the upcoming quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adobe provides digital marketing, multimedia, and creativity software products. The stock has declined by about 4% so far this year.

The company is expected to report earnings of $3.68 per share in Q1, above its year-ago figure of $3.37 per share. Meanwhile, revenue is pegged at $4.62 billion, representing a year-over-year jump of 8.7%.

In the fourth quarter earnings call, the management stated that Q1 results would be “sequentially down and seasonally light for new business.” Further, the company is expecting to report total revenue in the range of $4.60 billion to $4.64 billion and adjusted earnings per share between $3.65 to $3.70.

Website Visits Reflect an Upward Trend

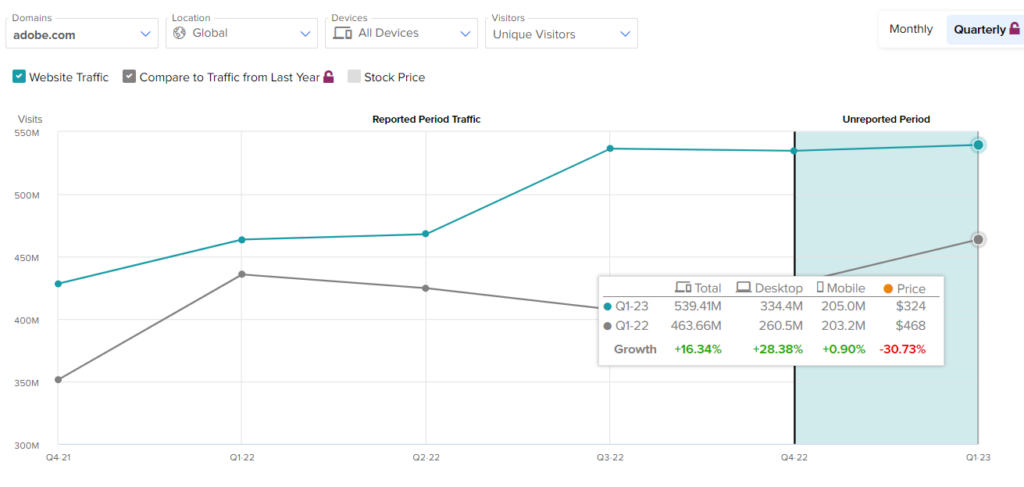

For a digital company like Adobe, total website visits are a good indicator of user involvement on its platform. As per the TipRanks Website Traffic tool, total global visits to adobe.com climbed 16.3% year-over-year in the fiscal first quarter.

The increase in monthly visits could indicate that demand for Adobe’s products and services remained strong during the quarter.

Is Adobe a Buy or Sell?

Wall Street is cautiously optimistic about Adobe. ADBE stock has a Moderate Buy consensus rating based on 11 Buys and 13 Holds. The average stock price target of $383.25 implies over 18.2% upside potential.

Ending Thoughts

For the past three years, Adobe has had an unbreakable record of exceeding analysts’ expectations. The impressive earnings history gives confidence about its potential to surpass the to-be-reported quarter’s expectations easily. Furthermore, the acquisition of Figma, which is expected to close this year, may help the company expand its total addressable market.