The Coca-Cola Company (NYSE:KO) is scheduled to report fourth-quarter 2022 earnings on February 14, before the market opens. The company’s Q4 performance might have benefited from post-pandemic demand recovery in the soft drink market. Also, Coca-Cola’s revenues are expected to rise year-over-year, driven by an elevated pricing strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Regarding fourth-quarter estimates, the Street expects Coca-Cola to post earnings of $0.45 per share. Meanwhile, revenue expectations are pegged at $10 billion, representing a year-over-year jump of 5.3%.

It is worth highlighting that the beverage giant has surpassed Street’s bottom-line expectations for the last 12 quarters.

In the third quarter of 2022, the company reported revenues of $11.1 billion, up 10% year-over-year. The increase was due to an improved price/mix and growth in concentrate sales. Furthermore, adjusted EPS rose 7% to $0.69.

Is KO a Buy or Sell?

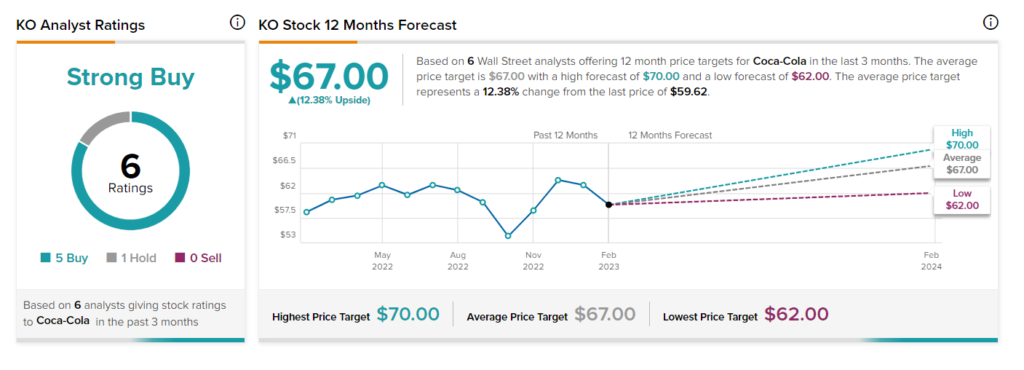

KO stock commands a Strong Buy consensus rating on TipRanks based on five Buy and one Hold recommendations. The analysts’ average price target of $67 implies 12.38% upside potential. Shares of the company have declined 6% over the past six months.

Ending Thoughts

Strong brand recognition and the easy availability of products in the markets continue to support Coca-Cola’s performance. Further, its strategy to introduce smaller bottles and multipacks during a period of reduced discretionary spending should support top-line growth in the upcoming quarter.