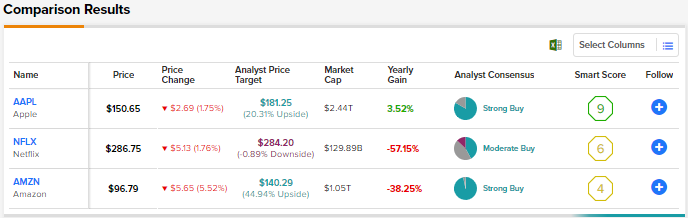

FAANG – five of the most prominent tech companies: Meta Platforms (META), previously called Facebook, Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Google’s parent company Alphabet (GOOGL) (GOOG), recently reported their quarterly results. Here we will discuss analysts’ opinions on three FAANG stocks following their results and use TipRanks’ Stock Comparison Tool to pick the one with the highest upside potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Apple (NASDAQ:AAPL) Stock

Apple’s fiscal fourth-quarter results (ended September 24, 2022) exceeded analysts’ expectations, reflecting resilience amid challenging macro conditions. The company’s sales grew 8.1% to $90.1 billion, while earnings per share (EPS) grew 4% to $1.29.

Sales from iPhone, the largest revenue contributor, grew almost 10% to $42.6 billion but lagged expectations. Also, Services sales of $19.2 billion rose 5% and fell short of estimates. It’s worth noting that Mac sales increased 25.4% to $11.5 billion, defying the broader industry trend of lower PC shipments.

While Apple’s overall performance was impressive, the company cautioned that revenue growth in the December quarter would be lower than the Q4 growth rate.

Is Apple a Buy or Sell Now?

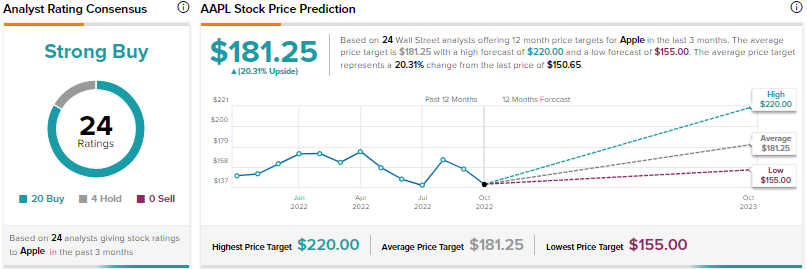

Evercore ISI analyst Amit Daryanani feels that Apple delivered an “impressive set of numbers and guide,” given the dismal earnings reported by other tech giants. Daryanani stated, “Eventually the question will be on durability of demand beyond Dec-qtr and the impact from macro not just on iPhones but also services.”

The analyst feels that Apple is “uniquely positioned” to maintain mid or high single-digit top-line growth and low or mid-teens EPS growth on a multi-year basis. Daryanani expects EPS growth to be driven by higher gross margin resulting from easing supply chain issues, operating expense controls, and share buybacks. Daryanani reaffirmed a Buy rating on Apple stock and a price target of $190.

Overall, Apple stock scores a Strong Buy consensus rating based on 20 Buys and four Holds. The average AAPL stock price target of $181.25 implies 20.3% upside potential. Shares have declined 15.2% year-to-date.

Netflix (NASDAQ:NFLX) Stock

The loss of subscribers in the first two quarters of the year had spooked Netflix investors. The company’s Q3 beat was cheered by investors, with the company adding 2.41 million net subscribers in the quarter. Subscriber additions exceeded the company’s own guidance of 1 million and also crushed the Street’s estimate of 1.09 million.

As part of its plan to reaccelerate growth, Netflix is launching a lower-priced ad-supported plan in 12 countries in November. The ad-based plan is not expected to make a material difference to the fourth quarter. Netflix expects 4.5 million paid net additions in the fourth quarter.

What is the Prediction for Netflix Stock?

