Shares of Rivian Automotive (NASDAQ:RIVN) gained in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at -$1.25, which beat analysts’ consensus estimate of -$1.62 per share. Sales increased by 595.8% year-over-year, with revenue hitting $661 million. This missed analysts’ expectations of $665.28 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The first quarter saw Rivian produce 9,395 vehicles and deliver 7,946 vehicles. Rivian took a cumulative inventory write-down of $561 million and losses on firm purchase commitments of $261 million. Ultimately, Rivian ended the quarter with $11.78 billion in cash, which was down from $12.1 billion back at 2022’s end.

Rivian also offered some projections going forward. It looks to achieve positive gross profit sometime in 2024 and believes it’s still on track to reach its goal of 50,000 vehicles total produced in 2023.

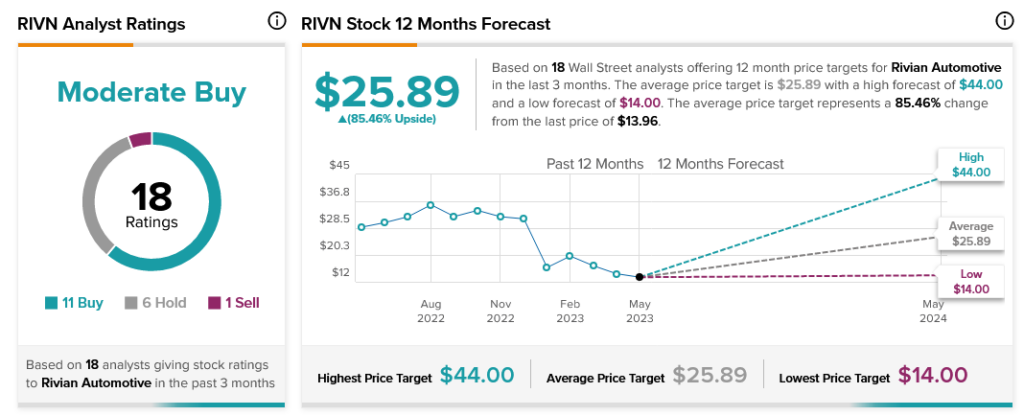

Overall, Wall Street has a consensus price target of $25.89 on Rivian, implying 85.46% upside potential, as indicated by the graphic above.