The stock market is in brutal mode right now and signaling to the pandemic era stars that it is payback time. For example, shares of Shopify (SHOP) have shed 51% year-to-date with 16% of the decline coming in Wednesday’s session, following the Canadian ecommerce giant’s Q4 report.

That is despite the company beating the estimates on both the top-and bottom-line. Revenue increased by 41% year-over-year to reach $1.38 billion – $40 million above the consensus estimate, while non-GAAP EPS of $1.37 provided a $0.06 beat.

But as has become de rigueur, investors are no longer impressed by quarterly outperformance, they want confirmation the growth is set to continue. And this is a problem for many online companies, which were particularly in favor during the height of Covid’s impact; as consumers shifted spending habits online, some experienced huge growth sprouts which will not be repeated.

The picture is even more complex for Shopify. Hand in hand with more normalized growth, the company has said it intends to heavily spend this year on the expansion of its distribution network.

While Piper Sandler’s Brent Bracelin thinks the plan could work in the long run, it alters the picture closer to the here and now.

“The elevated investment appetite was surprising and could pressure profits and cash flows in the short-run,” the 5-star analyst explained. “In the end, this should better position the company to capture a more meaningful portion of the $4T U.S. retail commerce industry with the potential to re-accelerate growth in 2023. However, the gross margin implications and higher execution risks in the near-term could change how growth investors value SHOP with a greater emphasis on EV/GP multiples going forward.”

To this end, while Bracelin sticks to an Overweight (i.e., Buy) rating, given “higher execution risks,” the analyst has slashed the price target from $1,400 to $900, suggesting shares could climb ~34% in the year ahead. (To watch Bracelin’s track record, click here)

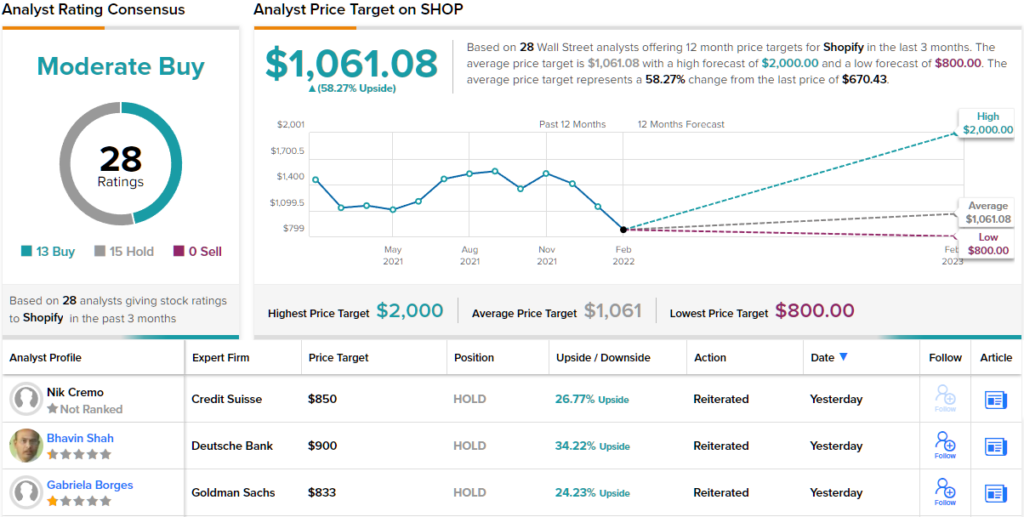

The Street’s average target, on the other hand, remains elevated. Shares are anticipated to appreciate by 74% over the coming months, given the average price target stands at $1,302 and change. The picture is more mixed on the ratings front; the stock’s Moderate Buy consensus rating is based on 14 Buys and 10 Holds. (See SHOP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.