Adobe (NASDAQ:ADBE) may need to get creative moving in the AI era. Shares have taken a beating over the past year, now down around 50% from their all-time high. With the recent hype surrounding OpenAI’s Dall-E 2 (an “AI system that can create realistic images and art”), questions linger as to what the future will hold for creative software giants. Indeed, the rise of creative AI brings forth some fascinating questions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For now, Adobe stock is feeling the full force of the headwinds. In this piece, we’ll look at both medium- and long-term factors for Adobe stock investors to keep tabs on.

Undoubtedly, Adobe has enjoyed a wide moat surrounding its suite of creative and productivity tools. Photoshop, Illustrator, and Acrobat are household names. With Figma thrown into the mix, Adobe still seems to be going strong in a market that could prove tough for rivals to challenge.

News of Adobe’s Figma acquisition raised some interesting questions about whether Adobe’s moat is wide enough to fend off smaller up-and-coming competitors in the creative software space. The $20 billion price tag was quite jarring.

The Figma deal seems to resemble some of the social-media deals made by Meta Platforms (NASDAQ:META) to defend its turf against up-and-comers. Given the damage to Adobe’s share price over the past year, though, I don’t think anti-trust regulators will be nearly as harsh as they would have been had the stock been at a fresh all-time high. In that way, Adobe stock’s vicious plunge may have a bit of a silver lining to it.

Adobe Will Have to Play Some Defense

The company has expanded beyond creative software, looking to marketing (the Adobe Experience Cloud) as a source of growth. Even as Adobe looks to new growth arenas, it needs to play defense when it comes to creativity software. Ultimately, its creative suite is the firm’s bread and butter, and it’s not just innovative up-and-comers like Canva that Adobe will need to keep tabs on (the acquisition of Canva seems doubtful after a Figma deal, as it’d draw even more attention from regulators); it’s the rise of creative AI.

For now, I remain neutral on Adobe stock. I think it’s modestly valued at 34.1 times trailing earnings. The current multiple is still well below the software industry average of around 47 times. In addition, shares of the mature tech firm still trade at quite a premium to most big-tech/FAANG stocks.

Indeed, the ~$160 billion firm is quite FAANG-like, given its impressive growth, sizeable moat, and impressive network. With that, I don’t think a price-to-earnings (P/E) multiple in the twenties is that unreasonable, especially given the magnitude of Adobe stock’s recent valuation “reset.”

Therefore, more downside could be in store if the Fed maintains its hawkish stance. Further, as creative AI looks to change the digital design world, questions linger as to how Adobe will maintain the width of its moat.

It’s Time for Adobe to Get Creative

Adobe may have faced challenges from smaller, innovative companies like Figma and Canva. That said, I think it’s a bad idea to discount Adobe’s innovative and creative abilities. The company isn’t just going to sit around and seek to acquire rivals as they come on the radar. Doing so would likely put the firm in the bad books with regulators.

For now, I don’t view the Figma acquisition as the start of a trend of just acquiring rivals. However, I think Adobe will need to embrace AI to fend off potential disruption as AI-powered creativity platforms like DALL-E breathe a new breath of innovation across the creative software field.

Adobe has its own AI tools. Whether we’re talking about Adobe Sensei or the recently-launched enhanced speech tool, the company knows about the wave of disruption that AI could bring to the creative space.

Overall, I think Adobe has done a great job of staying on the cutting edge of recent innovations. Further, I’d look for Adobe to continue acquiring bite-sized firms to help power its AI capabilities.

Is ADBE Stock a Buy, According to Analysts?

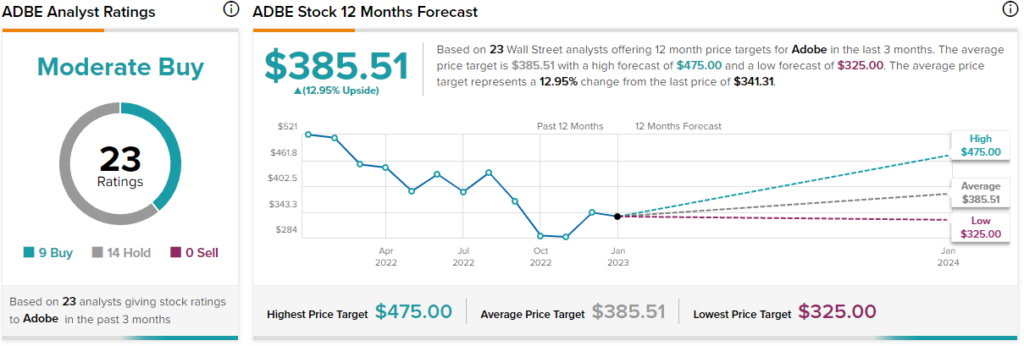

Turning to Wall Street, ADBE stock comes in as a Moderate Buy. Out of 23 analyst ratings, there are nine Buys and 14 Hold recommendations. The average Adobe price target is $385.51, implying upside potential of 12.95%. Analyst price targets range from a low of $325.00 per share to a high of $475.00 per share.

The Takeaway

Even with creative AI taking center stage, I think Adobe will remain relevant for many years and decades. It will be interesting to see how the firm stacks up against other creative AIs as they arrive.