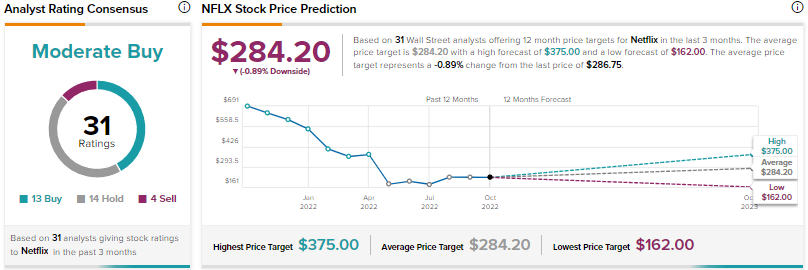

Following the recent results, Deutsche Bank analyst Bryan Kraft upgraded Netflix stock to a Buy from Hold and increased the price target to $350 from $270.

Kraft sees “visibility into a subscriber growth inflection point” next year due to the introduction of new measures to monetize account sharing in early 2023 and the launch of ad-supported plans.

Overall, the Street is cautiously optimistic on Netflix stock, with a Moderate Buy consensus rating based on 13 Buys, 14 Holds, and four Sells. At $284.20, the average NFLX stock price target suggests a marginal downside from current levels. Netflix stock has plunged 52.4% so far this year.

Amazon (NASDAQ:AMZN) Stock

Amazon’s mixed Q3 results and lower-than-anticipated Q4 sales guidance dragged down the stock. After reporting losses in the first two quarters, the company generated EPS of $0.28 in Q3, beating the Street’s estimate of $0.22. Q3 sales grew 15% to $127.1 billion but lagged expectations. Amazon’s Q4 guidance indicates sales growth in the range of 2% to 8%.

Amazon’s outlook and the Q3 sales guidance miss reflect the impact of macro challenges on consumer spending. Also, currency headwinds, which impacted Q3 sales by $5 billion, remain a concern. Moreover, the company’s high-margin Amazon Web Services (AWS) cloud computing business delivered sales growth of 27%, marking the slowest revenue growth since at least 2014.

On the positive side, Amazon’s advertising revenue increased 25% to about $9.6 billion, bucking the negative trend experienced by certain ad-dependent tech companies.

Is Amazon Stock Expected to Rise?

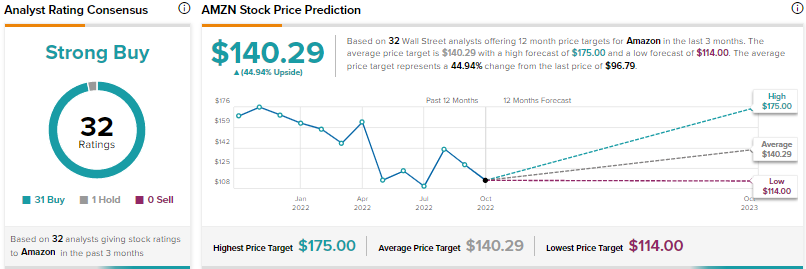

Several analysts cut their price targets for Amazon stock to reflect near-term concerns. However, they reaffirmed their bullish stance, indicating confidence in the company’s long-term growth.

Raymond James analyst Aaron Kessler lowered his price target for Amazon stock to $130 from $164 due to the slowdown in AWS growth and lower Q4 gross margin expectations. However, Kessler maintained a Buy rating on Amazon stock.

Kessler explained, “While we expect a more challenging growth outlook near-term, we remain positive on long-term growth for both retail and AWS with improving margins over time as Amazon focuses on productivity improvements.”

On TipRanks, Amazon stock earns a Strong Buy consensus rating based on 31 Buys versus one Hold. The average Amazon stock target price of $140.29 implies 45% upside potential. Shares have tanked 42% so far in 2022.

Conclusion

Analysts are more bullish about Apple and Amazon than Netflix. Wall Street expects higher upside potential in AMZN stock than the other two stocks.

Analysts are looking beyond the near-term weakness in Amazon and remain optimistic about the company’s long-term growth story. They view the current pullback in Amazon stock as a great opportunity to buy this FAANG stock.