Seven major banks will be reporting Q2 earnings this week. On July 18th, five banks will report: Bank of America (BAC), Morgan Stanley (MS), Charles Schwab (SCHW), PNC Financial Services (PNC), and Bank of New York Mellon (BK). On July 19th, Goldman Sachs (GS) and Discover Financial Services (DFS) will report earnings as well.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last week, several top U.S. banks, including JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and Citigroup (NYSE:C), delivered second-quarter earnings. The results revealed that banks with significant exposure to consumer lending could continue to make money. However, the ones heavily dependent on investment banking fees and revenues could show a drop in earnings. In addition, higher deposit costs and an increase in provisions for credit losses could remain a drag.

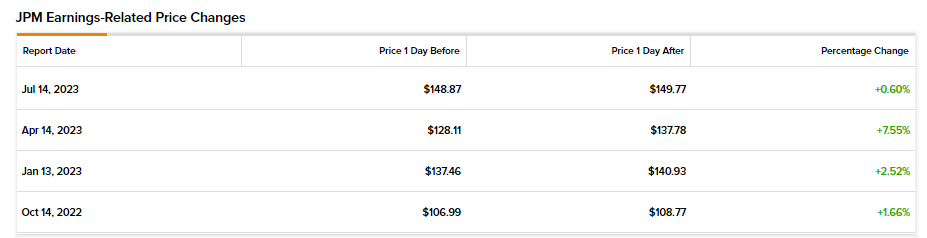

With more banks set to report earnings this week, let’s check what analysts expect from their quarterly results. Our earnings expectation table also shows how these bank stocks behaved (rose or fell) soon after the last earnings report by looking at the percentage change in price. That data helps investors set expectations regarding the stock’s behavior following the next earnings report.

For instance, in Q2, JPM handily exceeded analysts’ earnings estimates, delivering earnings of $4.75 per share in Q2 compared to the Street’s expectations of $3.94. Meanwhile, earnings showed sharp year-over-year and sequential growth led by higher net interest income and accretion from the First Republic deal. Despite the significant beat, JPM stock closed only 0.6% higher, implying that the positives were already priced in, and investors expected a strong earnings beat.

Bank Earnings Expectations

The table below shows that analysts expect top banks, including Morgan Stanley (NYSE:MS), Bank of America (NYSE:BAC), and Goldman Sachs (NYSE:GS), to report a year-over-year decline in EPS in Q2, due to the decrease in investment banking fees.

Further, higher deposit costs, increased competition, and a tight regulatory environment could affect the earnings of medium-sized banks like Charles Schwab (NYSE:SCHW), PNC Financial (NYSE:PNC), and Discover Financial Services (NYSE:DFS).

| Company | Ticker | Earnings Date | EPS Estimate – Q2 2023 | Reported EPS – Q1 2023 | Reported EPS – Q2 2022 | Revenue Estimate – Q2 2023 | Earnings Related Change (Last Quarter) |

|---|---|---|---|---|---|---|---|

| Bank of America | NYSE:BAC | 18-Jul-23 | $0.84 | $0.73 | $0.94 | $24.95 Billion | 0.63% |

| Morgan Stanley | NYSE:MS | 18-Jul-23 | $1.20 | $1.70 | $1.44 | $13.02 Billion | 0.66% |

| Charles Schwab | NYSE:SCHW | 18-Jul-23 | $0.71 | $0.93 | $0.97 | $4.63 Billion | 3.94% |

| PNC Financial Services | NYSE:PNC | 18-Jul-23 | $3.30 | $3.98 | $3.39 | $5.45 Billion | 0.36% |

| Bank of New York Mellon | NYSE:BK | 18-Jul-23 | $1.22 | $1.12 | $1.03 | $4.37 Billion | 1.48% |

| Goldman Sachs | NYSE:GS | 19-Jul-23 | $3.16 | $8.79 | $7.73 | $10.61 Billion | -1.70% |

| Discover Financial Services | NYSE:DFS | 19-Jul-23 | $3.72 | $3.58 | $3.96 | $3.88 Billion | -0.54% |

At the same time, analysts expect Bank of New York Mellon (NYSE:BK) to deliver improved Q2 earnings on a year-over-year and sequential basis. It primarily focuses on large institutional clients who maintain substantial deposit balances with the bank. Thus, the financial services company could continue to generate positive operating leverage from higher net interest revenue, a stable deposit base, and a strong balance sheet.

Read on for a deeper dive into analysts’ thoughts on three of the most notable bank stocks reporting this week: BAC, MS and GS.

What Can We Expect from BAC’s Earnings?

Bank of America will announce its second-quarter earnings on Tuesday, July 18. Wall Street expects BAC to report earnings of $0.84 a share in Q2, compared to earnings of $0.73 in the previous quarter. The quarter-over-quarter improvement reflects an anticipated increase in NII (Net Interest Income) due to higher average interest rates and modest loan growth.

However, EPS is expected to show a year-over-year decline due to the lower investment banking fee and higher provision for credit losses.

Ahead of Q2 earnings, BAC stock has eight Buy, Six Hold, and two Sell recommendations for a Moderate Buy consensus rating on TipRanks. Further, analysts’ average price target of $34.39 implies 18.14% upside potential from current levels.

Is Morgan Stanley a Good Buy Now?

Wall Street analysts expect Morgan Stanley to report earnings of $1.20 per share in Q2, reflecting a decline on a quarter-over-quarter and year-over-year basis. Underwriting and M&A activities remain subdued, taking a toll on Morgan Stanley’s bottom line.

Morgan Stanley stock has 10 Buy, three Hold, and one Sell recommendations for a Moderate Buy consensus rating. These analysts’ average price target of $98.17 implies 14.44% upside potential from current levels.

Is Goldman Sachs Stock a Buy or a Sell?

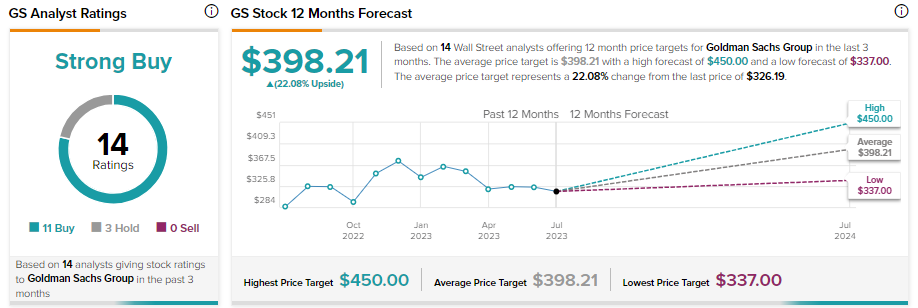

Wall Street expects Goldman Sachs to witness a substantial decline in earnings in the second quarter, reflecting lower industry-wide investment banking activity levels. Analysts expect Goldman Sachs to post earnings of $3.16 per share in Q2, compared to $7.73 in the prior-year quarter. Meanwhile, EPS is projected to decline on a quarter-over-quarter basis.

The ongoing macroeconomic and geopolitical concerns continue to hurt investment banking activity levels, which in turn, negatively affect Goldman Sachs’ earnings.

Nonetheless, analysts remain upbeat about Goldman Sachs stock. It has received 11 Buy and three Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $398.21 implies 22.08% upside potential.

Bottom Line

Banks will likely gain from higher average interest rates and a modest loan increase. However, higher deposit costs, increased provisions for credit losses, and lower investment banking activity levels will continue to hurt earnings growth.