Shares of the top technology giants Apple (NASDAQ:AAPL) and Meta Platforms (NASDAQ:META) are among the most widely discussed stocks on the social media platform Reddit. While these shares are buzzing on Reddit and have significantly gained mentions, they have outperformed the S&P 500 Index (SPX) and have appreciated considerably on a year-to-date basis. Despite the rally in their prices, analysts’ average price targets suggest a decent upside in these stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this background, let’s delve into these trending Reddit stocks.

Can Apple’s Stock Go Higher?

Apple stock has gained over 37% year-to-date. However, its stock came under pressure recently due to concerns over iPhone sales in China. Nonetheless, Morgan Stanley analyst Erik Woodring reiterated a Buy on Apple stock on September 7 and doesn’t expect the issues to snowball. Further, Woodring added that Apple is performing well in the Chinese market.

On the other hand, Apple will introduce its iPhone 15 and a new version of the Apple Watch on September 12. Commenting on the launch, Goldman Sachs analyst Mike Ng said he expects the iPhone 15 to lead to an improved price/mix. He maintained a Buy on AAPL stock on August 31 and expects the company to benefit from a large installed base and lower churn.

Overall, Apple is expected to benefit from a growing installed base of paid subscriptions and strength in the Services segment. However, near-term macro uncertainty is keeping analysts a bit cautious.

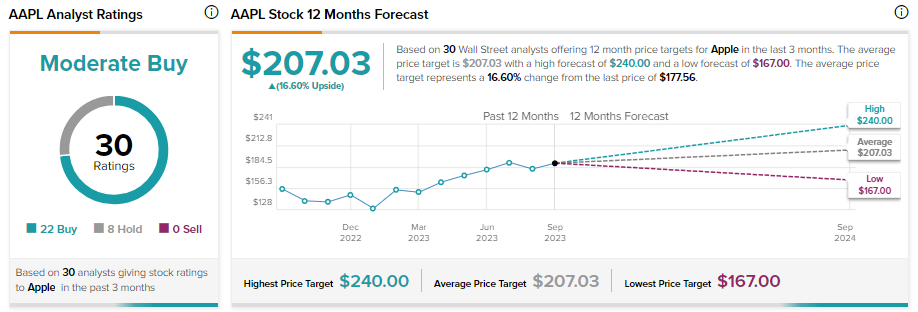

Apple stock has received 22 Buy and eight Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $207.03 implies that it can go 16.6% higher from current levels.

What is the Price Target for Meta?

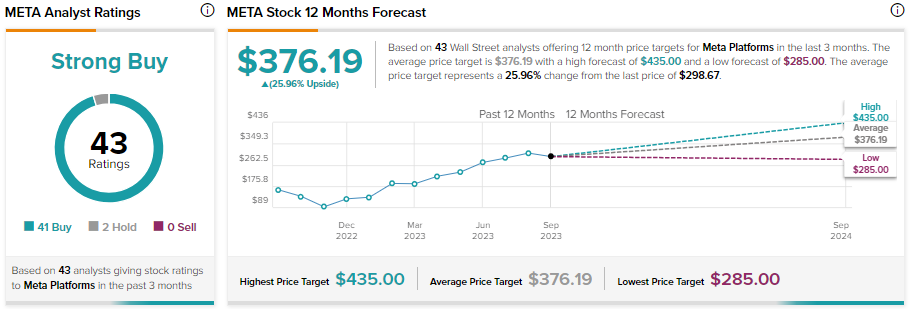

Meta stock has gained over 148% year-to-date. Despite the surge in price, analysts’ average 12-month price target of $376.19 suggests a further upside potential of 25.96% from current levels.

The improving advertising market, the company’s focus on driving user engagement, deep cost-cutting measures, and investments in AI (artificial intelligence) provide a solid foundation for future revenue and earnings growth.

Citing the reacceleration in ad growth, Morgan Stanley analyst Brian Nowak reiterated a Buy on Meta stock on September 6. Including Nowak, Meta stock has received 41 Buy recommendations. At the same time, two analysts have rated Meta stock a Hold. Overall, Meta has a Strong Buy consensus rating.

The Bottom Line

Apple and Meta stocks are trending on Reddit and have good long-term growth prospects. Further, analysts’ price target indicates further upside in both of these stocks. However, Meta, with higher upside potential from current levels (based on analysts’ price target) and a Strong Buy consensus rating, looks more compelling than Apple in the short term.