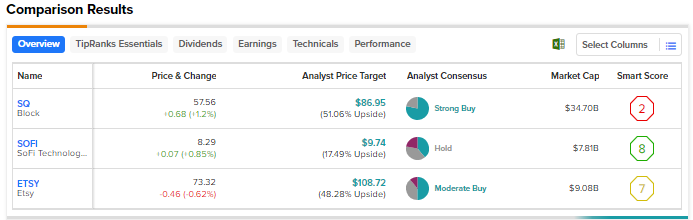

Several growth stocks have made a strong comeback this year on improved investor sentiment and optimism about company-specific growth catalysts. While the risk of further rate hikes by the Federal Reserve remains an overhang on growth stocks over the near term, analysts are bullish on several companies that can weather short-term pressures and deliver compelling returns over the long term. With the help of TipRanks’ Stock Comparison Tool, we placed Block (NYSE:SQ), SoFi (NASDAQ:SOFI), and Etsy (NASDAQ:ETSY) against each other to pick the growth stock that can deliver the highest returns as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Block (NYSE:SQ)

Fintech giant Block showed its strength against a challenging economic backdrop when it reported upbeat second-quarter results earlier this month. Revenue increased 26% to $5.53 billion, with strength across the company’s Cash App and Square ecosystems. Further, adjusted earnings per share (EPS) jumped to $0.39 from $0.18 in the prior-year quarter, fueled by solid margins.

Given the solid Q2 2023 results, the company raised its full-year profit forecast. It now expects to post $25 million in adjusted operating income compared to its previous guidance of $115 million in adjusted operating loss.

Despite solid Q2 earnings and an improved outlook, investors were worried about the Q2 gross payment volume (GPV), which fell short of expectations. They were also concerned about the deceleration in the year-over-year growth in July gross profit compared to Q2 gross profit growth rate.

Is Block a Buy or Sell?

On August 4, Needham analyst Mayank Tandon slightly increased his price target for Block to $82 from $80 and reiterated a Buy rating. The analyst stated that the better-than-expected subscription and services revenue in both Square and Cash App businesses drove the Q2 results. He highlighted that Block’s expanding product portfolio continues to experience robust adoption rates from users in the Square and Cash App segments.

While Tandon noted the Q2 GPV miss due to macro pressures and credit risk related to the continued rise in 90+ days past due consumer receivables, he views SQ’s risk-reward as favorable for those seeking exposure to the solid secular trends driving digital payments adoption.

Wall Street’s Strong Buy consensus rating on SQ stock is based on 18 Buys and five Holds. At $86.95, the average price target implies about 51% upside. Shares have declined 8.4% year-to-date.

SoFi Technologies (NASDAQ:SOFI)

Fintech company SoFi reported a loss of $0.06 per share on revenue of about $489 million, faring better than analysts’ expectations of a loss per share of $0.07 on revenue of $474 million. The company’s revenue gained from the strong performance of the Technology Platform and Financial Services business segments.

SoFi raised its full-year revenue guidance and full-year adjusted EBITDA guidance, reflecting strength across key businesses. Moreover, the company is confident about turning profitable on a GAAP basis by Q4 2023. The company is fully leveraging the benefits of its bank license to drive profitability. As of the end of Q2 2023, 50% of SoFi’s loans were funded by its deposits, thus bringing down reliance on expensive third-party credit.

Looking ahead, SoFi is expected to benefit from the end of the student loan moratorium. While the company anticipates a recovery to higher student loan refinancing revenue levels after September, it does not expect to return to pre-COVID levels in 2023.

What is the Prediction for SoFi stock?

On August 1, Bank of America analyst Mihir Bhatia raised his price target for SoFi Technologies to $11.50 from $10 and reiterated a Hold rating. While full-year guidance was increased, the analyst thinks the current valuation already reflects the growth opportunity in SoFi.

With seven Buys, seven Holds, and four Sells, Wall Street has a Hold consensus rating on SoFi stock. The average price target of $9.74 implies 17.5% upside. SoFi shares have surged about 80% so far this year.

Etsy (NASDAQ:ETSY)

Etsy, an online marketplace for handmade and artisan goods, delivered better-than-anticipated Q2 2023 results, mainly driven by a 21% rise in the company’s services revenue. The key growth driver for the services business was Etsy ads. Overall, the company’s Q2 2023 revenue increased 7.5% year-over-year to almost $629 million.

The company’s EPS decreased 12% to $0.45 but exceeded analysts’ expectations. Despite the Q2 beat, Etsy shares plunged as the company’s Q3 2023 guidance failed to impress investors. Etsy expects Q3 2023 revenue between $610 million and $645 million compared to analysts’ estimate of $632 million.

Etsy cautioned about the potential impact of certain factors on consumer discretionary spending that could hit its Q3 2023 performance, including fading of previously high levels of consumer savings, the resumption of student loan payments this fall, and the discontinuation of child tax credits.

Is Etsy a Good Share to Buy?

In reaction to the Q2 2023 results, Truist Financial analyst Youssef Squali increased his price target to $126 from $120 and reiterated a Buy rating on the stock. The analyst stated that the company’s “solid” Q2 2023 results and outlook reflected continued normalization in the business. Squali thinks the company’s guidance is “appropriately conservative,” given potential risks to consumer spending from elevated inflation, higher interest rates, weak macro conditions, and forex headwinds.

Wall Street is cautiously optimistic on Etsy, with a Moderate Buy consensus rating based on nine Buys, seven Holds, and two Sells. The average price target of $108.72 implies 48.3% upside potential. Shares have declined 39% since the start of this year.

Conclusion

Wall Street is more bullish on Block stock than Etsy, while it is sidelined on SoFi following a stellar year-to-date rally in the stock. Analysts see the pullback in Block shares as an attractive opportunity to gain exposure to this fintech play. Block is expected to gain from the shift toward digital payments over the long term.