Adobe (NASDAQ:ADBE) is slated to release its second quarter Fiscal 2023 results on June 15, after market close. Ahead of the company’s earnings, analyst Brian Schwartz from Oppenheimer expects “a favorable outcome for Adobe in its F2Q reported results.” This is based on expectations of a significant increase in net new Digital Media ARR along with support from Adobe’s expanding generative AI solutions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In addition, the analyst is of the opinion that Adobe effectively implemented cost control measures in the upcoming quarter, particularly through measures like the hiring freeze. These actions likely contributed to the growth of Adobe’s bottom line, positively impacting its financial performance.

Schwartz expects the management to provide conservative guidance for the upcoming quarter on account of macro challenges, Figma acquisition-related uncertainties, and “moderating demand and customer spending trends.”

Overall, the analyst has maintained a Hold rating on ADBE stock as he believes Adobe offers a “balanced risk/reward profile” after last month’s stock price rally in the software market.

Street’s Q2 Expectations

Currently, the analysts expect Adobe to post earnings of $3.79 per share in Q2, compared with $3.35 per share reported in the prior-year period. Meanwhile, revenue is expected to rise about 10% from the year-ago quarter to $4.77 billion.

Encouraging Website Traffic Trend

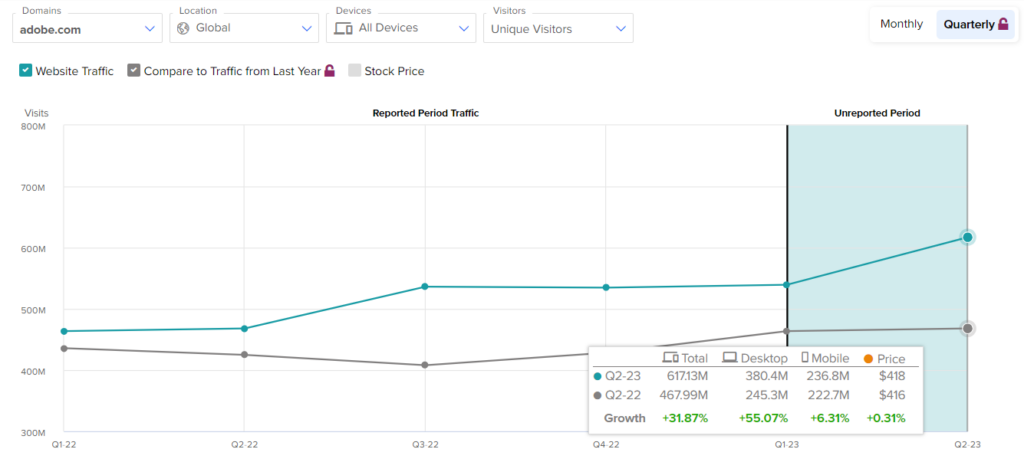

TipRanks’ Website Traffic Tool offers insight into Adobe’s fiscal second-quarter performance. According to the tool, ADBE’s website traffic registered a 32% year-over-year rise in global visits during the quarter.

The increase in monthly visits could indicate that demand for the company’s products remained strong during the quarter.

What is the Price Target for ADBE Stock?

Overall, Wall Street analysts are cautiously optimistic about ADBE stock. On TipRanks, Adobe has a Moderate Buy consensus rating based on 13 Buys and 14 Holds ratings. Meanwhile, the average price target of $460.98 implies 3.8% downside potential from current levels.

Ending Thoughts

Adobe’s artificial intelligence tool, Firefly, has the potential to attract new customers and boost revenue growth. Additionally, analyst Schwartz expressed that he would hold a more optimistic outlook on the stock if there were “greater clarity around the Figma deal outcome and/or a sustainable reacceleration in the core Digital Media business.”