Competition in the electric vehicles (EV) market is getting intense, with emerging players and established automakers aggressively moving ahead to capture market share. Leading EV maker Tesla (NASDAQ:TSLA) slashed its prices earlier this year to boost sales, as it is facing rising competition in key markets. In fact, Chinese EV maker BYD (BYDDY) delivered more vehicles than Tesla last year. Here, we will use TipRanks’ Stock Comparison Tool to place American EV maker Rivian (NASDAQ:RIVN) against Elon Musk-led Tesla to select the better EV player.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rivian Heading in the Right Direction

California-based Rivian currently manufactures R1T pickup trucks and R1S SUVs. It also produces electric delivery vans (EDVs) for Amazon (NASDAQ:AMZN), under an agreement for 100,000 EDVs. RIVN investors have been worried about issues related to production ramp-up, product recalls, and significant cash burn.

Rivian’s recently reported first-quarter results provided investors some relief, as the company reported lower-than-expected losses. Revenue surged 596% year-over-year to $661 million.

Moreover, Rivian reaffirmed its 2023 production guidance of 50,000 vehicles, which represents more than 100% increase compared to last year. The company is also optimizing its cost structure and improving its operating efficiency. Despite growing rivalry in the EV market, Rivian is confident of maintaining prices as it believes that its vehicles have superior batteries, better performance, and premium features.

Compared to Rivian, Tesla is a well-established, larger player in the EV market, known for its cutting-edge technology, solid margins, and impressive cash flows. In 2022, Tesla’s revenue grew 51% to $81.5 billion and the company generated free cash flow of $7.6 billion. In comparison, Rivian generated a negative free cash flow of $6.4 billion in 2022. Its gross profit continues to be in the red.

Overall, Rivian is taking efforts to enhance its productivity and improve its financial position. Nonetheless, there is a long road ahead for the company to reach where Tesla stands currently.

Let’s have a look at Wall Street’s ratings for these two stocks.

Is Rivian a Good Stock to Buy?

Following the Q1 results earlier this month, Goldman Sachs analyst Mark Delaney highlighted the “handful of positives” in the quarter, including Rivian’s efforts to reduce its cost of goods sold per vehicle and outlook to deliver positive gross profit in 2024.

While the analyst continues to believe that Rivian offers attractive vehicles, he thinks that the company will have to “necessitate good execution” to meet its profit targets, given the rising competition. Additionally, Delaney thinks that Rivian’s cash usage could weigh on its valuation in the current capital markets backdrop. He reduced RIVN’s price target to $16 from $18 and reiterated a Hold rating on RIVN.

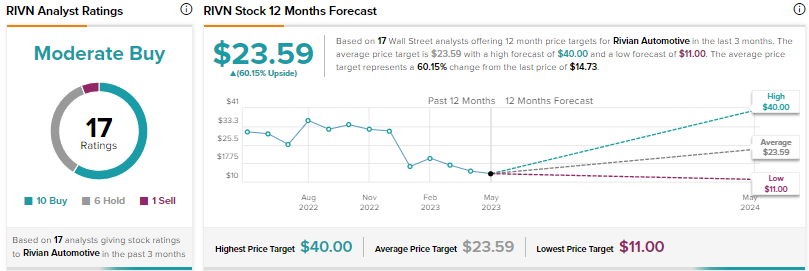

Overall, Wall Street is cautiously optimistic on Rivian stock based on 10 Buys, six Holds, and one Sell. The average price target of $23.59 implies 60.2% upside. Shares have declined 20% year-to-date.

Is Tesla a Buy, Hold, or Sell?

Recently, Oppenheimer analyst Colin Rusch visited Tesla’s factory in Austin, Texas. Rusch said that with the Austin production accelerating from the levels noted at Tesla’s analyst day, he sees the company investing in innovations to support “scaling, increased simplicity, and geopolitical derisking of its supply chain.”

The analyst believes that Tesla’s efforts, mainly related to lithium refining, vehicle simplicity, materials optimization, and software learning cycles, remain well ahead of competitors. However, Rusch reiterated a Hold rating on TSLA, citing concerns around its automotive gross margins as the company continues to grow its share of global light-duty vehicles.

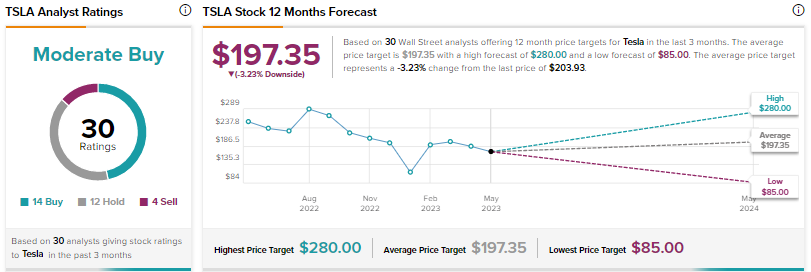

Overall, Wall Street’s Moderate Buy consensus rating on Tesla stock is based on 14 Buys, 12 Holds, and four Sells. The average price target of $197.35 indicates a possible downside of 3.2%. Shares have jumped 66% so far in 2023.

Conclusion

Amid macro pressures and heightened competition, Wall Street is cautiously optimistic on Rivian and Tesla. Rivian has clearly much to prove in terms of efficiently boosting its production and addressing the elevated levels of cash burn. Given Tesla’s year-to-date rally, Wall Street’s average price target doesn’t indicate further upside in the stock.

Meanwhile, the pullback in Rivian shares offers an opportunity to build a position in the emerging EV player. However, investors should be aware of the risks associated with Rivian.